Results of Operations

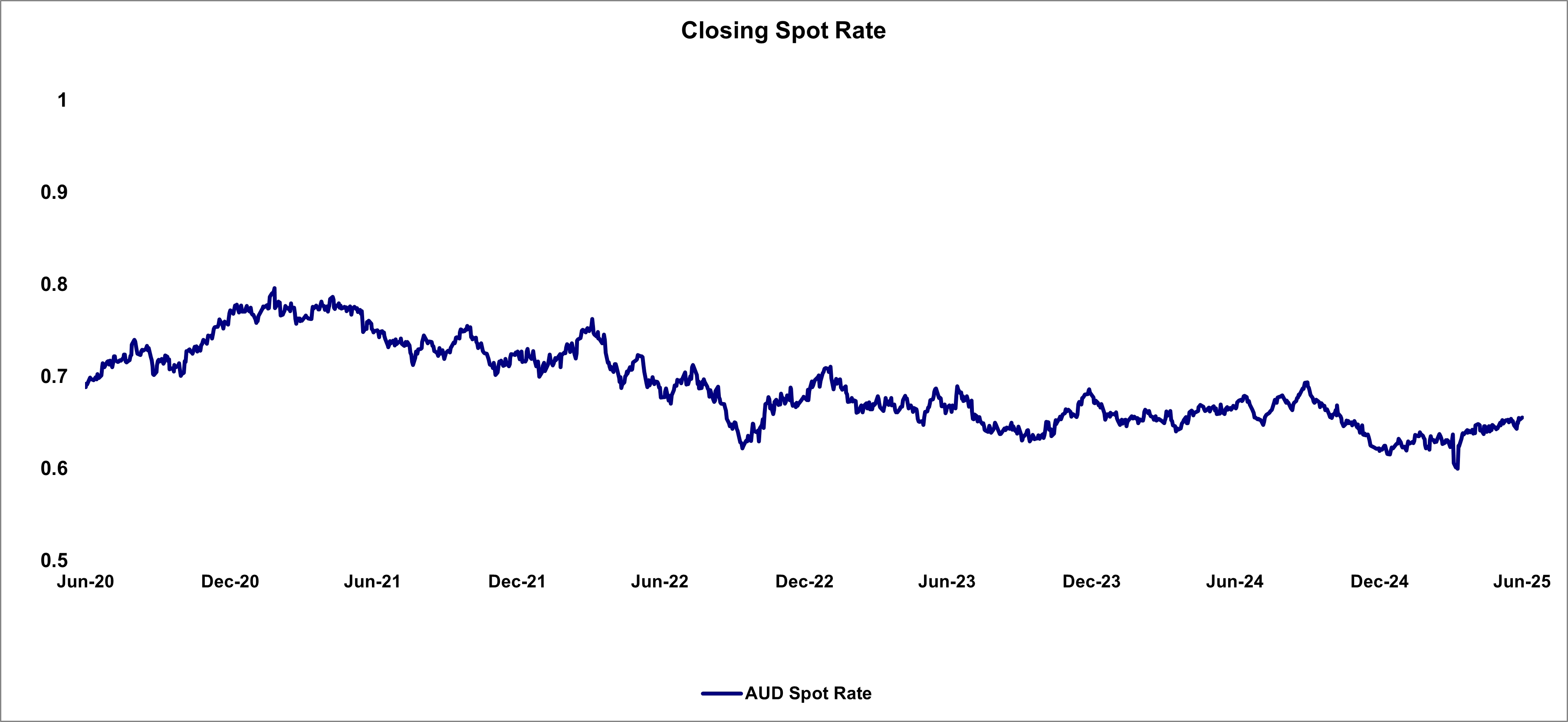

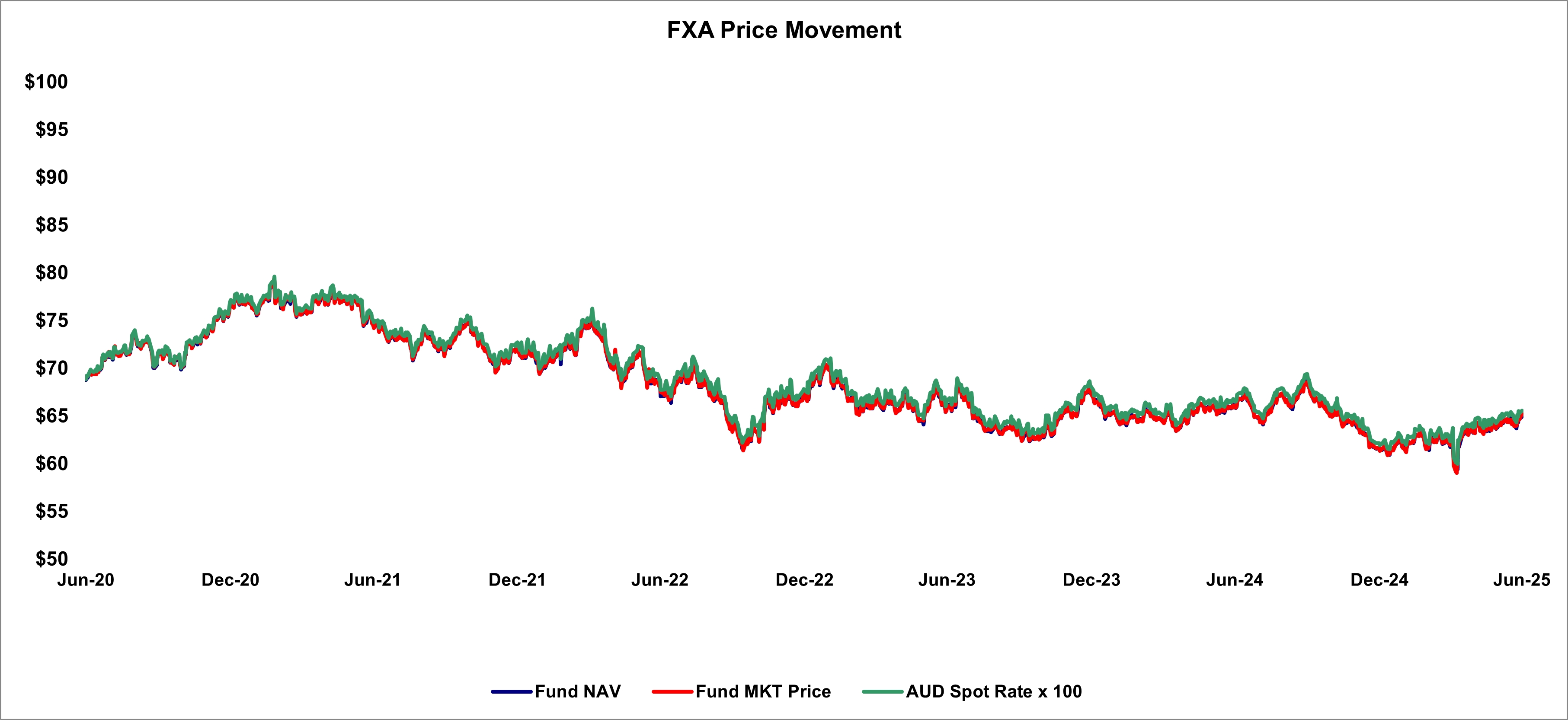

During the three and six months ended June 30, 2025 and 2024, the Trust's net comprehensive income (loss) was, in part, impacted by market volatility resulting from global tariff gyrations and mounting U.S. economic concerns for 2025, and expectations around the Federal Reserve (the “Fed”) easing and heightened geopolitical concerns for 2024, which are considered to be unusual or infrequent events. Although the full and direct impact of global tariffs, U.S. economic concerns, Fed easing expectations and rising geopolitical tensions, on the Trust's net comprehensive income (loss) during the three and six months ended June 30, 2025 and 2024, cannot be known, it is believed that they have each independently impacted the Closing Spot Rate, the interest rate paid by the Depository, and the global economy and markets generally, including the number of Shares created and redeemed by the Trust.

The Australian dollar (AUD/USD) edged higher in the second quarter of 2025, supported mostly by U.S. dollar weakness, though weak commodity prices capped those gains given Australia is a significant exporter. Domestically, the Reserve Bank of Australia (RBA) cut its cash rate by 25 basis points in May to 3.85%, citing easing inflationary pressures. However, the RBA maintained a cautious, data-dependent outlook amid persistent global uncertainties. While the rate cut provided some support to domestic growth expectations, the AUD’s gains were tempered by investor caution and mixed signals from global economic data. The slight bounce in energy prices on the back of Middle East tensions in June also failed to provide sustained support.

The Australian Dollar (AUD/USD) experienced positive performance in the second quarter of 2024, even despite gains in the

U.S. Dollar. Strong Australian retail sales data in May further fueled inflation fears, raising bets for a potential rate hike; Australian

inflation had come in above forecasts three months in a row. In comparison, several global central banks had already started their

easing cycles, leaving further rate hikes out of the picture. Higher interest rates tend to boost the country’s currency. The U.S. dollar

continued to gain with Fed rate cut expectations further delayed.

The Australian dollar (AUD/USD) was higher in the first half of 2025, mostly supported by U.S. dollar weakness, but weak commodity performance was a headwind. Global tariff uncertainty and a slowdown in Chinese demand weighed on Australia’s export driven economy in the first quarter. While sentiment improved a bit in the second quarter as energy prices bounced on escalating tensions in the Middle East and trade war fears eased a bit with the U.S.-China trade truce, broader risk appetite remained fragile, limiting the AUD’s advance despite a softer dollar. The Reserve Bank of Australia’s decision to cut rates in May, while signaling a cautious and data-dependent stance, added a boost to sentiment, but investor caution persisted.

The Australian Dollar (AUD/USD) ended the first half of 2024 lower than the previous quarter. In the first quarter, U.S. Dollar

moves drove the bulk of the price action, though escalated geopolitical tensions also pressured investors’ risk appetite – the AUD is

generally considered a riskier currency compared to the haven USD. The Fed’s higher-for-longer rhetoric and stickier-than-expected

U.S. inflation pushed out expectations for U.S. rate cuts. Specific to the AUD, the sluggish recovery in China also served as a headwind given the country is Australia’s largest export partner. However, the pair did rebound significantly in the second quarter as strong Australian retail sales raised bets that the Reserve Bank of Australia (RBA) could hike rates. In contrast, many global central banks had already kicked off their easing cycles.

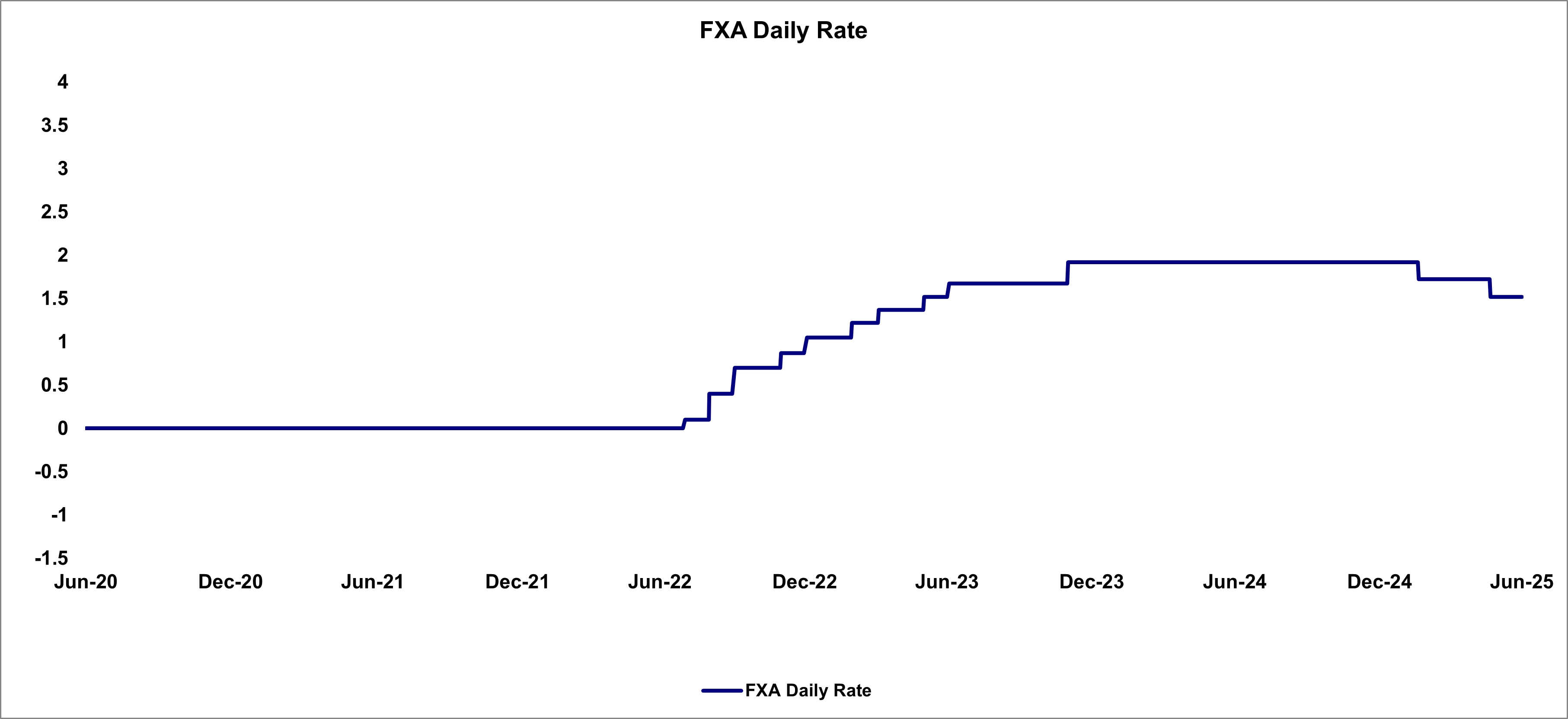

Additionally, the interest rate paid by the Depository has generally trended downward over the past year with the current interest rate of 1.52%, as set forth in the FXA Rate Chart above. As long as the interest income, if any, exceed the Sponsor's fee and the interest expense on currency deposits, the Trust will incur a net comprehensive income.

Item 3. Quantitative and Qualitative Disclosures About Market Risk.

Except as described above with respect to fluctuations in the Australian Dollar/USD exchange rate and changes in the nominal annual interest rate paid by the Depository on Australian Dollars held by the Trust, the Trust is not subject to market risk. The Trust does not hold securities and does not invest in derivative instruments.

Item 4. Controls and Procedures.

Under the supervision and with the participation of the management of the Sponsor, including Brian Hartigan, its Principal Executive Officer, and Kelli Gallegos, its Principal Financial and Accounting Officer, Investment Pools, the Trust carried out an evaluation of the effectiveness of the design and operation of its disclosure controls and procedures (as defined in Rules 13a-15(e) or 15d-15(e) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) as of the end of the period covered by this Quarterly Report, and, based upon that evaluation, Brian Hartigan, the Principal Executive Officer of the Sponsor, and Kelli Gallegos, the Principal Financial and Accounting Officer, Investment Pools, of the Sponsor, concluded that the Trust's disclosure controls and procedures were effective to provide reasonable assurance that information the Trust is required to disclose in the reports that it files or submits with the Securities and Exchange Commission (the “SEC”) under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the SEC's rules and forms, and to provide reasonable assurance that information required to be disclosed by the Trust in the reports that it files or submits under the Exchange Act is accumulated and communicated to management of the Sponsor, including its Principal Executive Officer and Principal Financial Officer, as appropriate to allow timely decisions regarding required disclosure.