Results of Operations

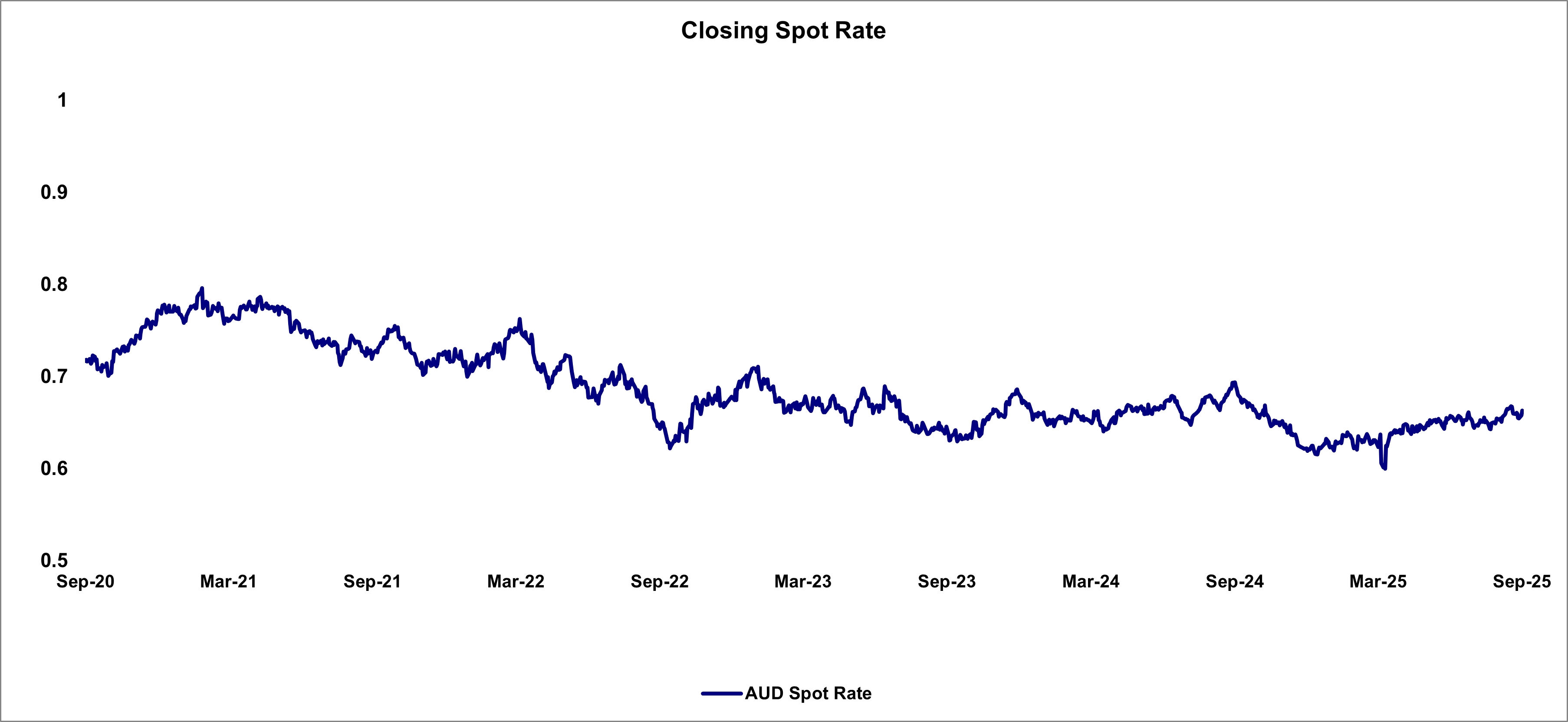

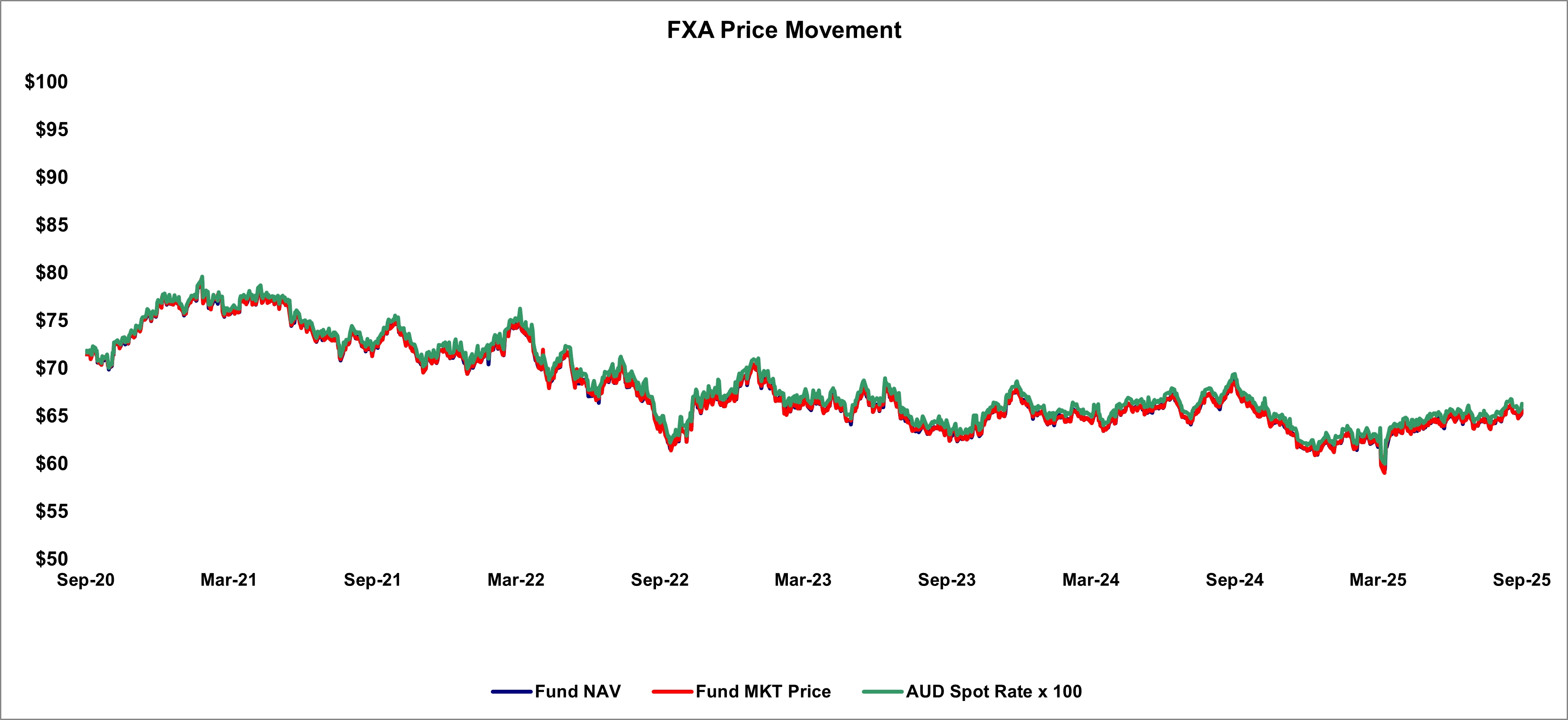

During the three and nine months ended September 30, 2025 and 2024, the Trust's net comprehensive income (loss) was, in part, impacted by market volatility resulting from global tariff gyrations and mounting U.S. economic uncertainty for 2025, and expectations around the Federal Reserve (the “Fed”) easing and heightened geopolitical concerns for both 2024 and 2025, which are considered to be unusual or infrequent events. Although the full and direct impact of global tariffs, U.S. economic concerns, Fed easing expectations and rising geopolitical tensions, on the Trust's net comprehensive income (loss) during the three and nine months ended September 30, 2025 and 2024, cannot be known, it is believed that they have each independently impacted the Closing Spot Rate, the interest rate paid by the Depository, and the global economy and markets generally, including the number of Shares created and redeemed by the Trust.

The Australian dollar (AUD/USD) closed the third quarter of 2025 with a gain. The Reserve Bank of Australia (RBA) kept rates unchanged in July rather than delivering the expected 25 basis point cut, which was seen as a deferral of policy easing. This supported the AUD given how skewed market pricing had been towards a rate cut, though the RBA did cut by 25 basis points in August, driven by softer labor market data. The volatility and downtrend in energy prices was also a headwind, but improved broader risk appetite, ongoing strength in the Chinese yuan – China is a key trading partner for Australia – and the comparatively deeper easing cycle being carried out by the Fed provided support for the AUD while weighing on the USD.

The Australian dollar (AUD/USD) experienced positive performance in the third quarter of 2024, mostly gaining on U.S. dollar

weakness. The Fed finally kicked off its easing cycle while the Reserve Bank of Australia (RBA) kept rates steady

as it still battled with a tight labor market and sticky inflation. However, the downturn in commodities and the overhang from the

Chinese economic lull have been persisting headwinds for the Aussie, since China is their largest export partner. The significant risk

off move at the end of July also dealt a heavy blow to the riskier currency, with investors instead turning to safe haven currencies like

the Swiss franc.

The Australian dollar (AUD/USD) posted strong gains year-to-date through the third quarter of 2025, underpinned by U.S. dollar weakness. The AUD intermittently experienced volatility due to its close relationship with commodities, particularly in April, as tariff uncertainty and dampened demand weighed on Australia's export-driven economy. However, this was offset by rising energy prices following escalating geopolitical tensions in the second quarter, and improvements in risk appetite and temporarily easing trade tensions between China and the U.S. in the third quarter. Rate cuts by the RBA added some downward pressure to the AUD, but this was largely mitigated by the RBA's tone of caution and guidance towards a slow and steady pace of easing, in comparison with the U.S.’s expected deeper easing cycle.

The Australian dollar (AUD/USD) ended the first three quarters of 2024 positive. In the first quarter, U.S. dollar moves drove the bulk of the price action, though escalated geopolitical tensions also pressured investors’ risk appetite; the Aussie is considered a risky currency. The Fed’s higher-for-longer rhetoric and stickier-than-expected U.S. inflation pushed out expectations for U.S. rate cuts, providing support for the U.S. dollar. However, the pair did rebound significantly in the second and third quarter – strong domestic retail sales in the second quarter raised bets that the RBA could hike rates while many global central banks had already kicked off their easing cycles. In the third quarter, the pair gained on U.S. dollar weakness as the Fed began cutting rates, though the persisting downtrend in commodities and China pessimism capped the upside for the Aussie.

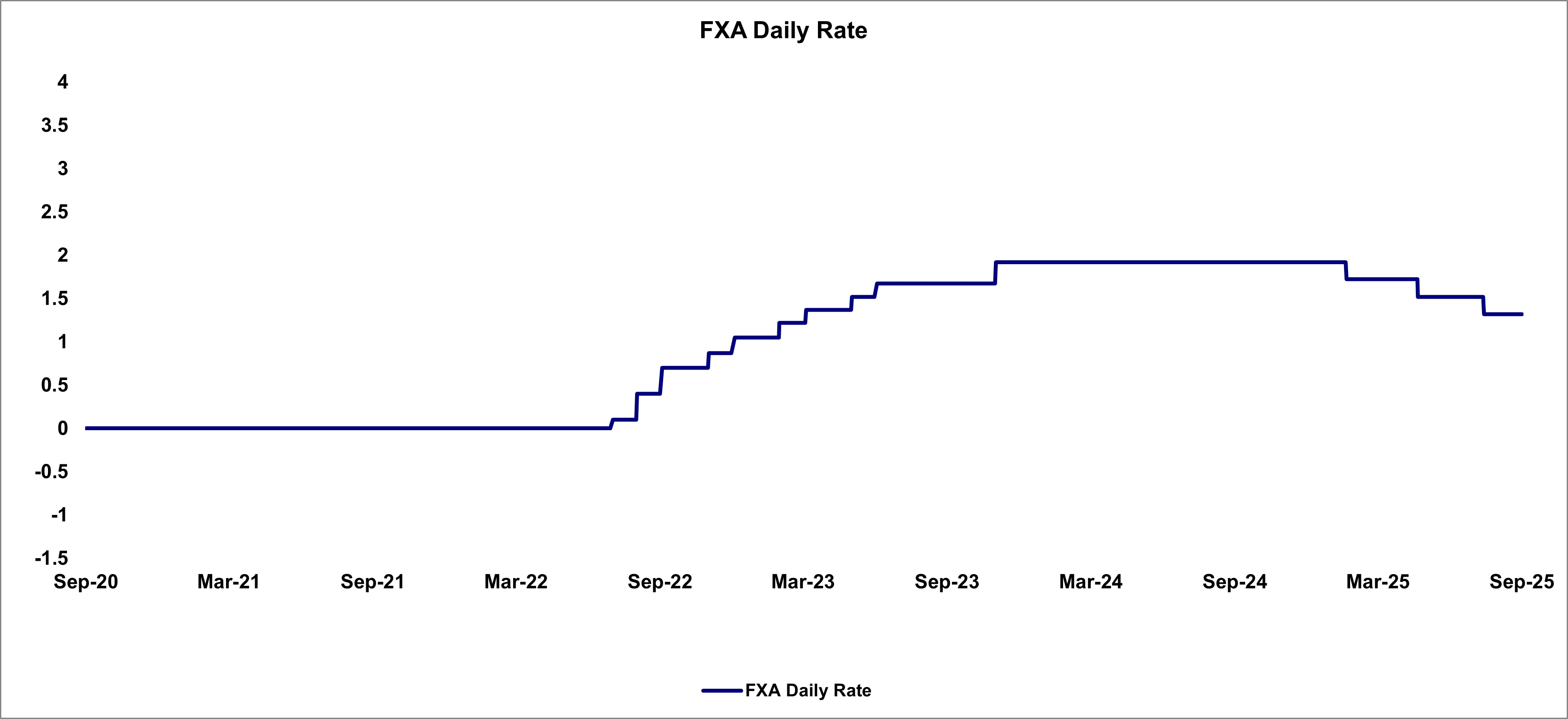

Additionally, the interest rate paid by the Depository has generally trended downward over the past year to current interest rate of 1.32%, as set forth in the FXA Rate Chart above. As long as the interest income, if any, exceed the Sponsor’s fee and the interest expense on currency deposits, the Trust will incur a net comprehensive income.

Item 3. Quantitative and Qualitative Disclosures About Market Risk.

Except as described above with respect to fluctuations in the Australian Dollar/USD exchange rate and changes in the nominal annual interest rate paid by the Depository on Australian Dollars held by the Trust, the Trust is not subject to market risk. The Trust does not hold securities and does not invest in derivative instruments.