Results of Operations

During the three months ended March 31, 2025 and 2024, the Trust's net comprehensive income (loss) was, in part, impacted by market volatility resulting from global tariff gyrations and mounting US recession concerns for 2025, and expectations around the Federal Reserve (the “Fed”) easing and heightened geopolitical concerns for 2025, which are considered to be unusual or infrequent events. Although the full and direct impact of global tariffs, US recession concerns, Fed easing expectations and rising geopolitical tensions, on the Trust's net comprehensive income (loss) during the three months ended March 31, 2025 and 2024, cannot be known, it is believed that they have each independently impacted the Closing Spot Rate, the interest rate paid by the Depository, and the global economy and markets generally, including the number of Shares created and redeemed by the Trust.

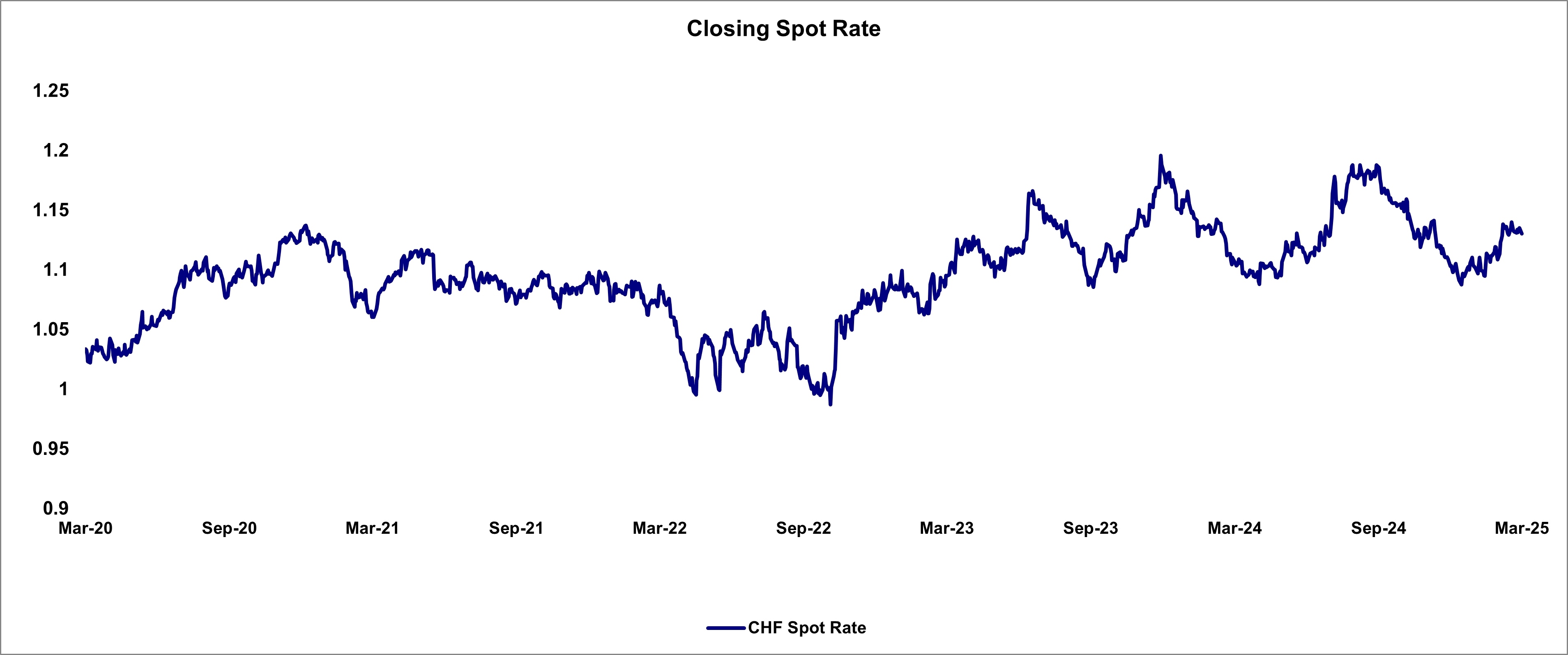

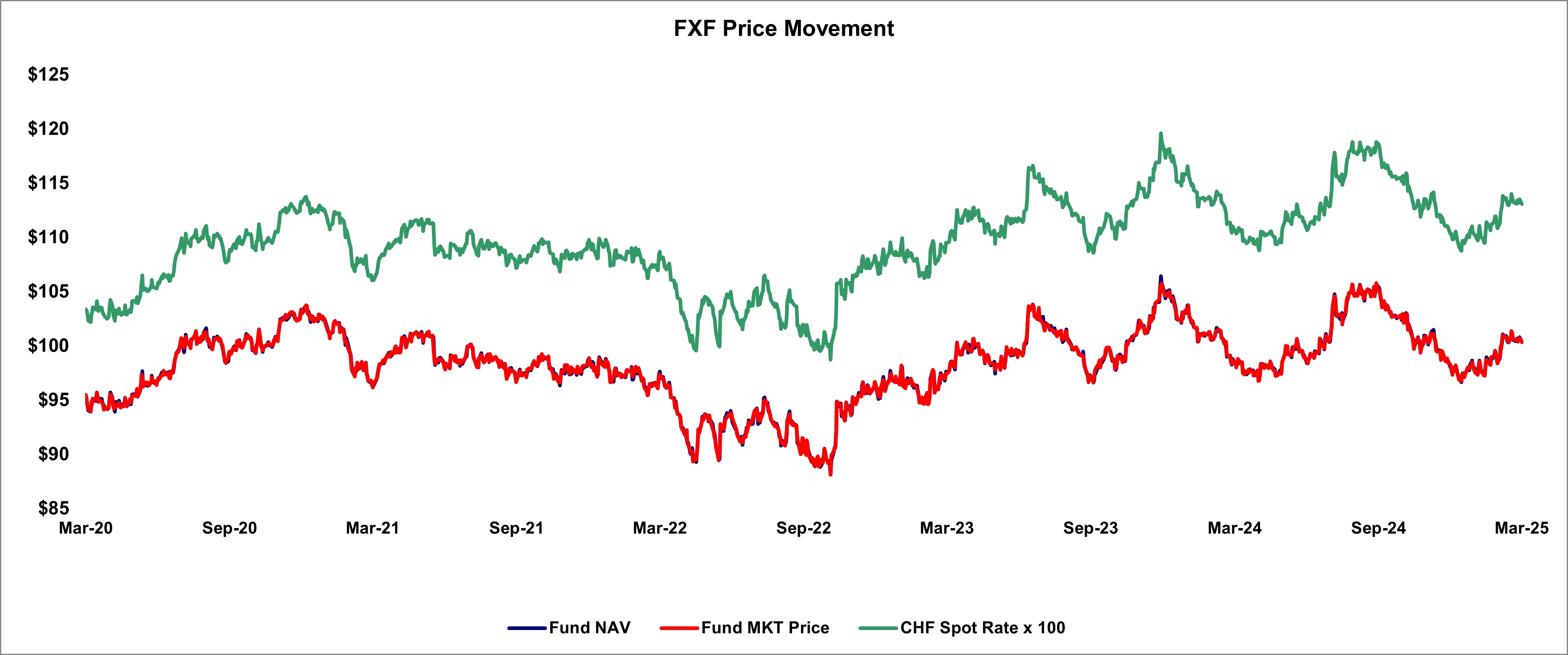

The Swiss Franc (CHF/USD) posted strong gains in the first quarter of 2025 due to significant US dollar weakness and rising safe haven demand. The greenback was pressured by mounting US recession and stagflation concerns, and the resulting equity market meltdown triggered a flight to safety; the Swiss Franc is seen as a haven currency given Switzerland’s economic and political stability. In addition, while Swiss inflation remains at four-year lows, the US is still dealing with inflation risk skewed to the upside and a seemingly slowing economy.

The Swiss Franc (CHF/USD) posted a loss in the first three months of 2024. While some of this was driven by gains in the USD – the Fed’s higher-for-longer rhetoric and stickier-than-expected US inflation pushed out expectations for rate cuts, supporting US yields – the pair was heavily pressured after the Swiss National Bank (“SNB”) became the first major central bank to start cutting its interest rates in March. Lower interest rates reduce the appeal of the country’s currency.

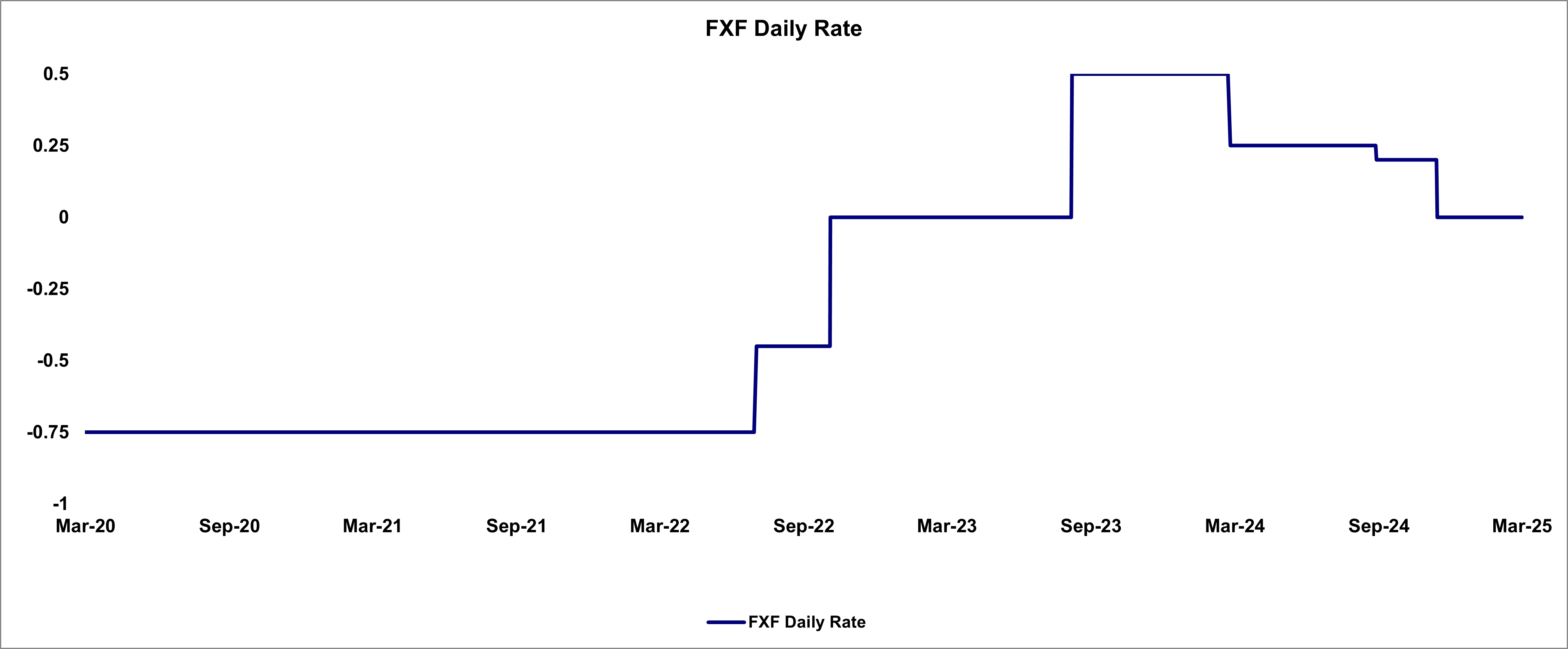

Additionally, the interest rate paid by the Depository has generally trended downward over the past year to the current interest rate of 0.00%, as set forth in the FXF Rate Chart above. As long as the Sponsor’s fee and the interest expense on currency deposits, if any, exceed interest income, the Trust will incur a net comprehensive loss.

Item 3. Quantitative and Qualitative Disclosures About Market Risk.

Except as described above with respect to fluctuations in the Swiss Franc/USD exchange rate and changes in the nominal annual interest rate paid by the Depository on Swiss Francs held by the Trust, the Trust is not subject to market risk. The Trust does not hold securities and does not invest in derivative instruments.

Item 4. Controls and Procedures.

Under the supervision and with the participation of the management of the Sponsor, including Brian Hartigan, its Principal Executive Officer, and Kelli Gallegos, its Principal Financial and Accounting Officer, Investment Pools, the Trust carried out an evaluation of the effectiveness of the design and operation of its disclosure controls and procedures (as defined in Rules 13a-15(e) or 15d-15(e) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) as of the end of the period covered by this Quarterly Report, and, based upon that evaluation, Brian Hartigan, the Principal Executive Officer of the Sponsor, and Kelli Gallegos, the Principal Financial and Accounting Officer, Investment Pools, of the Sponsor, concluded that the Trust's disclosure controls and procedures were effective to provide reasonable assurance that information the Trust is required to disclose in the reports that it files or submits with the Securities and Exchange Commission (the “SEC”) under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the SEC's rules and forms, and to provide reasonable assurance that information required to be disclosed by the Trust in the reports that it files or submits under the Exchange Act is accumulated and communicated to management of the Sponsor, including its Principal Executive Officer and Principal Financial Officer, as appropriate to allow timely decisions regarding required disclosure.

Changes in Internal Control Over Financial Reporting

There has been no change in internal control over financial reporting (as defined in the Rules 13a-15(f) and 15d-15(f) of the Exchange Act) that occurred during the Trust's quarter ended March 31, 2025 that has materially affected, or is reasonably likely to materially affect, the Trust's internal control over financial reporting.