Net change in unrealized appreciation on investment in bitcoin for the six months ended June 30, 2025 was approximately $464,101, compared to net change in unrealized appreciation on investment in bitcoin for the period from January 10, 2024 (commencement of operations) to June 30, 2024 of approximately $250,421. This change was primarily due to an increase in the fair value of bitcoin held by the Trust.

Net Increase (Decrease) in Net Assets resulting from Operations

Net decrease in net assets resulting from operations for the six months ended June 30, 2025 was approximately $507,657, compared to net increase in net assets resulting from operations for the period from January 10, 2024 (commencement of operations) to June 30, 2024 of approximately $225,626. This change was primarily due to an increase in net realized gain and an increase in unrealized appreciation on investments in bitcoin, with a net realized and unrealized gain on investment in bitcoin of approximately $511,405, less the Sponsor Fee of $3,748, for the six months ended June 30, 2025, compared to a net realized and unrealized gain on investment in bitcoin of approximately $226,453, less the Sponsor Fee of $827, for the period from January 10, 2024 (commencement of operations) to June 30, 2024.

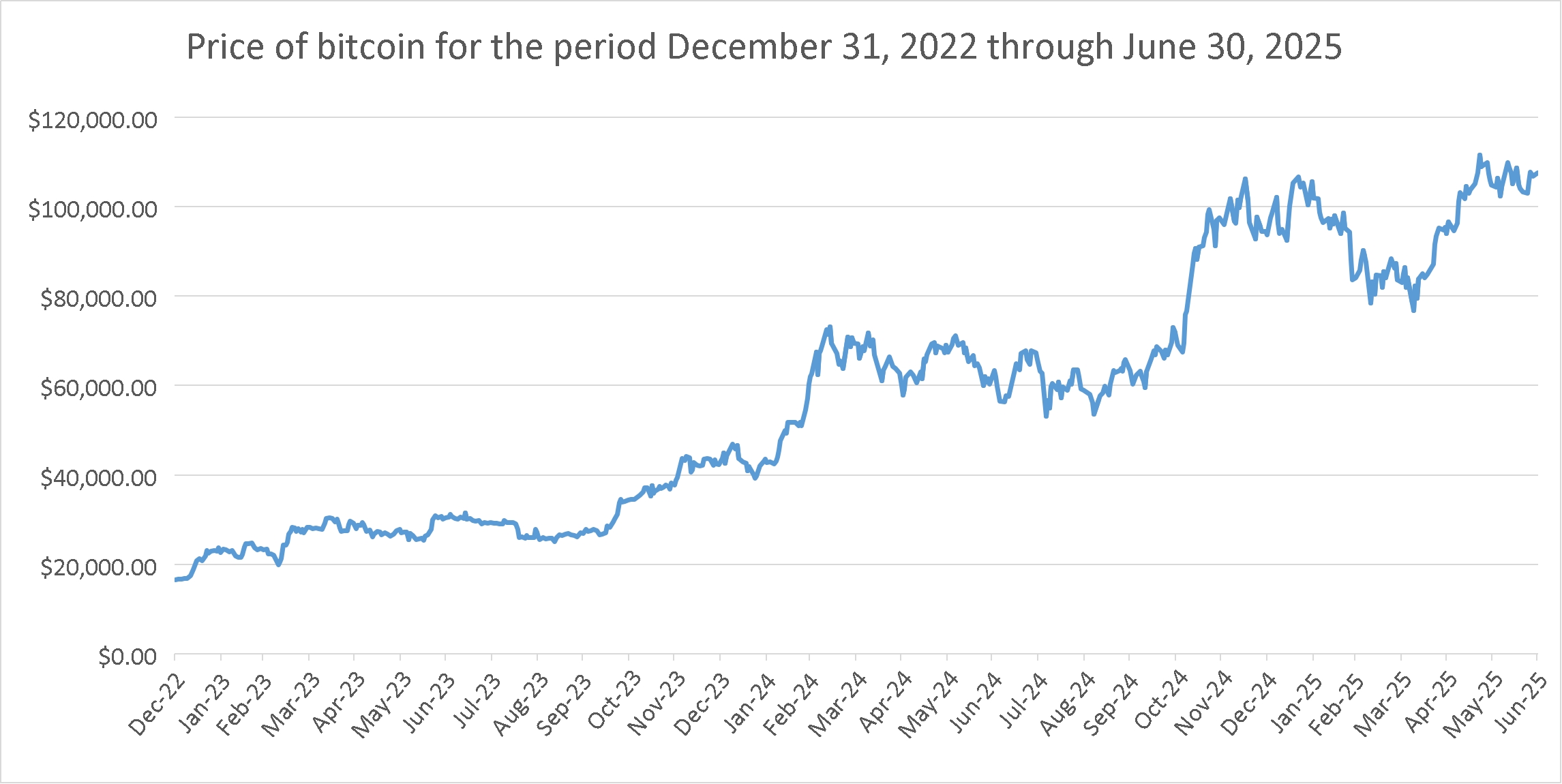

The change in net realized and unrealized gain (loss) was primarily due to fluctuations in the bitcoin price during the respective period. For the six-month period ended June 30, 2025, the net realized and unrealized loss on investment in bitcoin was driven by bitcoin price appreciation from $93,730.35 per bitcoin as of December 31, 2024 to $107,487.49 per bitcoin as of June 30, 2025. For the period from January 10, 2024 (commencement of operations) to June 30, 2024, the net realized and unrealized gain on investment in bitcoin was driven by bitcoin price appreciation from $45,852.66 per bitcoin as of January 10, 2024 (commencement of operations) to $60,330.17 per bitcoin as of June 30, 2024.

Net Assets

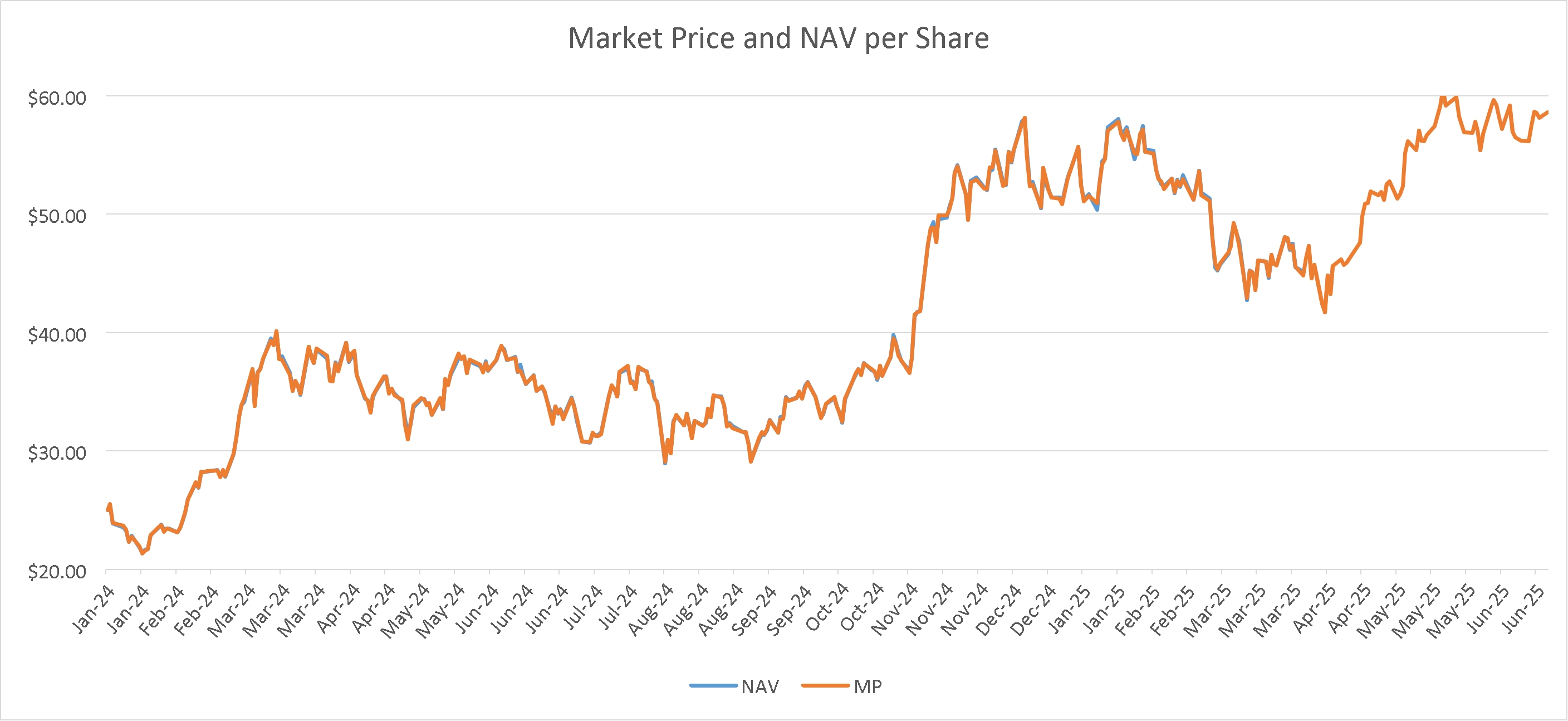

As of June 30, 2025, the Trust held a net closing balance of 39,518.9512 bitcoin with a total market value of $4,247,793 based on the BRRNY price of $107,487.49 used to determine the Trust's NAV. The total market value of the Trust's bitcoin held was $4,258,323 based on the price of a bitcoin (Lukka Prime Rate) in the principal market (Crypto.com) of $107,753.95, used to determine the Trust's Principal Market NAV.

Net assets increased to approximately $4,257,654 at June 30, 2025, with a 15.26% increase in Principal Market NAV per-share for the six months ended June 30, 2025. The increase in net assets primarily resulted from the aforementioned bitcoin price appreciation, the net decrease in capital share transactions of approximately $12,042, and a net increase resulting from operations of $507,657.

As of June 30, 2024, the Trust held a net closing balance of 37,528.2763 bitcoin with a total market value of $2,264,087 based on the BRRNY price of $60,330.17, used to determine the Trust's NAV. The total market value of the Trust's bitcoin held was $2,249,899 based on the price of a bitcoin (Lukka Prime Rate) in the principal market (Crypto.com) of $59,952.11, used to determine the Trust's Principal Market NAV.

Net assets increased to approximately $2,249,658 at June 30, 2024, with a 30.68% increase in Principal Market NAV per-share for the period from January 10, 2024 (commencement of operations) to June 30, 2024. The increase in net assets primarily resulted from the aforementioned bitcoin price appreciation, the net increase in capital share transactions of approximately $2,024,032, and a net increase resulting from operations of $225,626.

^ Amounts displayed are in the '000s, except for per-share/coin references

Liquidity and Capital Resources

The Trust pays a unitary Sponsor Fee of 0.20% per annum of the Trust’s bitcoin holdings. The Sponsor contractually waived the Sponsor Fee on the first $1 billion of the Trust assets through July 10, 2024, and has been accruing at an annual rate of 0.20% of the Trust’s bitcoin holdings since then. As a result, the only ordinary expense of the Trust is expected to be the Sponsor Fee. In exchange for the Sponsor Fee, the Sponsor has agreed to assume and pay the normal operating expenses of the Trust, which include the Trustee’s monthly fee and out-of-pocket expenses, the fees of the Trust’s regular service providers (Cash Custodian, Bitcoin Custodian, Prime Execution Agent, Marketing Agent, Transfer Agent and Administrator), exchange listing fees, tax reporting fees,