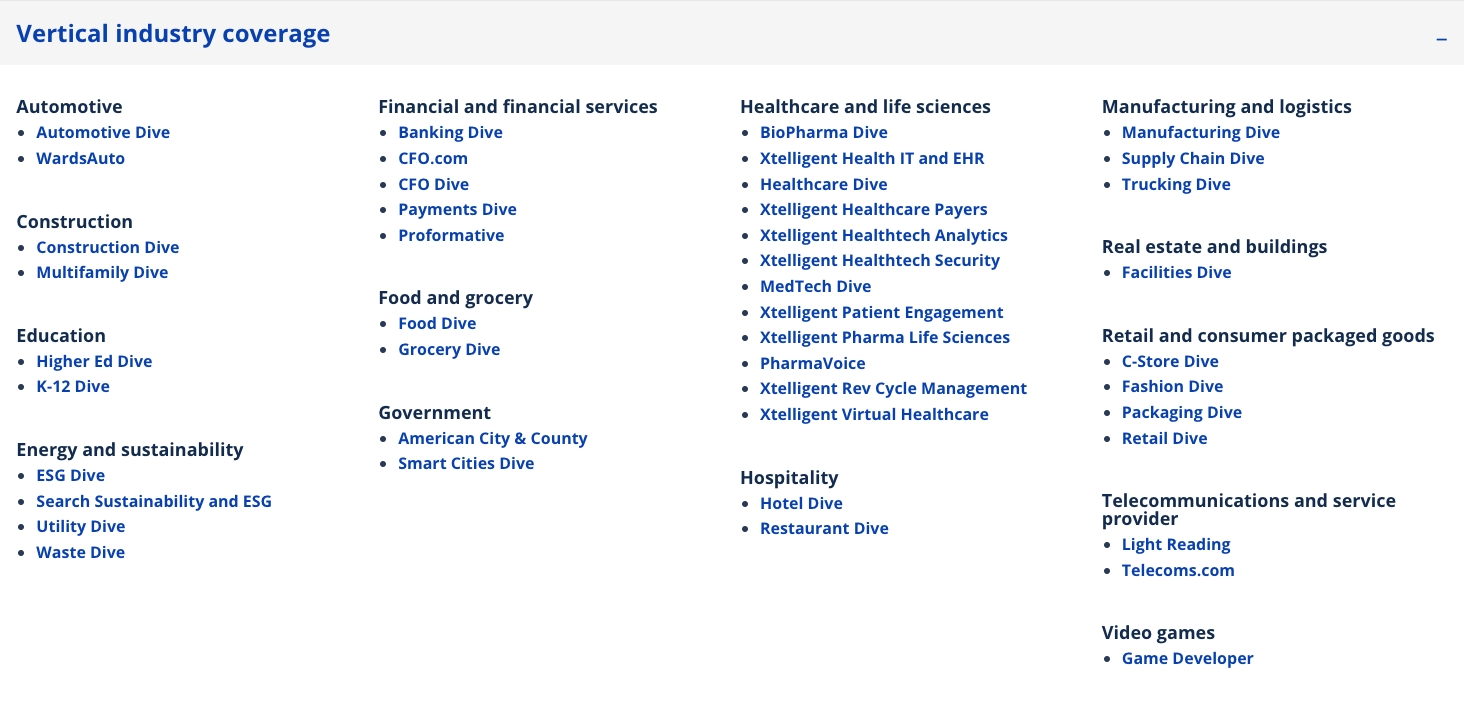

Automotive. With the convergence of the automotive and technology markets, a traditionally closed ecosystem is rapidly evolving amongst new market entrants, developing consumer needs and geopolitical instability. Our trusted automotive brands from our legacy Informa Tech Digital Businesses and our legacy TechTarget business provide expert insight at the intersection of the automotive and technology markets, with unrivalled opportunities to shape company positions in auto-tech through marketing services, events and research.

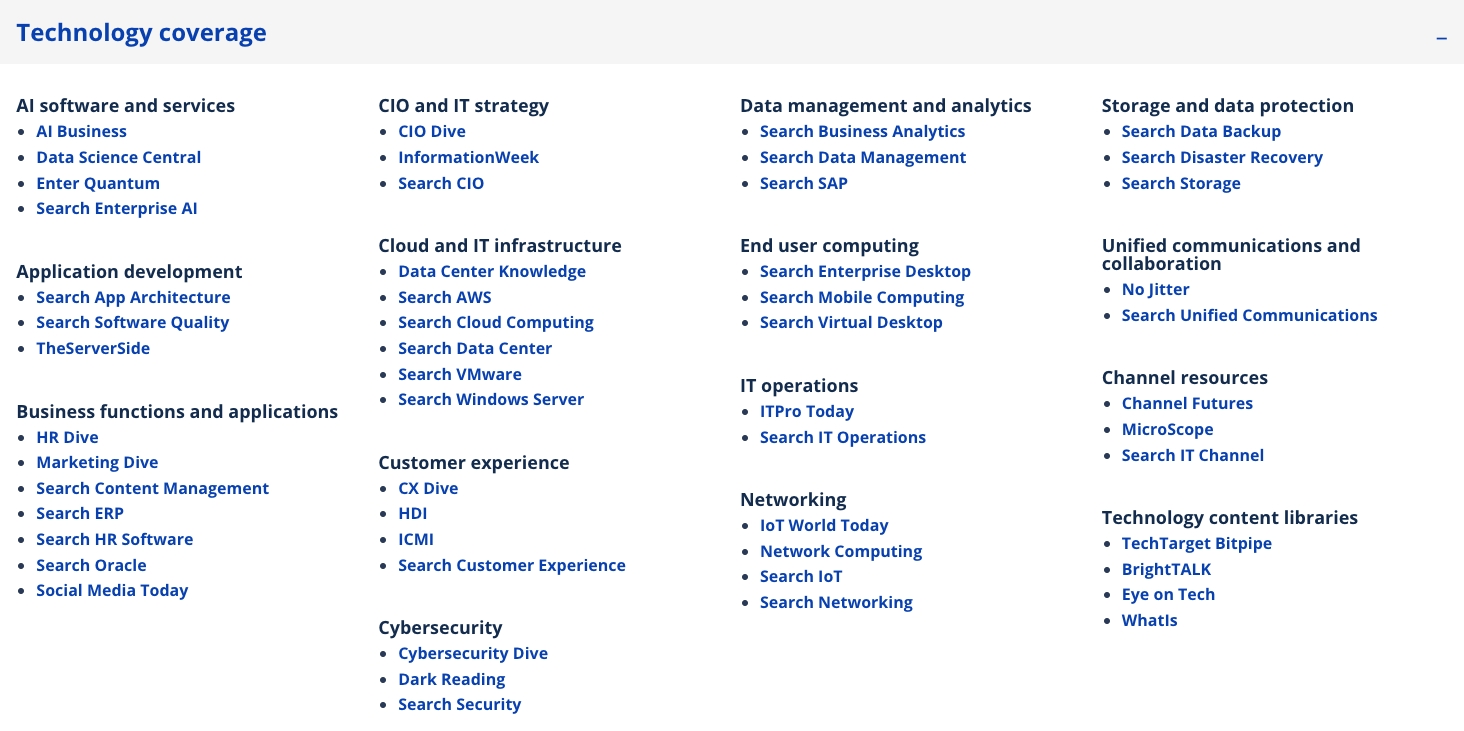

Business Applications. Any mid- or large-sized enterprise will have a host of business applications that are mission critical for their operations and success, including enterprise resource planning platforms (“ERP”), databases and business intelligence software, content management platforms, customer facing applications and CRM software. This creates a high demand for specialized information from IT and business professionals involved in their purchase, implementation, and ongoing support. We provide expert insights and leading online resources on business applications, through a range of online properties including TechTarget Customer Experience, TechTarget HR Software, and TechTarget ERP.

Channel. We are home to a comprehensive suite of products serving the channel ecosystem, with a broad reach across technology advisors/agents, value-added resellers, solution providers, managed service providers, independent software vendors and consultants. Focused on the future of the indirect sales channels – a specialist market where B2B technology companies actively seek alliances with channel partners – we provide expert analyst, intelligence and advisory services, including through our specialist research provider Canalys, that inform vendors’ go-to-market strategies and deliver specialist information, insight and content to channel professionals.

CIO/IT Strategy. We deliver specialist content specifically targeted at chief information officers (“CIOs”), senior enterprise technology executives and business executives with technology responsibility, enabling them to make informed enterprise technology purchases throughout the critical stages of the purchase decision process. Their areas of interest generally align with the major sectors of the IT market: AI, BI and big data, business applications, cloud, data center, DevOps, end user computing, networking, outsourcing, risk management, security and storage. The challenge for senior technology executives and those with responsibility for technology is how to use new and major technologies, including AI and big data, to gain a competitive edge. Post-pandemic, their interests are increasingly broad too, from customer experience and digital workplace experience to the strategically important cybersecurity and data privacy. We provide a range of solutions addressing the specific segment and customer market of CIO and IT Strategy, through expert intelligence, advisory services, editorial and media properties such as the CIO/IT Strategy site.

Components and Devices. Components and devices power the digital world and participants in this ecosystem are delivering the technologies that drive 5G, AI, IoT, and cybersecurity transformations. We deliver expert-led analysis and advisory services, data-driven brand products, content marketing and specialist content that drives industry expansion.

Computer, IT Operations and DevOps. The high pace of digital transformation within enterprises means IT strategies are continually being reshaped. IT decision makers are required to navigate a diverse set of IT platforms, servers, desktop solutions and virtual environments, work out how to scale to meet the demand of today’s cloud native applications while being future-ready for new applications and mindful of sustainability, including data center energy efficiency. We deliver a comprehensive suite of brands, products and services that educate, guide and connect the community, including trusted independent research, specialist media sites, expert editorial, training, data-driven brand products and demand generation services.

Cybersecurity. Every aspect of enterprise computing depends on secure connectivity, data and applications. As businesses worldwide continue to adapt to new forms of online threat from hackers, criminals, and other nations, they are making an unprecedented investment in online defense. Equally, technology providers are looking to bring to market increasingly sophisticated security solutions that supplement or replace traditional perimeter security solutions. We offer a powerful combination of leading market intelligence, events, and media.

Environmental, Social and Governance in Technology: Changing consumer and employee expectations, investor scrutiny and government regulations are driving corporate leaders and technology providers to focus more on environmental, social and governance matters. In the Tech industry, this has a particular focus on how enterprises and their partners manage energy efficiency, carbon footprints and environmental impacts. We bring expert editorial, specialist content and content marketing services that deliver value-added insight to business leaders.

Healthcare Technology. The healthcare industry is undergoing continued digital transformation, as it looks to capture patient outcome and efficiency benefits from how technology, information and data is applied. We have a suite of high-quality, content-led brands that bring essential insight and connections to the healthcare technology community, including brands/properties such as Xtelligent Healthcare Media, HealthITSecurity.com and MedTech Dive.

Media and Entertainment. The media and entertainment industry is global and fast moving, with technology providers, media platforms, service providers and device manufacturers looking to anticipate consumer trends and find competitive edge. Our media and entertainment group provides expert research, analysis and data-driven intelligence that shape strategies and uncover new commercial and partnership opportunities.