•changes in environmental laws or regulations, discovery of previously unknown or more extensive contamination, or the failure of a potentially responsible party to perform;

•failure to comply with the U.S. Foreign Corrupt Practices Act (or other applicable anti-corruption legislation), export controls and trade sanctions; and

•risk of product liability claims and litigation.

Refer to Item 1A, Risk Factors for more information on factors that could cause actual results or events to differ materially from those anticipated and disclosed within this Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and in other documents we file from time to time with the SEC.

The forward-looking statements included in this Annual Report on Form 10-K speak only as of the date of this report. We undertake no obligation (and expressly disclaim any obligation) to update any forward-looking statements, whether written or oral or as a result of new information, future events or otherwise.

PART I

| ITEM 1. | DESCRIPTION OF BUSINESS | ||||

(Amounts reported in this Annual Report on Form 10-K, except per share amounts, are stated in millions unless otherwise specified. References herein to "ITT," "the Company," and such words as "we," "us," and "our" include ITT Inc. and its subsidiaries on a consolidated basis, unless the context otherwise indicates.)

COMPANY OVERVIEW

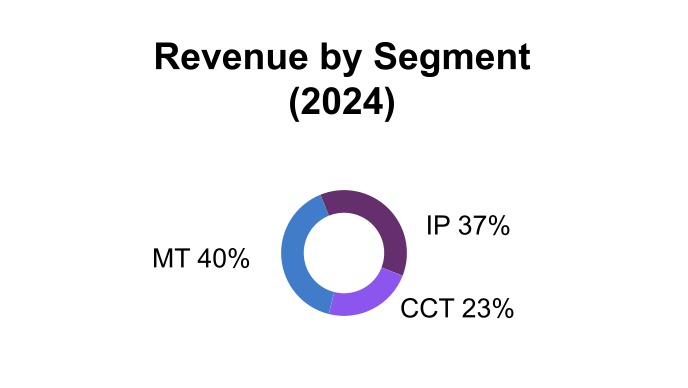

ITT is a diversified manufacturer of highly engineered critical components and customized technology solutions primarily for the transportation, industrial and energy markets. We manufacture components that are integral to the operation of equipment, systems and manufacturing processes in these key markets. Our products enable functionality for applications where reliability and performance are critically important to our customers and the users of their products. We operate through three primary segments: Motion Technologies (MT), Industrial Process (IP), and Connect & Control Technologies (CCT).

| 2024 COMPANY SNAPSHOT | |||||

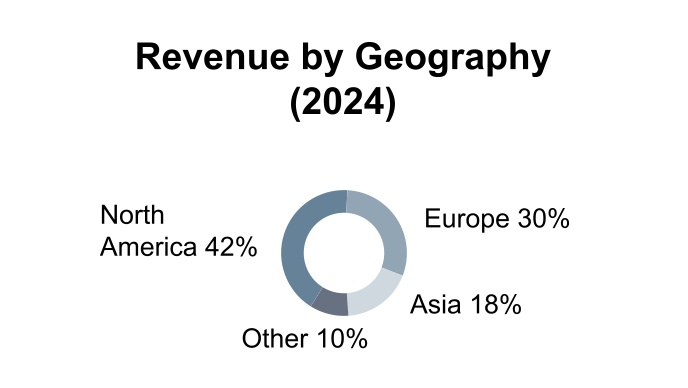

• $3.6 billion of sales across approx. 125 countries | • Approx. 11,700 employees in 39 countries | ||||

• Global presence with 67% of revenue outside the U.S. | • Balanced and diversified portfolio | ||||

MT is a global manufacturer of highly engineered brake pads, shock absorbers and damping technologies for the automotive and rail markets. IP is a global manufacturer of industrial pumps, valves, and monitoring and control systems, and provides aftermarket services for the energy, chemical and petrochemical, pharmaceutical, general industrial, marine, mining, pulp and paper, food and beverage, power generation and biopharmaceutical markets. CCT is a global designer and manufacturer of harsh-environment interconnect solutions and critical energy absorption and flow control components, primarily for the aerospace, defense and industrial markets. For additional segment information, see Segment Information section.