| ● | Our consumer CFU is responsible for managing relationships with mobile and home customers. |

| ● | Our enterprise business CFU is responsible for developing our business strategy, governance, corporate product development, marketing, and managing relationships with SMEs, Government institutions, and other enterprise customers. |

| ● | Our wholesale & international business CFU is responsible for managing relationships with wholesale customers and other licensed telecommunication operators. |

| ● | Our group business development CFU is responsible for driving business growth by implementing our holding scheme strategy, functional strategy, and business development initiatives. These efforts aim to strengthen the relationship between us as the holding company and Group business development operations. |

In addition, we have five functional units (“FUs”) which perform certain specified internal corporate functions. Our FUs are discussed in greater detail below:

| ● | Our strategic portfolio FU is responsible for creating corporate value through the optimization and harmonization of functional business units and corporate management, realization of synergies within each CFU and subsidiary, optimizing cross-CFU and subsidiary synergies, optimize synergies among SOEs, and engaging in merger and acquisition planning and execution. |

| ● | Our network and IT solutions FU is responsible for promoting integrated network and IT infrastructure across our CFUs and subsidiaries. |

| ● | Our finance and risk management FU is responsible for our implementation cost and capital efficiency program, maximizing the value of our assets, managing the overall risk of the Group and investor relations. |

| ● | Our human capital management FU is responsible for talent management upgrading human resources capabilities, organizational structure and workforce planning, design, and implementation, industrial relations, training, human capital assessment and corporate social responsibility. |

| ● | Our digital services FU is responsible for supporting the maintenance and development of our digital services rendered to all of our customers. |

Our mobile CFU has been integrated into the consumer CFU due to the IndiHome Integration. For more information, see “—Strategy—Enhancing our Assets through Acquisitions and Spin-offs.”

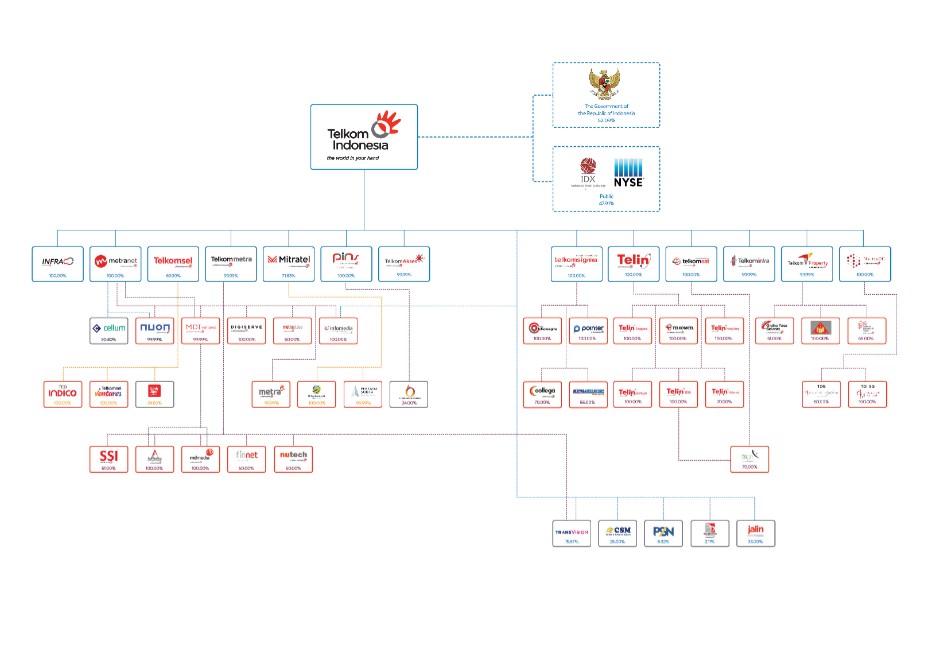

For a list of our subsidiaries and their countries of incorporation, see Exhibit 8.1 to this Form 20-F. A complete list of our subsidiaries and investments in associated companies, and our ownership percentage of each entity, as of December 31, 2024, is contained in Notes 1d and 11 to our Consolidated Financial Statements included elsewhere in this report.

101

The following diagram illustrates our corporate structure of our principal operating entities as of the date of this report:

D. PROPERTY, EQUIPMENT AND RIGHT OF USE ASSETS

Our property and equipment are primarily used for telecommunications operations, which mainly consist of transmission and installation equipment, cable network and in turn consist of (i) switching equipment, (ii) telegraph, telex, and data communication equipment, (iii) transmission installation and equipment, (iv) satellite, earth station, and equipment, (v) cable network, (vi) power supply, (vii) data processing equipment, and (viii) other telecommunication peripherals collectively grouped as 'telecommunication infrastructure'. A description of these is contained in Note 12 to our Consolidated Financial Statements and “— Business Overview — Network Infrastructure and Development.” See also “Item 5B — Liquidity and Capital Resources — Capital Expenditures” for material plans to construct, expand or improve our property and equipment.

Except for ownership rights granted to individuals in Indonesia, reversionary rights to land rests with the Government, pursuant to Agrarian Law No. 5 of 1960. Land title is designated through land rights, including Right to Build (Hak Guna Bangunan or “HGB”) and Right of Use (Hak Guna). Both rights stipulate that title holders enjoy full use of the land for a specified period, subject to renewal and extensions. In most instances, land rights are part of right use of assets, freely tradable and may be placed as security under loan agreements.

We lease several parcels of land located throughout Indonesia together with rights to build and use such land for periods varying from 1-50 years, which will expire between 2025 and 2071. During 2024, there were deductions in Group leases, including expired leases and reclassifications related to land rights, buildings, transmission, installations, equipment, and other assets used in operations, amounting to Rp539 billion. We hold registered rights to build and right to use for most of our properties. Pursuant to Government Regulation No. 18 of 2021 on Right to Manage, Land Right,

102