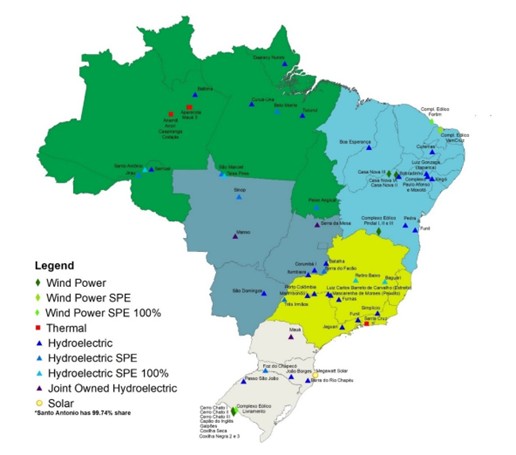

The map below shows the geographic location of our generation assets as of December 31, 2024.

Operational Process

Hydroelectric Plants

Hydroelectric plants use existing hydraulic potential provided by the hydraulic flow and by the high gradient along the course of a river to generate electricity from its water displacement. Also, supply most of our electricity during periods of high demand.

We use our hydro-powered plants to provide the bulk of our primary and back-up electricity generated during peak periods of high demand. During periods of rapid change in supply and demand, hydroelectric plants also provide greater production flexibility than our other forms of electric generation because we are able to instantly increase (or decrease) output from these sources, in contrast to thermal or nuclear facilities where there is a time lag while output is adjusted.

Hydroelectric plants are our most cost-efficient source of electricity, and their efficiency is significantly influenced by meteorological factors, such as rainfall levels. Based on our experience with both hydroelectric and thermal plants, the former has higher construction costs but a longer average useful life.

The ONS is solely responsible for determining how much electricity each of our plants should generate per year. As of December 31, 2024, the total installed capacity of our hydroelectric plants was 42,293.49 MW (including our participation in the SPEs).

45

Wind Farms

Wind farms are electricity generation projects formed by one or more wind turbines, also known as windmills, consisting of associated systems, measurement, control and supervision equipment. The production of wind power takes place through a wind turbine that captures a part of the kinetic energy of the wind that passes through the area swept by the blades and transforms it into mechanical rotational energy. The rotor shaft drives the electric generator, which, through electromagnetic induction, transforms a part of this rotational mechanical energy into electricity. The set formed by several wind turbines installed in a space, land or sea, is called a wind farm.

Solar Plants

A solar plant, also known as a photovoltaic plant, is a complex full of photovoltaic modules, also known as solar panels, capable of generating electricity through sunlight. A solar plant can be composed of thousands or even hundreds of thousands of photovoltaic modules, which can be installed on land or even on the water of dams, rivers or seas, in this case called floating solar plants.

Thermoelectric Plants

Conventional thermoelectric plants generate electricity through a three-step process: (i) burning fossil fuels, like coal, oil or gas, transforming water into steam with the heat generated in the boiler; (ii) using high-pressure steam to turn the turbine, which in turn drives the electric generator; and (iii) steam condensation, transferring the residue of its thermal energy to an independent cooling circuit, and returning the water to the boiler to complete the cycle.

The mechanical power generated by the passage of steam through the turbine and in the generator where it mechanically rotates transforms mechanical power into electrical power. This kind of plant can also operate in a combined cycle, generating electricity combining the operation of a gas turbine, driven by the burning of natural gas or diesel oil, with the operation of a generator.

On June 9, 2024, we entered into an agreement with Âmbar Energia S.A. group for the sale of our remaining operating thermoelectric power plants in the amount of R$4.7 billion, of which R$1.2 billion corresponded to an earn-out. This sale was the result of a competitive bidding process which was initiated in July 2023. In June 2024, we also announced the signing of two additional agreements with Âmbar Energia S.A., comprising:

(i) an agreement that regulates the credit assignment to Âmbar Energia S.A. of the historical sums owed by counterparties to the energy sale contracts of the thermoelectric power plants, in the event of a subsequent transaction involving the transfer of control of such counterparties. Further, the agreement also gives us a purchase option to capture any potential economic benefit resulting from the operational and financial recovery of the distribution company that is a counterparty to the energy sale contracts; and

(ii) an amendment to the purchase option formerly granted regarding the Baleia wind energy complex (non-operational). The amendment grants us rights over insurance indemnities discussed in an action for collection, currently being discussed with the relevant insurance company. We believe that this sale enabled us to maximize the valuation of these assets with an adequate risk allocation with the execution of the reserve energy contracts. This initiative reinforces our commitment to mitigate operational and financial risks, as well as advance in the optimization of our asset portfolio and capital allocation. This transaction also brings us a step closer to achieving our Net Zero 2030 target.

Generation assets and concessions

As of December 31, 2024, we operated under the following concessions/authorizations granted by ANEEL for our generation business. The numbers related to the installed capacity of our operational projects were obtained directly from ANEEL. For the projects under development, we considered the total installed capacity.

46