30

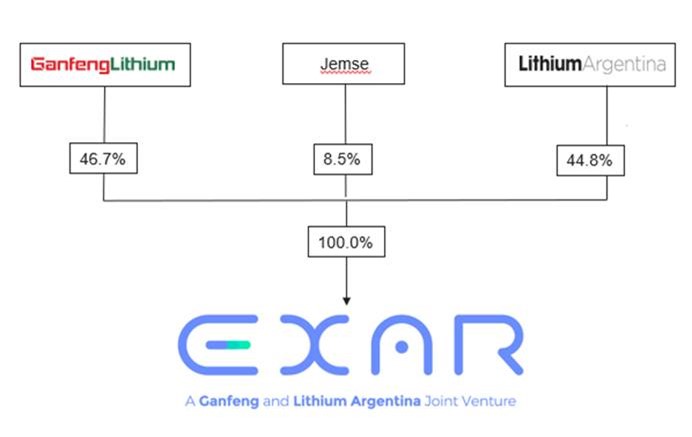

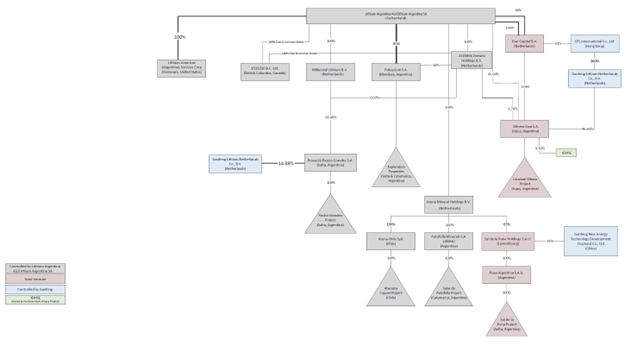

C. Organizational Structure

The following diagram sets out the organizational structure of the Company:

D. Property, Plants and Equipment

Summary Overview of Mining

As used in this annual report, the terms “mineral resource,” “measured mineral resource,” “indicated mineral resource,” “inferred mineral resource,” “mineral reserve,” “proven mineral reserve” and “probable mineral reserve” are defined and used in accordance with S-K 1300. All determinates of mineral resources and mineral reserves have been prepared by qualified persons. Under S-K 1300, mineral resources may not be classified as “mineral reserves” unless the determination has been made by a qualified person that the mineral resources can be the basis of an economically viable project. Mineral resources are not mineral reserves and do not meet the threshold for mineral reserve modifying factors, such as estimated economic viability, that would allow for conversion to mineral reserves. There is no certainty that any part of the mineral resources estimated will be converted into mineral reserves.

Except for that portion of mineral resources classified as mineral reserves, mineral resources have not demonstrated economic value. Inferred mineral resources are estimates based on limited geological evidence and sampling and have too high of a degree of uncertainty to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. Estimates of inferred mineral resources may not be converted to a mineral reserve. It cannot be assumed that all or any part of an inferred mineral resource will be upgraded to a higher category. A significant amount of exploration must be completed to determine whether an inferred mineral resource may be upgraded to a higher category. Therefore, you are cautioned not to assume that all or any part of an inferred mineral resource can be the basis of an economically viable project, or that it will be upgraded to a higher category.

31

Properties

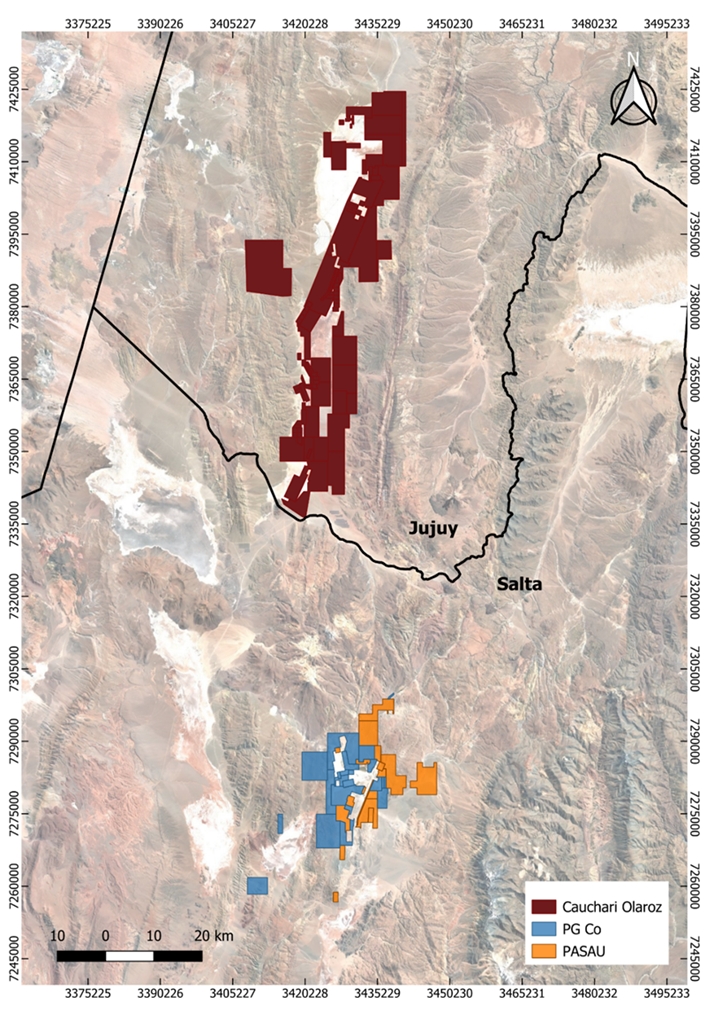

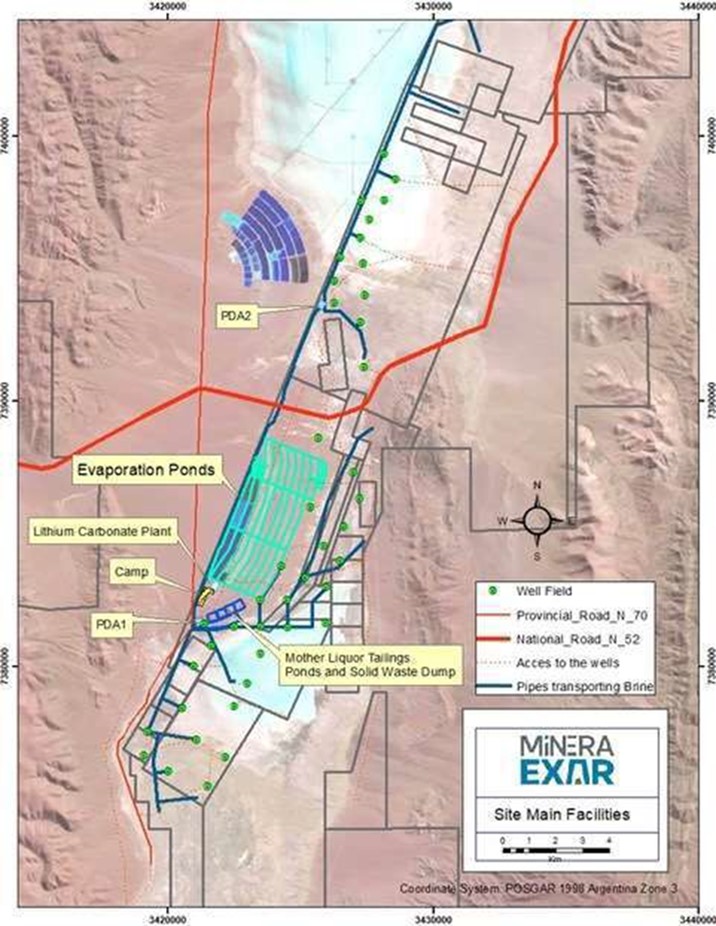

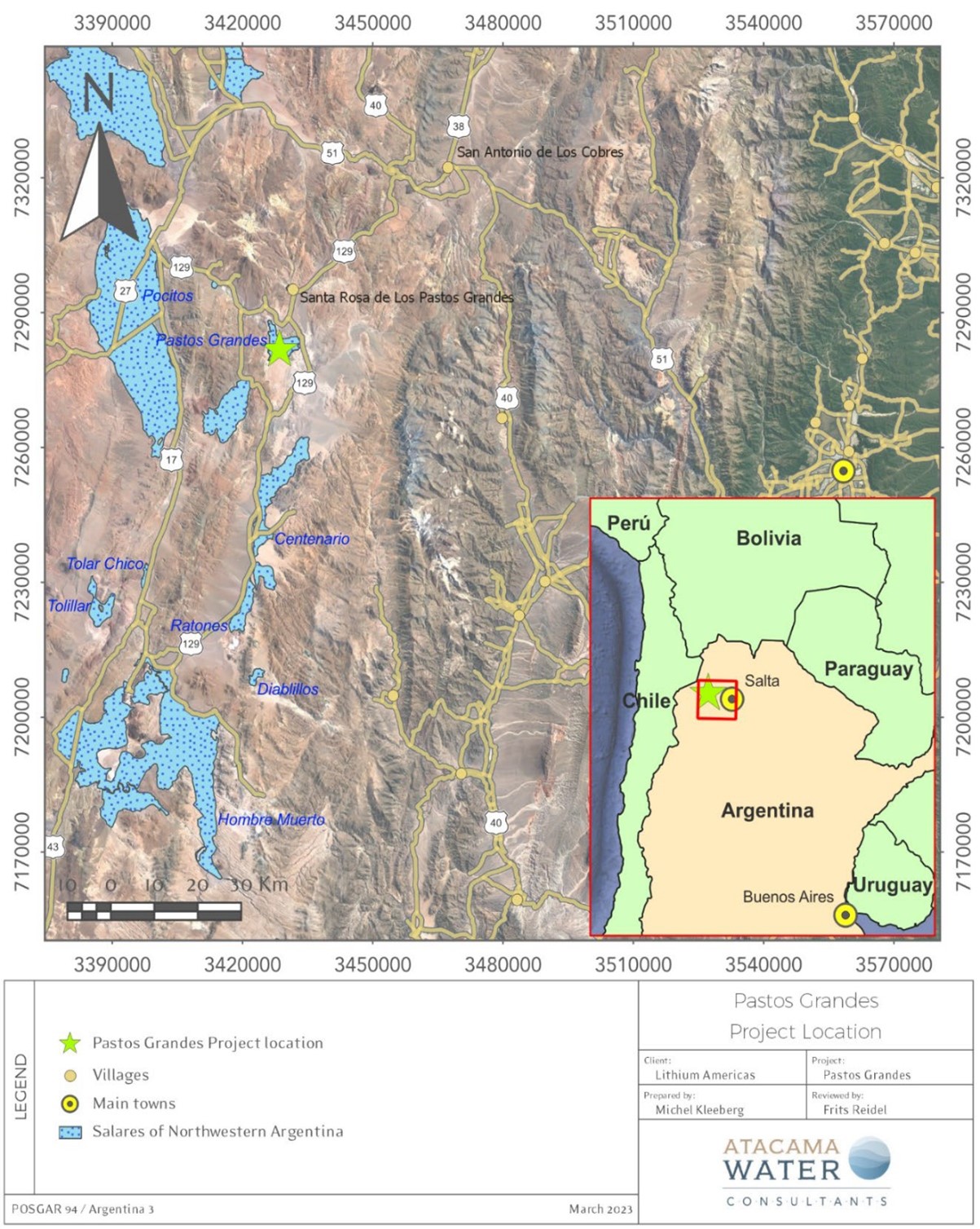

The Company is helping to advance two significant lithium projects, the Cauchari-Olaroz Operation, located in the Province of Jujuy in Argentina, and the Pastos Grandes Project, located in the Province of Salta in Argentina. The Pastos Grandes Project includes the PGCo (Lithium Argentina owns approximately 85% interest). Cauchari-Olaroz is a production stage project. Pastos Grandes is an exploration stage project because the Company has not yet determined that Pastos Grandes has mineral reserves under S-K 1300.

The Cauchari-Olaroz Operation and the Pastos Grandes Project are the Company’s two material projects. The Company also holds a 65% interest in the Sal de la Puna project and 100% in the Antofalla Project, each of which are exploration stage projects.

Except as otherwise stated, the scientific and technical information relating to Cauchari-Olaroz Salars contained in this annual report is derived from the Cauchari TRS prepared by Andeburg Consulting Services Inc. (“ACSI”), LRE Water, EnviroProTech-t and CSU Projects, none of which are affiliated with the Company. The Cauchari TRS was also prepared by Ernest Burga, P.Eng., David Burga, P.Geo., Daniel Weber, P.G., RM-SME, Anthony Sanford, Pr.Sci.Nat., and Marek Dworzanowski, C.Eng., Pr.Eng., each of whom is a “qualified person” under S-K 1300 for the sections of the Cauchari TRS that they are responsible for preparing and none of whom are affiliated with the Company.

Except as otherwise stated, the scientific and technical information relating to Pastos Grandes Salar contained in this annual report has been reviewed and approved by Frederik Reidel, CPG, a qualified person for the purposes of NI 43-101 and S-K 1300 by virtue of his experience, education, and professional association and who is independent of the Company.

Except as otherwise stated, all technical and scientific information contained in this annual report has been reviewed and approved by David Burga, P.Geo, a qualified person for the purposes of NI 43-101 and S-K 1300 by virtue of his experience, education, and professional association and who is independent of the Company.

Detailed scientific and technical information on the Cauchari-Olaroz Operation prepared in accordance with NI 43-101 (including mineral resources and reserves estimates prepared in accordance with CIM Definition Standards adopted by the Canadian Institute of Mining, Metallurgy and Petroleum on May 10, 2014) can be found in the NI 43-101 technical report entitled “NI 43-101 Technical Report – Operational Technical Report at the Cauchari-Olaroz Salars, Jujuy Province, Argentina”. The technical report has an effective date of December 31, 2025, and was prepared by “Qualified Persons” for the purposes of NI 43-101, independent of the Company.

Detailed scientific and technical information on the Pastos Grandes Project prepared in accordance with NI 43-101 can also be found in the NI 43-101 technical report entitled “Lithium Resources Update, Pastos Grandes Project, Salta Province, Argentina”. The technical report has an effective date of April 30, 2023, and was prepared by a “Qualified Person” for the purposes of NI 43-101, independent of the Company. Copies of the technical reports prepared in accordance with NI 43-101 are available on the Company’s website at www.lithium-argentina.com and on the Company’s SEDAR+ profile at www.sedarplus.ca.