UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

☐ REGISTRATION

STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL

REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2024

OR

☐ TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL

COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report _________

For the transition period from _________ to

__________

Commission file number 001-38307

RETO ECO-SOLUTIONS, INC.

(Exact Name of registrant as specified in its charter)

Not Applicable

(Translation of Registrant’s name into English)

British Virgin Islands

(Jurisdiction of incorporation or organization)

X-702, Tower A, 60 Anli Road, Chaoyang District

Beijing, People’s Republic of China

100101

(Address of principal executive offices)

Hengfang Li

X-702, Tower A, 60 Anli Road, Chaoyang District

Beijing, People’s Republic of China

100101

(+86) 10-64827328

Email: ir@retoeco.com

(Name, Telephone, E-mail and/or Facsimile number

and Address of Company Contact Person)

Securities registered or to be registered pursuant

to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A shares, $1.0 par value per share | | RETO | | The Nasdaq Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g)

of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section

15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding

shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: as

of December 31, 2024, 19,352,636 Class A shares and 1,000,000 Class B shares were issued and outstanding (or 1,935,264 Class A shares

and 1,000,000 Class B shares after taking into account of the 10-for-1 share combination effected on March 7, 2025).

Indicate by check mark if

the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No

☒

Note – Checking the

box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

from their obligations under those Sections.

If this report is an annual

or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934. Yes ☐ No ☒

Note - Checking the box above

will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their

obligations under those Sections.

Indicate by check mark whether

the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934

during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been

subject to such filing requirements for the past 90 days. Yes ☒ No

☐

Indicate by check mark whether

the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T

(§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit

such files). Yes ☒ No ☐

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition

of “large accelerated filer,” accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange

Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ | Emerging growth company ☐ |

If an emerging growth company

that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the

extended transition period for complying with any new or revised financial accounting standards † provided pursuant to Section

13(a) of the Exchange Act. ☐

†The term “new

or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting

Standards Codification after April 5, 2012.

Indicate by check mark whether

the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control

over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that

prepared or issued its audit report. ☐ Yes ☒ No

If securities are registered

pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing

reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether

any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the

registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which

basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☒ | International Financial Reporting Standards as issued | Other ☐ |

| | By the International Accounting Standards Board ☐ | |

If “Other” has

been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to

follow.

Item 17 ☐

Item 18 ☐

If this is an annual report,

indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No

☒

(APPLICABLE ONLY TO ISSUERS

INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether

the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of

1934 subsequent to the distribution of securities under a plan confirmed by a court. ☐

Yes ☐ No

Table of Contents

CERTAIN TERMS AND CONVENTIONS

Except where the context otherwise requires and

for purposes of this annual report on Form 20-F only:

| |

● |

“Act” refers to The BVI Business Companies Act, 2004 (as amended); |

| |

|

|

| |

● |

“Beijing REIT” refers to Beijing REIT Technology Development Co., Ltd., a PRC limited liability company and a wholly owned subsidiary of REIT Holdings (China) Limited prior to the December 2024 Divestiture (defined below); |

| |

● |

“BVI” refers to the British Virgin Islands; |

| |

● |

“China” or the “PRC” refers to the People’s Republic of China and the term “Chinese” has a correlative meaning for the purpose of this annual report; |

| |

|

|

| |

● |

“Class A Shares” refers to Class A shares, par value US$1.0 each, of ReTo (defined below); |

| |

|

|

| |

● |

“Class B Shares” refers to Class B shares, par value US$0.01 each, of ReTo (defined below); |

| |

|

|

| |

● |

“common share” refers to common shares issued in ReTo prior to the 2024 Share Redesignation (defined below); |

| |

|

|

| |

● |

“Shares” refers to Class A Shares and Class B Shares, collectively; |

| |

● |

“CSRC” refers to the China Securities Regulatory Commission; |

| |

|

|

| |

● |

“December 2024 Divestiture” refers to the Company’s sale of all of its shares in REIT Holdings (China) Limited to a certain buyer on December 31, 2024; |

| |

|

|

| |

● |

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended; |

| |

|

|

| |

● |

“FINRA” refers to the Financial Industry Regulatory Authority, Inc.; |

| |

● |

“Hong Kong” refers to the Hong Kong Special Administrative Region of the PRC; |

| |

|

|

| |

● |

“Honghe ReTo” refers to Honghe ReTo Ecological Technology Co., Ltd., a PRC limited liability company and a wholly owned subsidiary of ReTo Hengda (defined below); |

| |

|

|

| |

● |

“JOBS Act” refers to the Jumpstart Our Business Startups Act, enacted in April 2012; |

| |

● |

“M&A” refers to the Memorandum and Articles of Association of ReTo (as amended and restated on August 8, 2024, and as further amended by reference on March 7, 2025) as further amended and / or amended and restated from time to time; |

| |

● |

“Macau” refers to the Macao Special Administrative Region of the PRC; |

| |

|

|

| |

● |

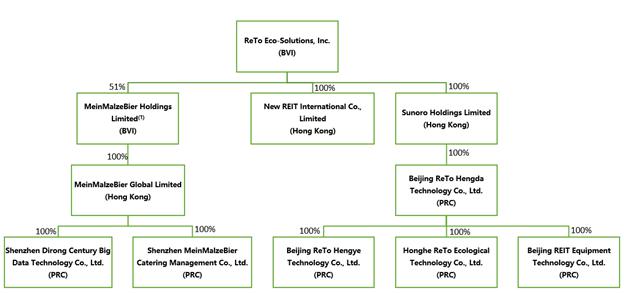

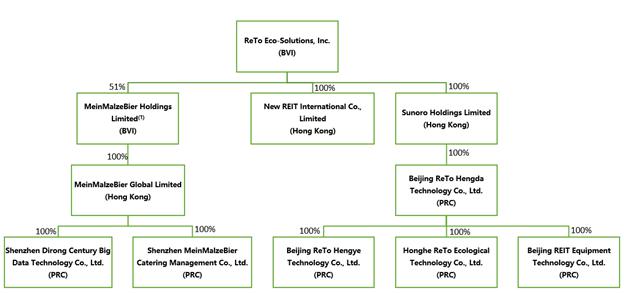

“MeinMalzeBier” refers to MeinMalzeBier Holdings Limited, a BVI business company in which ReTo holds a 51% ownership interest; |

| |

|

|

| |

● |

“mainland China” refers to the People’s Republic of China, excluding, for the purpose of this annual report, Taiwan, Hong Kong and Macau; |

| |

|

|

| |

● |

“MOFCOM” refers to China’s Ministry of Commerce; |

| |

|

|

| |

● |

“PCAOB” refers to the Public Company Accounting Oversight Board of the United States; |

| |

|

|

| |

● |

“PRC subsidiaries” refers to the Company’s subsidiaries that were incorporated in mainland China; |

| |

● |

“REIT Equipment” refers to Beijing REIT Equipment Technology Co., Ltd. (formerly known as Beijing REIT Ecological Engineering Technology Co., Ltd. until August 9, 2023), a PRC limited liability company and a wholly owned subsidiary of ReTo Hengda (defined below); |

| |

● |

“REIT Holdings” refers to REIT Holdings (China) Limited, a Hong Kong limited company and a wholly owned subsidiary of ReTo prior to the December 2024 Divestiture; |

| |

● |

“REIT Ordos” Refers to REIT Ecological Technology Co., Ltd., a PRC limited liability company and a wholly owned subsidiary of REIT Holdings prior to the December 2024 Divestiture; |

| |

● |

“REIT Technology” refers to REIT Technology Development Co., Ltd., a PRC limited liability company and a wholly owned subsidiary of REIT Holdings prior to the December 2024 Divestiture; |

| |

● |

“Renminbi” or “RMB” refers to the legal currency of the People’s Republic of China; |

| |

● |

“ReTo” refers to ReTo Eco-Solutions, Inc., a BVI business company (registered in the BVI with company number 1885527); |

| |

|

|

| |

● |

“ReTo Hengda” refers to Beijing ReTo Hengda Technology Co., Ltd. (formerly known as Sunoro Hengda (Beijing) Technology Co., Ltd. until April 8, 2025), a PRC limited liability company and a wholly owned subsidiary of Sunoro Holdings (defined below); |

| |

|

|

| |

● |

“ReTo Hengye” refers to Beijing ReTo Hengye Technology Co., Ltd. (formerly known as Senrui Bochuang (Beijing) Technology Co., Ltd. until April 10, 2025), a PRC limited liability company and a wholly owned subsidiary of ReTo Hengda; |

| |

● |

“SAFE” refers to China’s State Administration of Foreign Exchange; |

| |

|

|

| |

● |

“SEC” refers to the U.S. Securities and Exchange Commission; |

| |

|

|

| |

● |

“Securities Act” refers to the Securities Act of 1933, as amended; |

| |

|

|

| |

● |

“Sunoro Holdings” refers to Sunoro Holdings Limited, a Hong Kong limited company and a wholly owned subsidiary of ReTo; |

| |

● |

“U.S. dollars,” “US$” and “$” refer to the legal currency of the United States; and |

| |

● |

“We,” “us,” “our,” or the “Company” refers to ReTo Eco-Solutions, Inc. and its subsidiaries, unless the context requires otherwise. |

For the sake of clarity, this

annual report follows the English naming convention of first name followed by last name, regardless of whether an individual’s name

is Chinese or English. For example, the name of our chief executive officer will be presented as “Hengfang Li,” even though,

in Chinese, his name would be presented as “Li Hengfang.”

Our reporting and functional

currency is the Renminbi. Solely for the convenience of the reader, this annual report contains translations of some RMB amounts into

U.S. dollars, at specified rates. Except as otherwise stated in this annual report, all translations from RMB to U.S. dollars are made

at RMB 7.2993 to US$1.00, the rate published by the Federal Reserve Board on December 31, 2024. No representation is made that the RMB

amounts referred to in this annual report could have been or could be converted into U.S. dollars at such rate.

Except as otherwise stated

in this annual report, all numbers of our Shares and related data have been updated to reflect the 10-for-1 share combination effective

May 15, 2023 (the “2023 Share Combination”), the 10-for-1 share combination effective March 1, 2024 (the “2024 Share

Combination”), and the 10-for-1 share combination effective March 7, 2025 (the “2025 Share Combination”). On August

8, 2024, we (a) redesignated the existing common shares, par value US$0.10 each, as Class A Shares with the same rights as the existing

common shares (the “2024 Share Redesignation”) and (b) created an additional 2,000,000 shares each to be designated as Class

B Shares, with each share to entitle the holder thereof to 1,000 votes but with transfer restrictions, pre-emption rights and no right

to any dividend or distribution of the surplus assets on liquidation.

Our fiscal year end is December

31. References to a particular “fiscal year” are to our fiscal year ended December 31 of that calendar year.

Due

to rounding, numbers presented throughout this annual report may not add up precisely to the totals provided and percentages may not precisely

reflect the absolute figures.

We own or have rights to trademarks

or trade names that we use in connection with the operation of our business, including our corporate names, logos and website names. In

addition, we own or have the rights to copyrights, trade secrets and other proprietary rights that protect the content of our products.

This annual report may also contain trademarks, service marks and trade names of other companies, which are the property of their respective

owners. Our use or display of third parties’ trademarks, service marks, trade names or products in this annual report is not intended

to, and should not be read to, imply a relationship with or endorsement or sponsorship of us. Solely for convenience, some of the copyrights,

trade names and trademarks referred to in this annual report or the documents incorporated by reference herein are listed without their

©, ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our copyrights, trade

names and trademarks. All other trademarks are the property of their respective owners.

FORWARD-LOOKING STATEMENTS

This annual report contains

forward-looking statements that reflect our current expectations and views of future events. These forward-looking statements are made

under the “safe-harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. All statements contained

in this annual report other than statements of historical fact, including statements regarding our future results of operations and financial

position, our business strategy and plans, and our objectives for future operations, are forward-looking statements. The words “believe,”

“may,” “will,” “estimate,” “continue,” “anticipate,” “intend,”

“expect,” and similar expressions are intended to identify forward-looking statements. We have based these forward-looking

statements largely on our current expectations and projections about future events and trends that we believe may affect our financial

condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs.

These forward-looking statements include statements relating to:

| |

● |

the potential impact on our business of the economic, political and social conditions of the PRC; |

| |

|

|

| |

● |

any changes in the laws of the PRC or local province that may affect our operations; |

| |

|

|

| |

● |

our ability to operate as a going concern; |

| |

|

|

| |

● |

the liquidity of our securities; |

| |

|

|

| |

● |

inflation and fluctuations in foreign currency exchange rates; |

| |

|

|

| |

● |

our expansion into new businesses, industries

or international markets, and undertaking of mergers, acquisitions, investments or divestments; |

| |

|

|

| |

● |

the ability to realize benefits of the acquisition of MeinMalzeBier and integrate and expand its businesses into our existing business and grow and manage growth profitably; |

| |

|

|

| |

● |

the ability to navigate geographic market risks of our products; |

| |

|

|

| |

● |

the ability to maintain a reserve for warranty or defective products and installation claims; |

| |

|

|

| |

● |

our on-going ability to obtain all mandatory and voluntary government and other industry certifications, approvals, and/or licenses to conduct our business; |

| |

|

|

| |

● |

our ability to maintain effective supply chain of raw materials and our products; |

| |

|

|

| |

● |

slowdown or contraction in industries in China in which we operate; |

| |

|

|

| |

● |

our ability to maintain or increase our market share in the competitive markets in which we do business; |

| |

|

|

| |

● |

our ability to diversify our product and service offerings and capture new market opportunities; |

| |

|

|

| |

● |

our estimates of expenses, capital requirements and needs for additional financing and our ability to fund our current and future operations; |

| |

|

|

| |

● |

the costs we may incur in the future from complying with current and future laws and regulations and the impact of any changes in the regulations on our operations; and |

| |

|

|

| |

● |

the loss of key members of our senior management. |

These forward-looking statements

are subject to a number of risks, uncertainties and assumptions, including those described in the “Item 3. Key Information —

D. Risk Factors,” “Item 5. Operating and Financial Review and Prospects,” and elsewhere in this annual report.

Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for

our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or

combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make.

In light of these risks, uncertainties and assumptions, the future events and trends discussed in this annual report may not occur and

actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

You should not rely upon forward-looking

statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved

or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future

results, levels of activity, performance, or achievements. We are under no duty to update any of these forward-looking statements after

the date of this annual report or to conform these statements to actual results or revised expectations.

The forward-looking statements

made in this annual report relate only to events or information as of the date on which the statements are made in this annual report.

Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result

of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated

events. You should read this annual report and the documents that we refer to in this annual report and exhibits to this annual report

completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of

our forward-looking statements by these cautionary statements.

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

Holding Company Structure

ReTo Eco-Solutions, Inc. (“ReTo,”

collectively with its consolidated subsidiaries, the “Company,” “we,” “us,” “our” or similar

terminology) is a holding company and a business company incorporated in the British Virgin Islands (the “BVI”) with no material

operations of its own. We conduct substantially all of our operations through our subsidiaries established in mainland China. Our equity

structure is a direct holding structure, that is, ReTo, the BVI entity listed in the U.S., controls Sunoro Holdings and MeinMalzeBier,

and other PRC operating entities through Sunoro Holdings and MeinMalzeBier. See “Item 4. Information on the Company - A. History

and development of the company” For more details.

We face various risks and

uncertainties relating to doing business in China. Our business operations are primarily conducted in China, and we are subject to complex

and evolving PRC laws and regulations. For example, we face risks associated with regulatory approvals on offshore offerings, anti-monopoly

regulatory actions, and oversight on cybersecurity and data privacy, which may impact our ability to conduct certain businesses, accept

foreign investments, or list and conduct offerings on a United States or other foreign exchange. These risks could result in a material

adverse change in our operations and the value of our Class A Shares, significantly limit or completely hinder our ability to continue

to offer securities to investors, or cause the value of such securities to significantly decline. For a detailed description of risks

relating to doing business in China, see “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business

in China.”

The PRC government’s

significant discretion and authority in regulating our operations and its oversight and control over offerings conducted overseas by,

and foreign investment in, China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer

securities to investors. Implementation of industry-wide regulations in this nature may cause the value of our securities to significantly

decline or become worthless. For more details, see “Item 3. Key Information—D. Risk Factors—Risks Relating to Doing

Business in China— The PRC government’s significant oversight and discretion over the conduct of our business and may intervene

or influence our operations at any time which could result in a material adverse change in our operation and/or the value of our Class

A Shares.”

Risks and uncertainties arising

from the legal system in China, including risks and uncertainties regarding the enforcement of laws and quickly evolving rules and regulations

in China, could result in a material adverse change in our operations and cause our Class A Shares to decrease in value or become worthless.

For more details, see “Item 3. Key Information—D. Risk Factors—Risks Relating to Doing Business in China— There

are uncertainties regarding the interpretation and enforcement of PRC laws, rules and regulations. The rules and regulations in China

can change quickly with little advance notice and uncertainties in the interpretation and enforcement of PRC laws, rules and regulations

could limit the legal protections available to you and us.”

Cash and Other Assets Transfers between the Holding Company and

Its Subsidiaries

For the fiscal years ended

December 31, 2022, 2023, and 2024, funds equivalent to approximately $4.2 million, $0.1 million, and $29.4 million, respectively, were

provided to the PRC subsidiaries as shareholder loans, which were accounted as loan receivable from the respective PRC subsidiary. These

funds have been used by the Company’s PRC subsidiaries for their operations.

As of the date of this annual

report, there have not been any dividends or other distributions from our PRC subsidiaries to REIT Holdings prior to the 2024 Divesture,

Sunoro Holdings and ReTo, all of which are located outside of mainland China. ReTo, as a BVI holding company, may rely on dividends and

other distributions on equity paid by its PRC subsidiaries for its cash and financing requirements, including the funds necessary to pay

dividends and other cash distributions to its shareholders, subject to ReTo’s M&A and the Act or to service any expenses and

other obligations it may incur.

Within our direct holding

structure, the cross-border transfer of funds from ReTo to its PRC subsidiaries is permitted under laws and regulations of the PRC currently

in effect. Specifically, ReTo is permitted to provide funding to its PRC subsidiaries in the form of shareholder loans or capital contributions,

subject to satisfaction of applicable government registration, approval and filing requirements in China. There are no quantity limits

on ReTo’s ability to make capital contributions to its PRC subsidiaries under the PRC law and regulations. However, the PRC subsidiaries

may only procure shareholder loans from Sunoro Holdings in an amount equal to the difference between their respective registered capital

and total investment amount as recorded in the Chinese Foreign Investment Comprehensive Management Information System or three times of

its net assets, at the discretion of such PRC subsidiary.

For additional information,

see “Item 3. Key Information—D. Risk Factors—Risks Related to Doing Business in China — PRC regulation on loans

to, and direct investment in, PRC entities by offshore holding companies and governmental control in currency conversion may delay or

prevent us from using the proceeds of our offerings to make loans to or make additional capital contributions to our PRC subsidiaries,

which could materially and adversely affect our liquidity and our ability to fund and expand our business.”

Subject to the passive foreign

investment company rules, the requirements of ReTo’s M&A and the Act, the gross amount of any distribution that we make to investors

with respect to our securities (including any amounts withheld to reflect PRC withholding taxes) will be taxable as a dividend, to the

extent paid out of our current or accumulated earnings and profits, as determined under United States federal income tax principles. Any

proposed dividend would be subject to ReTo’s M&A and the Act; specifically, ReTo may only pay a dividend if ReTo’s directors

are satisfied, on reasonable grounds, that, immediately after the dividend is paid, the value of its assets will exceed its liabilities

and it will be able to pay its debts as they fall due.

The PRC Enterprise Income

Tax Law (the “EIT Law”) and its implementation rules provide that a withholding tax at a rate of 10% will be applicable to

dividends payable by PRC companies to non-PRC-resident enterprises unless reduced under treaties or arrangements between the PRC central

government and the governments of other countries or regions where the non-PRC resident enterprises are tax resident. Pursuant to the

tax agreement between mainland China and the Hong Kong Special Administrative Region, the withholding tax rate in respect to the payment

of dividends by a PRC enterprise to a Hong Kong enterprise may be reduced to 5% from a standard rate of 10%. However, if the relevant

tax authorities determine that our transactions or arrangements are for the primary purpose of enjoying a favorable tax treatment, the

relevant tax authorities may adjust the favorable withholding tax in the future. Accordingly, there is no assurance that the reduced 5%

withholding rate will apply to dividends received by our Hong Kong subsidiary from our PRC subsidiaries. This withholding tax will reduce

the amount of dividends we may receive from our PRC subsidiaries.

We maintain bank accounts

in China, including cash in Renminbi in the amount of approximately RMB1.6 million and cash in USD in the amount of approximately US$0.5

million as of December 31, 2024. Funds are transferred between ReTo and its subsidiaries for their daily operation purposes. The transfer

of funds between our PRC subsidiaries are subject to the Provisions of the Supreme People’s Court on Several Issues Concerning the

Application of Law in the Trial of Private Lending Cases (2020 Second Revision, the “Provisions on Private Lending Cases”),

which was implemented on January 1, 2021 to regulate the financing activities between natural persons, legal persons and unincorporated

organizations. The Provisions on Private Lending Cases set forth that private lending contracts will be upheld as invalid under the circumstance

that (i) the lender swindles loans from financial institutions for relending; (ii) the lender relends the funds obtained by means of a

loan from another profit-making legal person, raising funds from its employees, illegally taking deposits from the public; (iii) the lender

who has not obtained the lending qualification according to the law lends money to any unspecified object of the society for the purpose

of making profits; (iv) the lender lends funds to a borrower when the lender knows or should have known that the borrower intended to

use the borrowed funds for illegal or criminal purposes; (v) the lending is in violation of public orders or good morals; or (vi) the

lending is in violation of mandatory provisions of laws or administrative regulations. We have relied on the opinion of our PRC counsel,

Yuan Tai Law Offices, that the Provisions on Private Lending Cases does not prohibit using cash generated from one subsidiary to fund

another subsidiary’s operations. We have not been notified of any other restriction which could limit our PRC subsidiaries’

ability to transfer cash between subsidiaries. We have adopted certain cash management policies that dictate the internal approval process

on transferring funds between our holding company and our subsidiaries. Such policies dictate the purpose, amount and procedure of cash

transfers. Each transfer of cash among our subsidiaries is subject to internal approvals from at least two manager-level personnel, with

required procedures including submitting supporting documentation (such as payment receipts or invoices), responsible personnel reviewing

the documentation, and executing the payment. A single employee is not allowed to complete each and every stage of a cash transfer, but

rather only specific parts of the whole procedure.

There is no assurance that

the PRC government will not intervene or impose restrictions on the ability of us or our subsidiaries to transfer cash. Most of our cash

is in Renminbi, and the PRC government could prevent the cash maintained in our bank accounts in mainland China from leaving mainland

China, could restrict deployment of the cash into the business of our subsidiaries and restrict the ability to pay dividends. For details

regarding the restrictions on our ability to transfer cash between us, and our subsidiaries, see “Item 3. Key Information—D.

Risk Factors—Risks Related to Doing Business in China — The PRC government could prevent the cash maintained in our bank accounts

in mainland China from leaving mainland China, restrict deployment of the cash into the business of its subsidiaries and restrict the

ability to pay dividends to U.S. investors, which could materially adversely affect our operations.” We currently do not have

cash management policies that dictate how funds are transferred between our BVI holding company and our subsidiaries.

Restrictions on Our Ability to Transfer Cash

Out of China and to U.S. Investors

Our PRC subsidiaries’

ability to distribute dividends is based upon their distributable earnings. Current PRC regulations permit our PRC subsidiaries to pay

dividends to their respective shareholders only out of their accumulated profits, if any, as determined in accordance with PRC accounting

standards and regulations. In addition, under PRC law, each of our PRC subsidiaries is required to set aside at least 10% of its after-tax

profits each year, if any, to fund certain statutory reserve funds until such reserve funds reach 50% of its registered capital. These

reserves are not distributable as cash dividends. If any of our PRC subsidiaries incurs debt on its own behalf in the future, the instruments

governing such debt may restrict its ability to pay dividends to ReTo.

To address persistent capital

outflows and the RMB’s depreciation against the U.S. dollar in the fourth quarter of 2016, the People’s Bank of China and

the State Administration of Foreign Exchange, or SAFE, implemented a series of capital control measures in the subsequent months, including

stricter vetting procedures for China-based companies to remit foreign currency for overseas acquisitions, dividend payments and shareholder

loan repayments. The PRC government may continue to strengthen its capital controls and our PRC subsidiaries’ dividends and other

distributions may be subject to tightened scrutiny in the future. The PRC government also imposes controls on the conversion of RMB into

foreign currencies and the remittance of currencies out of mainland China. Therefore, we may experience difficulties in completing the

administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from our profits, if any.

Effect of The Holding Foreign Companies Accountable

Act

The Holding Foreign Companies

Accountable Act (the “HFCAA”), which was signed into law on December 18, 2020, requires a foreign company to submit that it

is not owned or manipulated by a foreign government or disclose the ownership of governmental entities and certain additional information,

if the PCAOB is unable to inspect completely a foreign auditor that signs the company’s financial statements. If the PCAOB is unable

to inspect the Company’s auditors for three consecutive years, the Company’s securities will be prohibited from trading on

a national exchange.

On December 2, 2021, the SEC

adopted final amendments to its rules implementing the HFCAA. Such final rules establish procedures that the SEC will follow in (i) determining

whether a registrant is a “Commission-Identified Issuer” (a registrant identified by the SEC as having filed an annual report

with an audit report issued by a registered public accounting firm that is located in a foreign jurisdiction and that the PCAOB is unable

to inspect or investigate completely because of a position taken by an authority in that jurisdiction) and (ii) prohibiting the trading

of an issuer that is a Commission-Identified Issuer for three consecutive years under the HFCAA. The SEC began identifying Commission-Identified

Issuers for the fiscal years beginning after December 18, 2020. A Commission-Identified Issuer is required to comply with the submission

and disclosure requirements in the annual report for each year in which it was identified. If a registrant is identified as a Commission-Identified

Issuer based on its annual report for the fiscal year ended, for example, September 30, 2021, the registrant will be required to comply

with the submission or disclosure requirements in its annual report filing covering the fiscal year ended September 30, 2022.

On December 16, 2021, the

PCAOB issued its determination that the PCAOB is unable to inspect or investigate completely PCAOB-registered public accounting firms

headquartered in mainland China and in Hong Kong, because of positions taken by PRC authorities in those jurisdictions, and the PCAOB

included in the report of its determination a list of the accounting firms that are headquartered in mainland China or Hong Kong. This

list did not include YCM CPA INC., our current auditor. Our auditor, as an auditor of companies that are traded publicly in the United

States and a firm registered with the PCAOB, is subject to laws in the United States pursuant to which the PCAOB conducts regular inspections

to assess its compliance with the applicable professional standards. On August 26, 2022, the PCAOB signed a Statement of Protocol with

the CSRC and MOF, taking the first step toward opening access for the PCAOB to inspect and investigate registered public accounting firms

headquartered in mainland China and Hong Kong without any limitations on scope. However, uncertainties exist with respect to the implementation

of this framework and there is no assurance that the PCAOB will be able to execute, in a timely manner, its future inspections and investigations

in a manner that satisfies the Statement of Protocol. On December 15, 2022, the PCAOB determined that the PCAOB was able to secure complete

access to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong and voted to vacate

its previous determinations to the contrary.

On December 29, 2022, the

Consolidated Appropriations Act, 2023, was signed into law, which amended the HFCAA (i) to reduce the number of consecutive non-inspection

years required for triggering the prohibitions under the HFCAA from three years to two, and (ii) so that any foreign jurisdiction could

be the reason why the PCAOB does not have complete access to inspect or investigate a company’s auditor. As it was originally enacted,

the HFCAA applied only if the PCAOB’s inability to inspect or investigate was due to a position taken by an authority in the foreign

jurisdiction where the relevant public accounting firm is located. As a result of the Consolidated Appropriations Act, 2023, the HFCAA

now also applies if the PCAOB’s inability to inspect or investigate the relevant accounting firm is due to a position taken by an

authority in any foreign jurisdiction. The denying jurisdiction does not need to be where the accounting firm is located.

These developments could add

uncertainties to the trading of our securities, including the possibility that the SEC may prohibit trading in our securities if the PCAOB

cannot fully inspect or investigate our auditor and we fail to appoint a new auditor that is accessible to the PCAOB and that Nasdaq can

delist our Class A Shares.

If it is later determined

that the PCAOB is unable to inspect or investigate our auditor completely, investors may be deprived of the benefits of such inspection.

Any audit reports not issued by auditors that are completely inspected by the PCAOB, or a lack of PCAOB inspections of audit work undertaken

in China that prevents the PCAOB from regularly evaluating our auditor’s audits and its quality control procedures, could result

in a lack of assurance that our financial statements and disclosures are adequate and accurate, then such lack of inspection could cause

our securities to be delisted from the stock exchange.

For details on the effects

of HFCAA on us, see “Item 3. Key Information — D. Risk Factors — Risks Related to Doing Business in China —

Our Class A Shares may be delisted under the HFCAA if the PCAOB is unable to inspect our auditor. The delisting of our Class A Shares,

or the threat of their being delisted, may materially and adversely affect the value of your investment.”

Regulatory Permissions and Developments

We have been advised by our

PRC Counsel, Yuan Tai Law Offices, that pursuant to the relevant laws and regulations in China, none of our PRC subsidiaries’

currently engaged business is stipulated on the Special Administrative Measures for the Access of Foreign Investment (Negative List) promulgated

by the Ministry of Commerce (the “MOFCOM”) and the National Development and Reform Commission of the People’s Republic

of China (“NDRC”) which the latest version entered into force on November 1, 2024 (2024 Version). Therefore, our PRC subsidiaries

are able to conduct their business without being subject to restrictions imposed by the foreign investment laws and regulations of the

PRC.

Currently, none of our PRC

subsidiaries is required to obtain additional licenses or permits beyond a regular business license for their operations currently being

conducted. Each of our PRC subsidiaries is required to obtain a regular business license from the local branch of the State Administration

for Market Regulation (“SAMR”). Each of our PRC subsidiaries has obtained a valid business license for its respective business

scope, and no application for any such license has been denied.

As of the date of this annual

report, neither ReTo nor any of its PRC subsidiaries is subject to permission requirements from the CSRC, the Cyberspace Administration

of China (the “CAC”) or any other entity that is required to approve of their respective operations. Recently, the PRC government

initiated a series of regulatory actions and made a number of public statements on the regulation of business operations in China with

little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over China-based

companies listed overseas, adopting new measures to extend the scope of cybersecurity reviews, and expanding efforts in anti-monopoly

enforcement.

Among other things, the Regulations

on Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (the “M&A Rules”) and Anti-Monopoly Law of the

People’s Republic of China promulgated by the Standing Committee of the National People’s Congress (the “SCNPC”)

which became effective in 2008 and amended and put into effect as from August 1, 2022 (the “Anti-Monopoly Law”), established

additional procedures and requirements that could make merger and acquisition activities by foreign investors more time-consuming and

complex. Such regulation requires, among other things, that the MOFCOM be notified in advance of any change-of-control transaction in

which a foreign investor acquires control of a PRC domestic enterprise or a foreign company with substantial PRC operations, if certain

thresholds under the Provisions of the State Council on the Standard for Declaration of Concentration of Business Operators, issued by

the State Council in 2008 and amended on September 19, 2018, are triggered. Moreover, the Anti-Monopoly Law requires that transactions

which involve the national security, the examination on the national security shall also be conducted according to the relevant provisions

of the State Council. In addition, the PRC Measures for the Security Review of Foreign Investment which became effective in January 2021

require acquisitions by foreign investors of PRC companies engaged in military-related or certain other industries that are crucial to

national security be subject to security review before consummation of any such acquisition.

On July 6, 2021, the relevant

PRC governmental authorities made public the Opinions on Strictly Cracking Down Illegal Securities Activities in Accordance with the Law.

These opinions emphasized the need to strengthen the administration over illegal securities activities and the supervision on overseas

listings by China-based companies and proposed to take effective measures, such as promoting the construction of relevant regulatory systems

to deal with the risks and incidents faced by China-based overseas-listed companies. As official guidance and related implementation rules

on these opinions have not been issued yet, the interpretation of these opinions remains unclear at this stage. See “Item 3.

Key Information—D. Risk Factors—Risks Relating to Doing Business in China— Approval of the CSRC or other PRC government

authorities may be required in connection with our future offerings under PRC law, and if required, we cannot predict whether or for how

long we will be able to obtain such approval.”

On December 28, 2021, the

Measures for Cybersecurity Review (2021 Version) was promulgated and became effective on February 15, 2022, which iterates that any “online

platform operators” controlling personal information of more than one million users which seeks to list in a foreign stock exchange

should also be subject to cybersecurity review. The Measures for Cybersecurity Review (2021 Version), further elaborates the factors to

be considered when assessing the national security risks of the relevant activities, including, among others, (i) the risk of core data,

important data or a large amount of personal information being stolen, leaked, destroyed, and illegally used or exited the country; and

(ii) the risk of critical information infrastructure, core data, important data or a large amount of personal information being affected,

controlled, or maliciously used by foreign governments after listing abroad. We have relied on the opinion of our PRC counsel, Yuan Tai

Law Offices, that as a result of: (i) we do not hold personal information in our business operations; and (ii) data processed in our business

does not have a bearing on national security and thus may not be classified as core or important data by the authorities, we are not required

to apply for a cybersecurity review under the Measures for Cybersecurity Review (2021 Version).

As advised by our PRC legal

counsel, Yuan Tai Law Offices, the PRC governmental authorities may have wide discretion in the interpretation and enforcement of these

laws, including the interpretation of the scope of “critical information infrastructure operators.” In anticipation of the

strengthened implementation of cybersecurity laws and regulations and the continued expansion of our business, we may face challenges

in addressing its requirements and make necessary changes to our internal policies and practices in data processing. As of the date of

this annual report, we have not been involved in any investigations on cybersecurity review made by the CAC on such basis, and we have

not received any inquiry, notice, warning, or sanctions in such respect.

On August 20, 2021, the SCNPC

promulgated the Personal Information Protection Law, which integrates the scattered rules with respect to personal information rights

and privacy protection and took effect on November 1, 2021. Personal information refers to information related to identified or identifiable

natural persons which is recorded by electronic or other means and excluding anonymized information. The Personal Information Protection

Law provides that a personal information processor could process personal information only under prescribed circumstances such as with

the consent of the individual concerned and where it is necessary for the conclusion or performance of a contract to which such individual

is a party to the contract. If a personal information processor shall provide personal information to overseas parties, various conditions

shall be met, which includes security evaluation by the national network department and personal information protection certification

by professional institutions. The Personal Information Protection Law raises the protection requirements for processing personal information,

and many specific requirements of the Personal Information Protection Law remain to be clarified by the CAC, other regulatory authorities,

and courts in practice. We may be required to make further adjustments to our business practices to comply with the personal information

protection laws and regulations.

None of our PRC subsidiaries

currently operates in an industry that prohibits or limits foreign investment. As a result, as advised by our PRC counsel, Yuan Tai Law

Offices, other than those requisite for a domestic company in mainland China to engage in the businesses similar to those of our PRC subsidiaries,

none of our PRC subsidiaries is required to obtain any permission from Chinese authorities, including the CSRC, the CAC, or any other

governmental agency that is required to approve its current operations. However, if our PRC subsidiaries do not receive or maintain the

approvals, or we inadvertently conclude that such approvals are not required, or applicable laws, regulations, or interpretations change

such that our PRC subsidiaries are required to obtain approval in the future, we may be subject to investigations by competent regulators,

fines or penalties, ordered to suspend our PRC subsidiaries’ relevant operations and rectify any non-compliance, prohibited from

engaging in relevant business or conducting any offering, and these risks could result in a material adverse change in our PRC subsidiaries’

operations, significantly limit or completely hinder our ability to offer or continue to offer securities to investors, or cause such

securities to significantly decline in value or become worthless. As of the date of this annual report, we and our PRC subsidiaries have

received from PRC authorities all requisite licenses, permissions, or approvals needed to engage in the businesses currently conducted

in China, and no permission or approval has been denied.

On February 17, 2023, CSRC released the Trial Administrative Measures

of Overseas Securities Offering and Listing by Domestic Companies (the “Trial Measures”) together with five guidelines, which

became effective on March 31, 2023. The Trial Measures lay out the filing regulation arrangement for both direct and indirect overseas

listing by PRC domestic companies, and clarify the determination criteria for indirect overseas listing in overseas markets. Any future

securities offerings and listings outside of mainland China by our Company, including but not limited to, follow-on offerings, secondary

listings and going private transactions, will be subject to the filing requirements with the CSRC under the Trial Measures. As of the

date of this annual report, we have not received any formal inquiry, notice, warning, sanction, or objection from the CSRC or any other

PRC governmental authorities with respect to our listing on Nasdaq. As of the date of this annual report, we are in the process of completing

the filing procedures with the CSRC in connection with our financings during the fiscal year ended December 31, 2024. The Company is also

preparing for the filing with CSRC for the MeinMalzeBier acquisition completed in April 2025 and expects to submit the filing in short

order. As the Trial Measures were newly published and there is uncertainty with respect to the filing requirements and their implementation,

we cannot be sure that we will be able to complete such filings in a timely manner, or at all. Any failure or perceived failure of us

to fully comply with such new regulatory requirements could significantly limit or completely hinder our ability to offer or continue

to offer securities to investors, cause significant disruption to our business operations, and severely damage our reputation, which could

materially and adversely affect our financial condition and results of operations and could cause the value of our securities to significantly

decline or be worthless. See “Item 3. Key Information — D. Risk Factors — Risks Relating to Doing Business in China

— Approval of the CSRC or other PRC government authorities may be required in connection with our future offerings under PRC law,

and if required, we cannot predict whether or for how long we will be able to obtain such approval.”

As of the date of this annual

report, except as disclosed above, neither ReTo nor any of our PRC subsidiaries, (i) is required to obtain permissions from the PRC authorities,

including the CSRC or the CAC, in connection with our issuance of securities to foreign investors, or (ii) has been denied such permissions

by any PRC authority. We are subject to the risks of uncertainty of any future actions of the PRC government in this regard including

the risk that we inadvertently conclude that the permission or approvals discussed here are not required, that applicable laws, regulations

or interpretations change such that we and our PRC subsidiaries are required to obtain approvals in the future.

| |

B. |

Capitalization and indebtedness. |

Not applicable.

| |

C. |

Reasons for the offer and use of proceeds. |

Not applicable.

Summary of Risk Factors

Set forth below is a summary

of the principal risks we face, organized under relevant headings.

Risks Related to Doing Business in China

We face risks and uncertainties

related to doing business in China in general, including, but not limited to, the following:

| |

● |

Changes in China’s economic, political or social conditions or government policies or in relations between China and the United States; |

| |

● |

The impact on our operations and value of our Class A Shares by PRC government’s significant oversight, control, intervention and/or influence over our business operation; |

| |

|

|

| |

● |

The complex and evolving laws and regulations regarding privacy and data protection, including China’s new Data Security Law, Cybersecurity Review Measures, Personal Information Protection Law, that our business is subject to; |

| |

● |

Uncertainties regarding the interpretation and enforcement of PRC laws, rules and regulations; |

| |

|

|

| |

● |

The risks of delisting or the threat of being delisted under the HFCAA if the PCAOB is unable to inspect our auditor; |

| |

|

|

| |

● |

The approval of the CSRC, CAC or other Chinese regulatory agencies which may be required in connection with our offshore offerings under Chinese law and, if required, our inability to obtain such approval or complete such filing; |

| |

|

|

| |

● |

The potential treatment as a resident enterprise for PRC tax purposes under the EIT Law and the risk of being subject to PRC income tax on our global income; |

| |

|

|

| |

● |

Foreign exchange controls in China, which could limit our use of funds that would be raised in future offerings, which could have a material adverse effect on our business; |

| |

|

|

| |

● |

The complex procedures under the PRC laws and regulation in connection with certain acquisitions of China-based companies by foreign investors; |

| |

● |

PRC regulation of loans to, and direct investment in, PRC entities by offshore holding companies and governmental control of currency conversion, which may restrict or prevent ReTo from making additional capital contributions or loans to its PRC subsidiaries; |

| |

|

|

| |

● |

Any limitation on the ability of our PRC subsidiaries to make payments to us; |

| |

|

|

| |

● |

Fluctuations in exchange rates; |

| |

|

|

| |

● |

The adverse impact on our business by the tensions in international trade and rising political tensions; |

| |

|

|

| |

● |

The potential supply chain disruptions; and |

| |

|

|

| |

● |

Any severe or prolonged downturn in the global or Chinese economy. |

Risks Related to Our Business and Industry

We are subject to risks and

uncertainties related to our business and industry, including, but not limited to, the following:

| |

● |

The potential slowdown of the industries in which our customers operate; |

| |

● |

Any decline in the availability or increase in the cost of raw materials; |

| |

● |

Any disruption in the supply chain of raw materials and our products; |

| |

● |

Wage increases in China; |

| |

● |

Our reliance on a limited number of vendors and the potential loss of any significant vendor; |

| |

● |

Certain risks in collecting our accounts receivable; |

| |

● |

Failure to protect our intellectual property rights; |

| |

● |

The substantial doubt about our ability to continue as a going concern in the report of our independent registered public accounting firm on our financial statements for the years ended December 31, 2024, 2023, and 2022; |

| |

● |

Failure to maintain a reserve for warranty or defective products and installation claims; |

| |

● |

Product defects and unanticipated use or inadequate disclosure with respect to our products; |

| |

● |

Various hazards that may cause personal injury or property damage and increase our operating costs, which may exceed the coverage of our insurance; |

| |

● |

Any material costs and losses as a result of claims based on failure of our products to meet regulatory requirements or contractual specifications; |

| |

● |

Substantial liabilities to comply with environmental laws and regulations; |

| |

● |

Inability to implement and maintain effective internal control over financial reporting; |

| |

● |

Our continued investing in technology, resources, and new business capabilities; |

| |

● |

Any failure to offer or maintain high quality products and support; |

| |

● |

The competitiveness of the markets in which we participate; |

| |

● |

Our reliance on a limited number of customers; |

| |

● |

Lack of business insurance; |

| |

|

|

| |

● |

Defects or errors in our products; |

| ● | Our reliance on the reliability,

security, and performance of the software and technologies for our products; and |

| ● | The impact on investor confidence

and our reputation that as well as additional risks and uncertainties that may result from the restatement of our unaudited condensed

consolidated financial statements for the six months ended June 30, 2023. |

Risks Related to Our Class A Shares

We face risks and uncertainties

related to our Class A Shares, including, but not limited to, the following:

| |

● |

Failure to meet the continued listing requirements of Nasdaq; |

| |

|

|

| |

● |

The volatility of trading prices of our Class A Shares; |

| |

● |

Any negative reports by securities or industry analysts publish about our business; and |

| |

● |

Substantial future sales or perceived sales of our Class A Shares in the public market. |

Risks Related to Doing Business in China

Changes in the political and economic policies

of the PRC government or in relations between China and the United States may materially and adversely affect our business, financial

condition and results of operations and may result in our inability to sustain our growth and expansion strategies.

Substantially all of our operations

are conducted in mainland China and substantially all of our revenues are sourced from mainland China. Accordingly, our financial condition

and results of operations are affected to a significant extent by economic, political and legal developments in the PRC or changes in

government relations between China and the United States or other governments. There is significant uncertainty about the future relationship

between the United States and China with respect to trade policies, treaties, government regulations and tariffs.

The PRC economy differs from

the economies of most developed countries in many respects, including the extent of government involvement, level of development, growth

rate, control of foreign exchange and allocation of resources. Although the PRC government has implemented measures emphasizing the utilization

of market forces for economic reform, the reduction of state ownership of productive assets, and the establishment of improved corporate

governance in business enterprises, a substantial portion of productive assets in China is still owned by the government. In addition,

the PRC government continues to play a significant role in regulating industry development by imposing industrial policies. The PRC government

also exercises significant control over China’s economic growth by allocating resources, controlling payment of foreign currency-denominated

obligations, setting monetary policy, regulating financial services and institutions and providing preferential treatment to particular

industries or companies.

While the PRC economy has

experienced significant growth in the past four decades, growth has been uneven, both geographically and among various sectors of the

economy. The PRC government has implemented various measures to encourage economic growth and guide the allocation of resources. Some

of these measures may benefit the overall PRC economy, but may also have a negative effect on us. Our financial condition and results

of operation could be materially and adversely affected by government control over capital investments or changes in tax regulations that

are applicable to us. In addition, the PRC government has implemented in the past certain measures, including interest rate increases,

to control the pace of economic growth. These measures may cause decreased economic activity.

As substantially all of our

operations are based in China, any future Chinese, U.S. or other rules and regulations that place restrictions on capital raising or other

activities by China based companies could adversely affect our business and results of operations. If the business environment in China

deteriorates from the perspective of domestic or international investment, or if relations between China and the United States or other

governments deteriorate, our operations in China as well as the market price of our Class A Shares may be adversely affected.

There are uncertainties regarding the interpretation

and enforcement of PRC laws, rules and regulations. The rules and regulations in China can change quickly with little advance notice and

uncertainties in the interpretation and enforcement of PRC laws, rules and regulations could limit the legal protections available to

you and us.

Substantially all of our operations

are conducted in mainland China, and are governed by PRC laws, rules and regulations. Our PRC subsidiaries are subject to laws, rules

and regulations applicable to foreign investment in China. The PRC legal system is a civil law system based on written statutes. Unlike

the common law system, prior court decisions may be cited for reference but have limited precedential value. In 1979, the PRC government

began to promulgate a comprehensive system of laws, rules and regulations governing economic matters in general. The overall effect of

legislation over the past three decades has significantly enhanced the protections afforded to various forms of foreign investment in

China. However, China has not developed a fully integrated legal system, and recently enacted laws, rules and regulations may not sufficiently

cover all aspects of economic activities in China or may be subject to significant degrees of interpretation by PRC regulatory agencies.

In particular, because these laws, rules and regulations, especially those relating to overseas listing and offering and the internet,

are relatively new, and because of the limited number of published decisions and the nonbinding nature of such decisions, and because

the laws, rules and regulations often give the relevant regulator significant discretion in how to enforce them, the interpretation and

enforcement of these laws, rules and regulations involve uncertainties and can be inconsistent and unpredictable.

In addition, the PRC legal

system is based in part on government policies and internal rules, some of which are not published on a timely basis or at all, and may

have a retroactive effect. As a result, we may not be aware of our violation of these policies and rules until after the occurrence of

the violation. Any administrative and court proceedings in China may be protracted, resulting in substantial costs and diversion of resources

and management attention. The rules and regulations in China can change quickly with little advance notice and uncertainties in the interpretation

and enforcement of PRC laws, rules and regulations could limit the legal protections available to you and us.

The PRC government’s significant oversight

and discretion over the conduct of our business and may intervene or influence our operations at any time which could result in a material

adverse change in our operation and/or the value of our Class A Shares.

We conduct our business in

mainland China primarily through our PRC subsidiaries. Our operations in mainland China are governed by PRC laws and regulations. The

PRC government’s significant oversight and discretion over the conduct of our business and may intervene or influence our operations

at any time which could result in a material adverse change in our operation and/or the value of our Class A Shares. Also, the PRC government

has recently indicated an intent to exert more oversight over offerings that are conducted overseas and/or foreign investment in China-based

issuers. Any such action could significantly limit or completely hinder our ability to offer or continue to offer securities to investors.

In addition, implementation of industry-wide regulations directly targeting our operations could cause our securities to significantly

decline in value or become worthless. Therefore, investors of ReTo face potential uncertainty from actions taken by the PRC government

affecting our business.

Approval of the CSRC or other PRC government

authorities may be required in connection with our future offerings under PRC law, and if required, we cannot predict whether or for how

long we will be able to obtain such approval.

On February 17, 2023, the

CSRC published the Trial Measures, which became effective on March 31, 2023. The Trial Measures lay out the filing regulation arrangement

for both direct and indirect overseas listing, and clarify the determination criteria for indirect overseas listing in overseas markets.

Among other things, if a domestic enterprise intends to indirectly offer and list securities in an overseas market, the record-filing

obligation is with a major operating entity incorporated in mainland China appointed by the issuer and such filing obligation shall be

completed within three business days after the overseas listing application is submitted. The required filing materials for an initial

public offering and listing should include at least the following: report, commitment from issuer and securities company, the resolutions,

shareholding structure chart and control structure chart, the information of issuer and intermediary project team members, Chinese legal

opinion and commitment of Chinese counsel, the Prospectus, approval and other documents issued by competent regulatory authorities of

relevant industries (if applicable); and security assessment opinion issued by relevant regulatory authorities (if applicable).

In addition, an overseas offering

and listing is prohibited under any of the following circumstances: (1) if the intended securities offering and listing is specifically

prohibited by national laws and regulations and relevant provisions; (2) if the intended securities offering and listing may constitute

a threat to or endangers national security as reviewed and determined by competent authorities under the State Council in accordance with

law; (3) if, in the past three years, the domestic enterprise or its controlling shareholders or actual controllers have committed corruption,

bribery, embezzlement, misappropriation of property, or other criminal offenses disruptive to the order of the socialist market economy,

or are currently under judicial investigation for suspicion of criminal offenses, or are under investigation for suspicion of major violations;

(4) if, the domestic enterprise is being investigated according to law due to suspected crimes or major violations of laws and regulations,

and there is no clear conclusion; (5) if there are material ownership disputes over the equity of the controlling shareholder or shareholders

controlled by controlling shareholders and actual controllers. The Trial Measures defines the legal liabilities of breaches such

as failure in fulfilling filing obligations or fraudulent filing conducts, imposing a fine between RMB 1 million and RMB 10 million, and

in cases of severe violations, a parallel order to suspend relevant business or halt operation for rectification, revoke relevant business

permits or operational license.

Any future securities offerings

and listings outside of mainland China by our Company, including but not limited to follow-on offerings, secondary listings, and going

private transactions, will be subject to the filing requirements with the CSRC under the Trial Measures, and we cannot assure you that

we will be able to comply with such filing requirements in a timely manner, or at all. Any failure of us to fully comply with new regulatory

requirements may significantly limit or completely hinder our ability to offer or continue to offer our Class A Shares, cause significant

disruption to our business operations, and severely damage our reputation, which would materially and adversely affect our financial condition

and results of operations and cause our Class A Shares to significantly decline in value or become worthless.

Our business is subject to complex and evolving

laws and regulations regarding privacy and data protection. Compliance with China’s new Data Security Law, Cybersecurity Review

Measures, Personal Information Protection Law, as well as additional laws, regulations and guidelines that the Chinese government promulgates

in the future may entail significant expenses and could materially affect our business.

Regulatory authorities in

China have implemented and are considering further legislative and regulatory proposals concerning data protection. China’s new

Data Security Law went into effect on September 1, 2021. The Data Security Law provides that the data processing activities must be conducted

based on “data classification and hierarchical protection system” for the purpose of data protection and prohibits entities

in China from transferring data stored in China to foreign law enforcement agencies or judicial authorities without prior approval by

the Chinese government. The Data Security Law sets forth the legal liabilities of entities and individuals found to be in violation of

their data protection obligations, including rectification order, warning, fines of up to RMB5 million, suspension of relevant business,

and revocation of business permits or licenses.

In addition, the PRC Cybersecurity

Law provides that personal information and important data collected and generated by operators of critical information infrastructure

in the course of their operations in the PRC should be stored in the PRC, and the law imposes heightened regulation and additional security

obligations on operators of critical information infrastructure.

On July 10, 2021, the CAC

issued the Cybersecurity Review Measures (revised draft for public comments), which proposed to authorize the relevant government authorities

to conduct cybersecurity review on a range of activities that affect or may affect national security. The PRC National Security Law covers

various types of national security, including technology security and information security. The Cybersecurity Review Measures (2021 Version)

took effect on February 15, 2022. The Cybersecurity Review Measures (2021 Version) expand the cybersecurity review to data processing

operators in possession of personal information of over 1 million users if the operators intend to list their securities in a foreign

country. Under the Cybersecurity Review Measures (2021 Version), the scope of entities required to undergo cybersecurity review to assess

national security risks that arise from data processing activities would be expanded to include all critical information infrastructure

operators who purchase network products and services and all data processors carrying out data processing activities that affect or may

affect national security. In addition, such reviews would focus on the potential risk of core data, important data, or a large amount

of personal information being stolen, leaked, destroyed, illegally used or exported out of China, or critical information infrastructure

being affected, controlled or maliciously used by foreign governments after such a listing. An operator that violates these measures shall

be dealt with in accordance with the provisions of the PRC Cybersecurity Law and the PRC Data Security Law.

According to the Cybersecurity

Review Measures (2021 Version), cybersecurity review will be required when (i) operators of critical information infrastructure purchasing

network products and services or online platform operators carry out data processing activities which do or may affect national security;

and (ii) any online platform operator controlling personal information of more than one million users which seeks to list in a foreign

stock exchange. The factors to be considered when assessing the national security risks of the relevant activities, including, among others,

(i) the risk of core data, important data or a large amount of personal information being stolen, leaked, destroyed, and illegally used

or exited the country; and (ii) the risk of critical information infrastructure, core data, important data or a large amount of personal

information being affected, controlled, or maliciously used by foreign governments after listing abroad. The CAC has said that under the

new rules companies holding data of more than 1,000,000 users must now apply for cybersecurity approval when seeking listings in other

nations because of the risk that such data and personal information could be “affected, controlled, and maliciously exploited by

foreign governments.” The cybersecurity review will also look into the potential national security risks from overseas initial public

offerings. As advised our PRC legal counsel , because (i) none of our PRC subsidiaries collecting personal information or processing data

in actual operation, and (ii) none of our PRC subsidiaries is an “online platform operator holding more than one million users’

personal information,” we believe the cybersecurity review requirement is not applicable us. However, there remains uncertainty

as to the interpretation and implementation of the revised Cybersecurity Review Measures and we cannot assure you that the CAC will reach

the same conclusion as our PRC counsel. As advised by our PRC legal counsel, the PRC governmental authorities may have wide discretion

in the interpretation and enforcement of these laws, including the interpretation of the scope of “critical information infrastructure