While we currently do not expect the HFCA Act to prevent us from maintaining the trading of our ADSs in the U.S., uncertainties exist with respect to future determinations of the PCAOB in this respect and any further legislative or regulatory actions to be taken by the U.S. or Chinese governments that could affect our listing status in the U.S. The delisting of our ADSs, or the threat of their being delisted, may materially and adversely affect the value of your investment.

Risks Associated with Our Corporate Structure

We are a holding company with no business operations of our own. We conduct all of our operations through our subsidiaries. As a result, our ability to pay dividends depends upon dividends paid by our subsidiaries. If our subsidiaries incur debt on their own behalf in the future, the instruments governing their debt may restrict their ability to pay dividends to us.

9

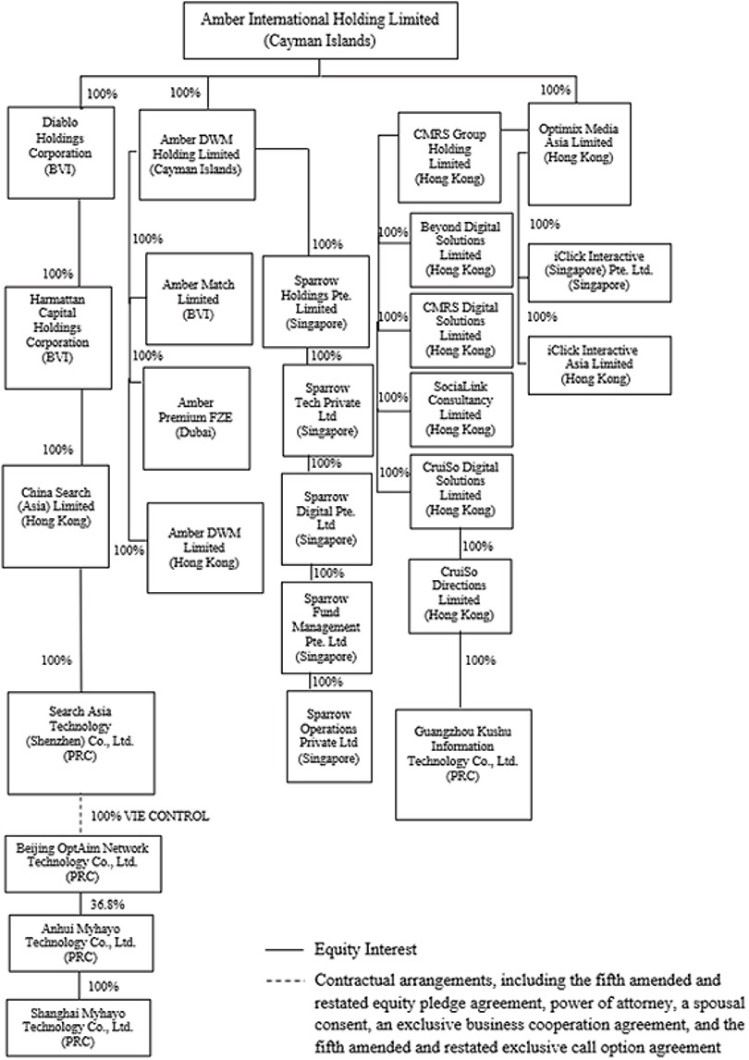

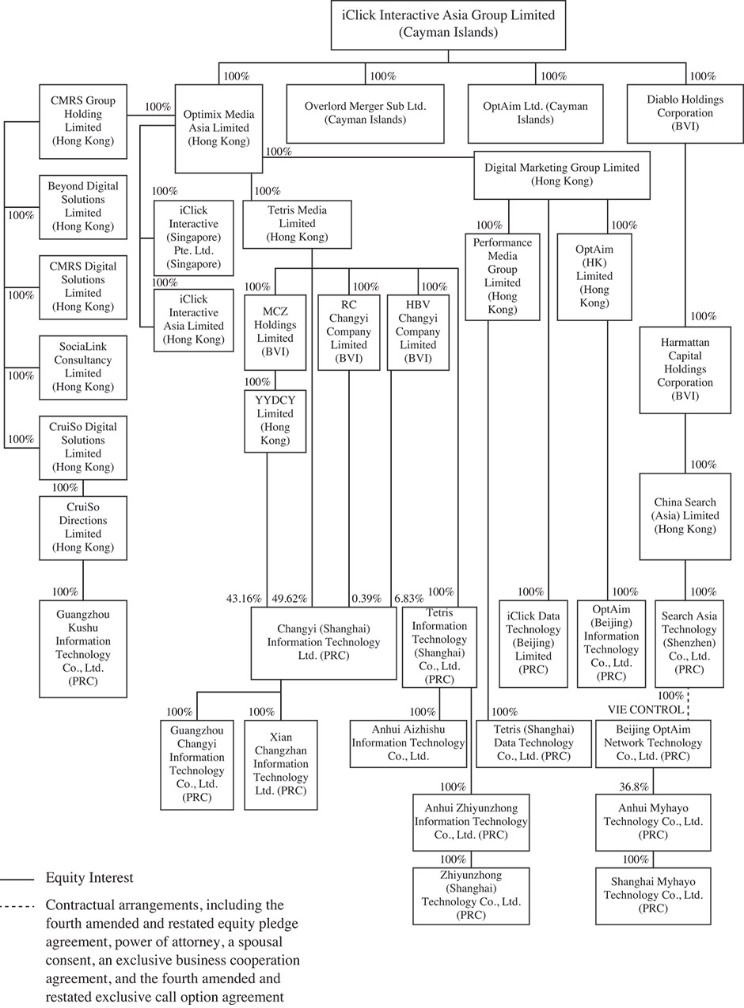

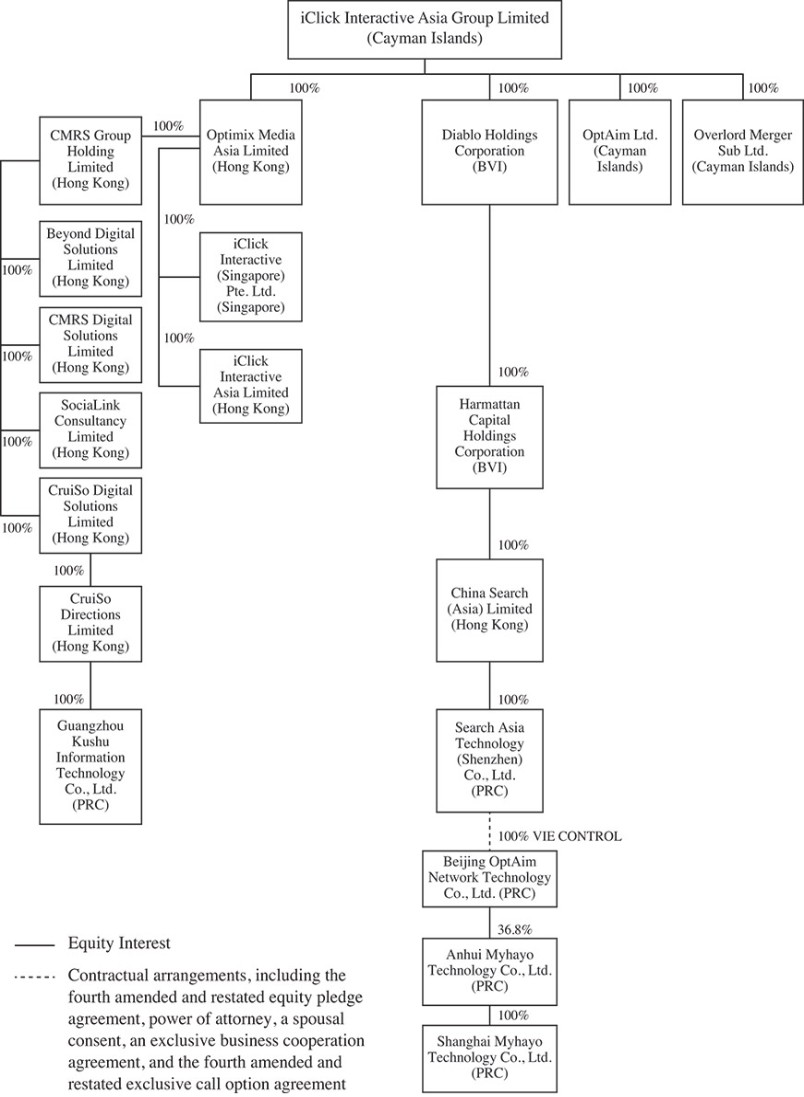

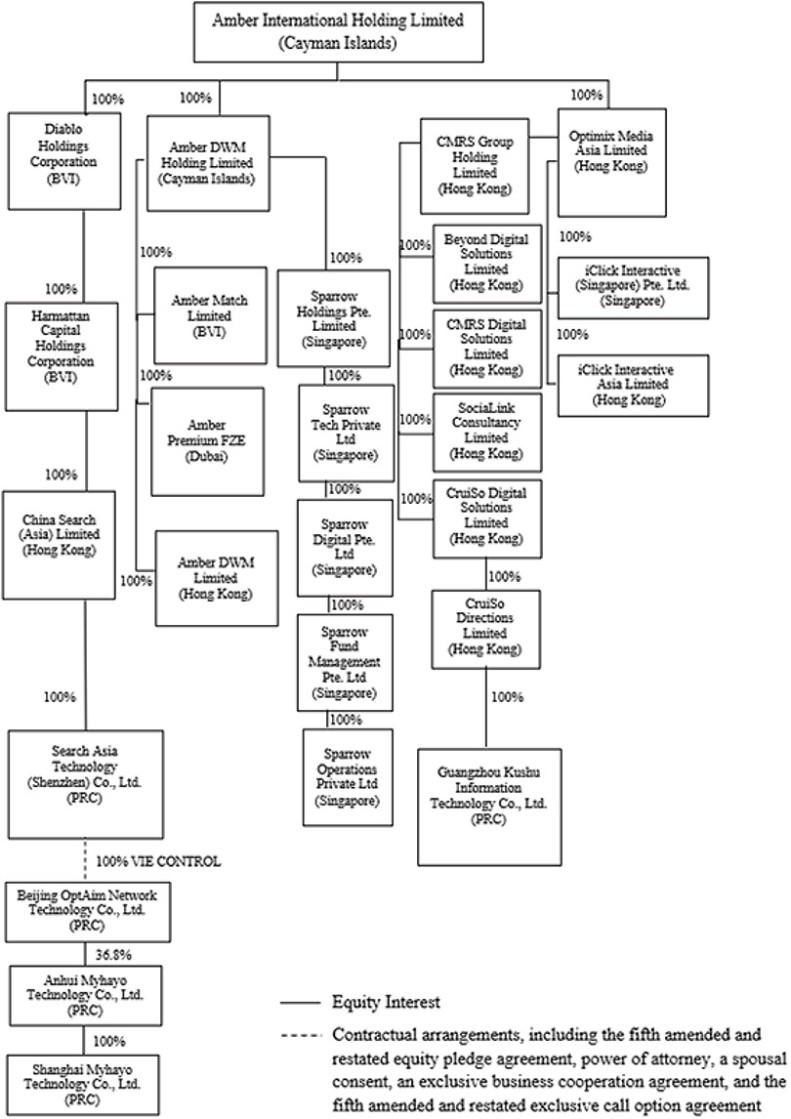

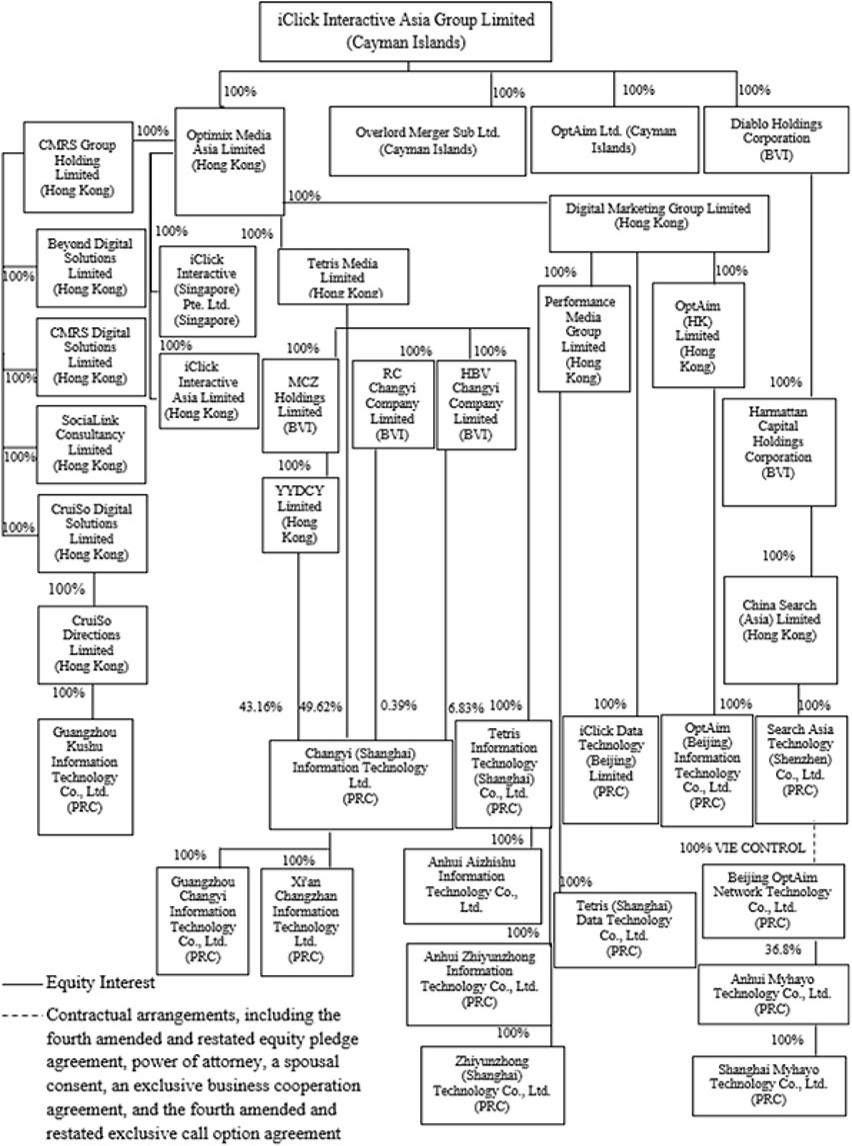

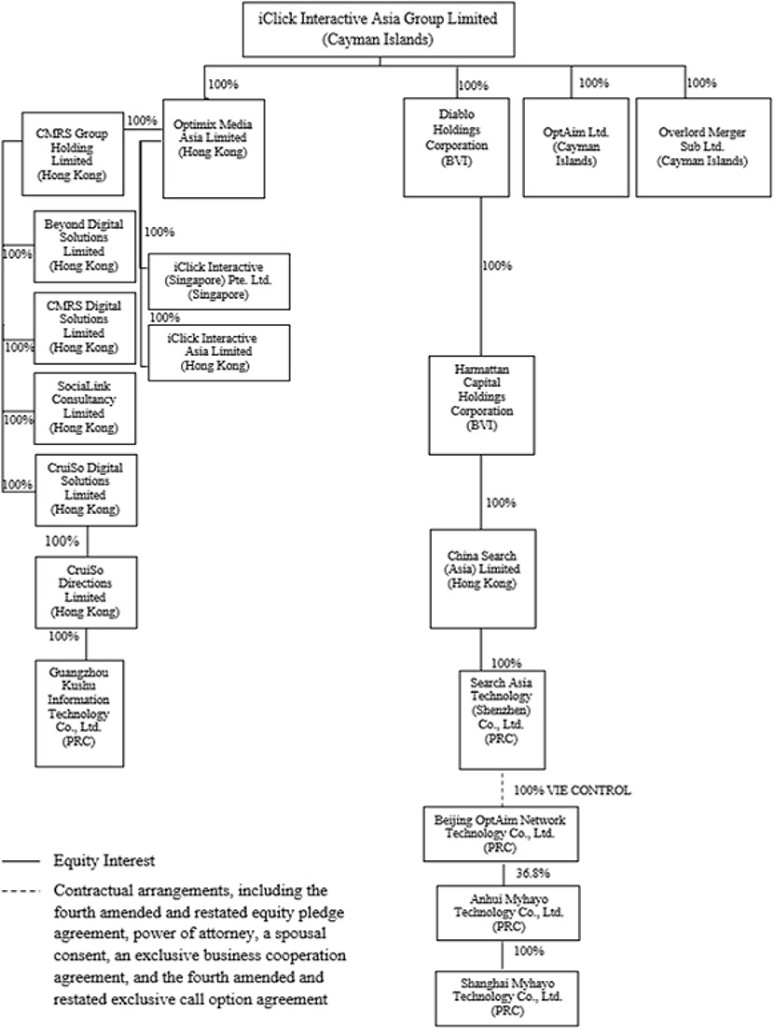

The following diagram illustrates our organizational structure, including all of our significant subsidiaries:

Before the Disposals

10

After the Disposals

The nominee shareholders of Beijing OptAim Network Technology Co., Ltd. are Mr. Jian Tang and Mr. Shaoqiang Shi, who are our former Chairman of the board and Finance Director in PRC.

11

A.[Reserved]

B.Capitalization and Indebtedness

Not Applicable.

C.Reasons for the Offer and Use of Proceeds

Not Applicable.

D.Risk Factors

Our business, financial condition and results of operations are subject to various changing business, competitive, economic, political and social conditions. In addition to the factors discussed elsewhere in this annual report, the following are some of the important factors that could adversely affect our operating results, financial condition and business prospects, and cause our actual results to differ materially from those projected in any forward-looking statements.

Summary of Risk Factors

Risks Related to Our Business

| ● | We may not obtain the regulatory approval in relation to DWM Asset Restructuring in a timely manner or at all and may need to continue relying on the intercompany service agreements to receive the economic benefits of the WFTL Assigned Contracts. |

| ● | Our institutional crypto financial services and solutions business is nascent, not fully proven by market and subject to material legal, regulatory, operational, reputational, tax and other risks in the jurisdictions where we operate and are not assured to be profitable. |

| ● | Our operating results are dependent on the prices of digital assets and volume of transactions that we conduct. If such price or volume declines, our business, operating results, and financial condition would be adversely affected. |

| ● | Our operating results are dependent on the prices of digital assets and volume of transactions that we conduct. If such price or volume declines, our business, operating results, and financial condition would be adversely affected. |

| ● | A particular digital asset’s status as a “security” in any relevant jurisdiction is subject to a high degree of uncertainty and if we are unable to properly characterize a digital asset, we may be subject to regulatory scrutiny, investigations, fines, and other penalties, which may adversely affect our business, operating results, and financial condition. |

| ● | If we fail to develop, maintain and enhance our brand and reputation, our business operating results and financial condition may be adversely affected. |

| ● | We may not be able to compete effectively, which could materially and adversely affect our business, financial condition, results of operations and prospects, as well as our reputation and brands. |

| ● | We may be subject to inquiries, investigations, and enforcement actions by regulators and governmental authorities worldwide, including those related to sanctions, export control, and anti-money laundering. |

| ● | We and our third-party service providers’ failure to safeguard and manage our and our clients’ funds and digital assets could adversely impact our business, operating results and financial condition. |

13