UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

☐ REGISTRATION STATEMENT PURSUANT TO SECTION

12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13

OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION

13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION

13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report

for the transition period from ____________to ____________

Commission file number: 001-38851

X3 HOLDINGS CO., LTD.

(Exact Name of Registrant as Specified in its Charter)

N/A

(Translation of Registrant’s Name into English)

Cayman Islands

(Jurisdiction of Incorporation or Organization)

Suite 412, Tower A, Tai Seng Exchange

One Tai Seng Avenue

Singapore 536464

(Address of principal executive offices)

Stewart Lor, Chief Executive Officer

Suite 412, Tower A, Tai Seng Exchange

One Tai Seng Avenue

Singapore 536464

Tel: +65.8067.3103

Email: ir@x3holdings.com

(Name, Telephone, E-mail and/or Facsimile number

and Address of Company Contact Person)

Securities registered or to be registered pursuant

to Section 12(b) of the Act:

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| ordinary shares, par value $0.00003 | | XTKG | | NASDAQ Capital Market |

Securities registered or to be registered pursuant

to Section 12(g) of the Act:

None

(Title of Class)

Securities for which there is a reporting obligation

pursuant to Section 15(d) of the Act:

None

(Title of Class)

Indicate the number of outstanding shares of each

of the issuer’s classes of capital or common shares as of the close of the period covered by the annual report:

As of December 31, 2024, the issuer had 13,755,975 (post-reverse stock

split adjusted to 2,292,652) Class A ordinary shares and 12,195 (post-reverse stock split adjusted to 2,032) Class B ordinary shares outstanding.

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report,

indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act

of 1934. Yes ☐ No ☒

Note - Checking the box above will not relieve

any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations

under those Sections.

Indicate by check mark whether the registrant:

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during

the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large

accelerated filer,” accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Emerging growth company | ☒ |

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| † |

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report. ☐

If securities are registered pursuant to Section

12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction

of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error

corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s

executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting

the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☒ | | International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ | | Other ☐ |

| |

* |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐ |

If this is an annual report, indicate by check

mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant

has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent

to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

TABLE OF CONTENTS

INTRODUCTION

Unless otherwise indicated or the context otherwise requires, references

in this annual report on Form 20-F to:

| |

● |

All references to “RMB,” “yuan” and “Renminbi” are to the legal currency of China, all references to “HKD” is to the legal currency of Hong Kong, and all references to “USD” and “U.S. dollars” are to the legal currency of the United States. |

| |

|

|

| |

● |

“AIC” refers to Administration for Industry and Commerce in China. |

| |

|

|

| |

● |

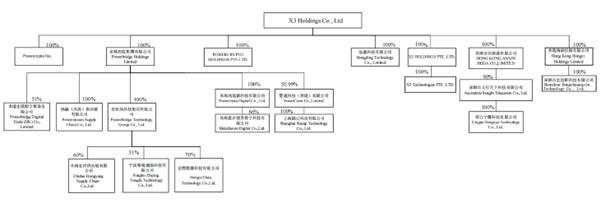

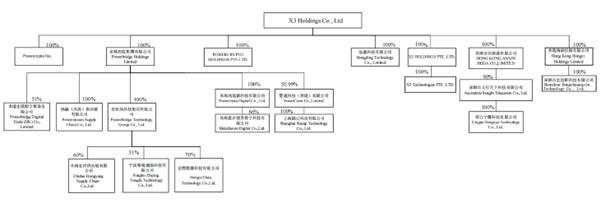

Depending on the context, the terms “we”, “us”, “our Company”, and “our” refer to X3 Holdings Co., Ltd. (formerly known as Powerbridge Technologies Co., Ltd.), a Cayman Islands holding company, and its subsidiaries and affiliated companies, as a group; “X3 Holdings” and “Powerbridge Cayman” refer to X3 Holdings Co., Ltd., the Cayman Islands holding company. |

| |

|

|

| |

● |

“Exchange Act” refers to the U.S. Securities Exchange Act of 1934, as amended. |

| |

|

|

| |

● |

“Fiscal Year” refers to the period from January 31 of each calendar year to December 31 of the following calendar year. |

| |

|

|

| |

● |

“Hongding Hong Kong” refers to Hongding Technology Co., Ltd., a Hong Kong company, which is a direct wholly-owned subsidiary of X3 Holdings Co., Ltd.. |

| |

|

|

| |

● |

“IPO” means the initial public offering by the Company of 2,012,500 Ordinary Shares consummated on April 4, 2019 (including the full exercise of the over-allotment option by the underwriters to purchase an additional 262,500 Ordinary Shares on May 10, 2019). |

| |

|

|

| |

● |

“IP” refers to intellectual property. |

| |

|

|

| |

● |

“Powerbridge HK” refers to Powerbridge Holdings Limited, a Hong Kong company, which is a direct wholly-owned subsidiary of X3 Holdings. |

| |

|

|

| |

● |

“Powerbridge Zhuhai” refers to Powerbridge Technology Group Co., Ltd., a PRC company, a wholly foreign-owned enterprise of Powerbridge HK. |

| |

|

|

| |

● |

“PRC” and “China” refer to the People’s Republic of China, and “mainland China” refers to the People’s Republic of China, excluding Taiwan, Hong Kong and Macau; |

| |

|

|

| |

● |

“Registration Statement” refers to the Company’s Registration Statement on Form F-1 (File No. 333-229128) for the sale of up to 1,750,000 Ordinary Shares initially filed on January 4, 2019, and subsequently amended thereafter, which became effective on March 28, 2019. |

| |

● |

“R&D” refers to research and development. |

| |

|

|

| |

● |

“Securities Exchange Commission”, “SEC”, “Commission” or similar terms refer to the Securities Exchange Commission. |

| |

|

|

| |

● |

“Sarbanes-Oxley Act” refers to the Sarbanes-Oxley Act of 2002. |

| |

|

|

| |

● |

“Securities Act” refers to the Securities Act of 1933. |

| |

|

|

| |

● |

“Shares” or “Ordinary Share” refers to our Class A ordinary shares and Class B ordinary shares, par value $0.00003 per share. |

| |

|

|

| |

● |

“United States”, “U.S.” and “US” refer to the United States of America. |

Discrepancies in any table between the amounts

identified as total amounts and the sum of the amounts listed therein are due to rounding.

This Annual Report on Form

20-F includes our audited consolidated financial statements for the years ended December 31, 2024, 2023 and 2022.

Unless otherwise noted, all

currency figures in this filing are in U.S. dollars. Any discrepancies in any table between the amounts identified as total amounts and

the sum of the amounts listed therein are due to rounding. Our reporting currency is U.S. dollar and our functional currency is Renminbi.

This Annual Report contains translations of certain foreign currency amounts into U.S. dollars for the convenience of the reader. Other

than in accordance with relevant accounting rules and as otherwise stated, all translations of Renminbi into U.S. dollars in this Annual

Report were made at the rate of RMB7.2993 to USD1.00, the noon buying rate on December 31, 2024, as set forth in the H.10 statistical

release of the U.S. Federal Reserve Board. Where we make period-on-period comparisons of operational metrics, such calculations are based

on the Renminbi amount and not the translated U.S. dollar equivalent. We make no representation that the Renminbi or U.S. dollar amounts

referred to in this Annual Report could have been or could be converted into U.S. dollars or Renminbi, as the case may be, at any particular

rate or at all.

FORWARD-LOOKING INFORMATION

This annual report on Form

20-F contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the

“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that

reflect our current expectations and views of future events. These statements involve known and unknown risks, uncertainties and other

factors, including those listed under “Item 3. Key Information — D. Risk Factors,” may cause our actual results, performance

or achievements to be materially different from those expressed or implied by the forward-looking statements.

You can identify these forward-looking

statements by terminology such as “may,” “will,” “expect,” “anticipate,” “aim,”

“estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “potential,”

“continue” or other similar expressions. We have based these forward-looking statements largely on our current expectations

and projections about future events and financial trends that we believe may affect our financial condition, results of operations, business

strategy and financial needs. These forward-looking statements include statements relating to, among other things:

This Annual Report on Form 20-F

contains forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities

Litigation Reform Act of 1995, including but not limited to.

| ● | Our

mission, goals and strategies; |

| ● | our

future business development, financial conditions and results of operations; |

| |

● |

the expected growth of the PRC information technology services industries; |

| |

|

|

| |

● |

our expectations regarding demand for and market acceptance of our products and services; |

| ● | our

expectations regarding our relationships with suppliers and customers; |

| ● | the

expected benefits of our acquisitions or investments; |

| ● | competition

in our industry; and |

| ● | relevant

government policies and regulations relating to our industry. |

These forward-looking

statements involve various risks and uncertainties. Although we believe that our expectations expressed in these forward-looking statements

are reasonable, our expectations may later be found to be incorrect. Our actual results could be materially different from our expectations.

Other sections of this Annual Report include additional factors that could adversely impact our business and financial performance. Moreover,

we operate in an evolving environment. New risk factors and uncertainties emerge from time to time and it is not possible for our management

to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any

factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

This Annual

Report contains certain data and information that we obtained from various government and private publications. Statistical data in these

publications also include projections based on a number of assumptions. The PRC information technology services industry may not grow

at the rate projected by market data, or at all. Failure of this market to grow at the projected rate may have a material adverse effect

on our business and the market price of our ordinary shares. Furthermore, if any one or more of the assumptions underlying the market

data are later found to be incorrect, actual results may differ from the projections based on these assumptions. You should not place

undue reliance on these forward-looking statements.

The forward-looking

statements made in this Annual Report relate only to events or information as of the date on which the statements are made in this Annual

Report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as

a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence

of unanticipated events. You should read this Annual Report and the documents that we refer to in this Annual Report and exhibits to this

Annual Report thoroughly and with the understanding that our actual future results may be materially different from what we expect.

Part I

Item 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not Applicable.

Item 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not Applicable.

Item 3. KEY INFORMATION

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Summary of the Risk Factors

An investment

in our securities involves a high degree of risk. You should carefully consider the risks described below, together with all of the other

information included in this Annual Report, before making an investment decision. If any of the following risks actually occurs, our business,

prospects, financial condition or results of operations could suffer. In that case, the trading price of our securities could decline,

and you may lose all or part of your investment. Below please find a summary of the principal risks that we face, organized under the

relevant headings.

All the

operational risks associated with being based in and having operations in China as discussed in relevant risk factors under “Item

3. Key Information — D. Risk Factors — Risks Related to Our Business and Industry” also apply to operations in Hong

Kong and Macau. With respect to the legal risks associated with being based in and having operations in China as discussed in the relevant

risk factors under “Item 3. Key Information — D. Risk Factors — Risks Related to Our Corporate Structure” and

“Item 3. Key Information — D. Risk Factors — Risks Related to Doing Business in China,” the laws, regulations

and the discretion of China governmental authorities discussed in this Annual Report are expected to apply to China entities and businesses,

rather than entities or businesses in Hong Kong and Macau which currently operate under different sets of laws from mainland China. However,

there can be no assurance as to whether the government of Hong Kong or Macau will enact laws and regulations similar to mainland China,

or whether any laws or regulations of mainland China will become applicable to our operations in Hong Kong or Macau in the future. These

risks are discussed more fully in “Item 3. Key Information — D. Risk Factors.”

Risks Related to Our Business and Industry

Risks and uncertainties related

to our business and industry include, but are not limited to, the following:

| ● | Economic

uncertainties or downturns could materially adversely affect our business. |

| ● | The

growth and success of our business depends on our ability to develop new services and enhance existing services in order to keep pace

with rapid changes in technology. |

| ● | If

we do not succeed in attracting new customers for our services and growing revenues from existing customers, we may not achieve our revenue

growth goals. |

| ● | We

may be unable to effectively manage our expansion for the anticipated growth, which could place significant strain on our management

personnel, systems and resources. We may not be able to achieve anticipated growth, which could materially and adversely affect our business

and prospects. |

| ● | We

face risks associated with having an extended selling and implementation cycle for our services that require us to make significant resource

commitments prior to realizing revenues for those services. |

| ● | Adverse

changes in the economic environment, either in China or globally, could reduce our customers’ purchases from us and increase pricing

pressure, which could materially and adversely affect our revenues and results of operations. |

| ● | We

generate a significant portion of our revenues from a relatively small number of major customers and loss of business from these customers

could reduce our revenues and significantly harm our business. |

| ● | We

may be forced to reduce the prices of our services due to increased competition and reduced bargaining power with our customers, which

could lead to reduced revenues and profitability. |

| ● | A

portion of our income is generated, and will in the future continue to be generated, on a project basis with a fixed price; we may not

be able to accurately estimate costs and determine resource requirements in relation to our projects, which would reduce our margins

and profitability. |

Risks Related to Our Corporate Structure

Risks and uncertainties related to our corporate

structure include, but are not limited to, the following:

| ● | We

are a Cayman Islands company and, because judicial precedent regarding the rights of shareholders is more limited under Cayman Islands

law than under U.S. law, shareholders may have less protection for their shareholder rights than they would under U.S. law. |

| ● | Judgments

obtained against us by our shareholders may not be enforceable. |

| ● | We

may lose our foreign private issuer status in the future, which could result in significant additional costs and expenses. |

| ● | Our

disclosure controls and procedures may not prevent or detect all errors or acts of fraud. |

| ● | If

we fail to establish and maintain proper internal financial reporting controls, our ability to produce accurate financial statements

or comply with applicable regulations could be impaired. |

Risks Related to Our Ordinary Shares

Risks and uncertainties related to our Shares include,

but are not limited to, the following:

| ● | Our

Shares may be delisted from the Nasdaq Capital Market as a result of our failure of meeting the Nasdaq Capital Market continued listing

requirements. |

| ● | Our

issuance of new shares and convertible note had a dilutive effect on our existing shareholders and may adversely impact the market price

of our Ordinary Shares. |

Risks Related to Doing Business in China

Risks and uncertainties related to conducting business

in China include, but are not limited to, the following:

| ● | The

PRC government may intervene or influence our operations at any time, or may exert more control over offerings conducted overseas and/or

foreign investment in China-based issuers, which could result in a material change in our operations and/or the value of our securities.

Actions by the PRC government to exert more control over offerings conducted overseas by, and foreign investment in, China-based issuers

could result in a material change in our operations, and significantly limit or completely hinder our ability to offer or continue to

offer securities to investors and cause the value of such securities to significantly decline or be worthless. In such events, our securities

could decline in value or become worthless. See “Risk Factors — Risks Relating to Doing Business in China —The

Chinese government may exert substantial influence over the manner in which we must conduct our business activities. We are currently

not required to obtain approval from Chinese authorities to issue securities to foreign investors, however, if our subsidiaries or the

holding company were required to obtain approval in the future and were denied permission from Chinese authorities to list on U.S. exchanges,

we will not be able to continue listing on U.S. exchange, which would materially affect the interest of the investors.” |

| ● | We

may be influenced by changes in the political and economic policies of the PRC government. |

| ● | Our

operations in mainland China are governed by PRC laws and regulations. The uncertainties with respect to the interpretation and enforcement

of PRC laws, rules and regulations and the fact that rules and regulations in mainland China can change quickly with little advance notice

could materially and adversely affect us. See “Risk Factors — Risks relating to Doing Business in China — Uncertainties

with respect to the PRC legal system, including uncertainties regarding the interpretation and enforcement of laws, and sudden

or unexpected changes in laws and regulations in China could adversely affect us and limit the legal protections available to you

and us.” |

| ● | Recent

regulatory initiatives implemented by the PRC competent government authorities on cyberspace data security may have introduced uncertainty

in our business operations and compliance status, which could result in materially adverse impact on our business, results of operations

and our listing on Nasdaq. |

| ● | We

may be adversely affected by the complexity and uncertainties of and changes in PRC regulation of Internet business and related companies. |

| ● | U.S.

regulators’ ability to conduct investigations or enforce rules in China is limited. |

| ● | We

face uncertainty regarding the PRC tax reporting obligations and consequences for certain indirect transfers of the stock of our operating

company. |

Risks Related to Our Business and Industry

Economic uncertainties or downturns could materially adversely

affect our business.

Current or future economic

uncertainties or downturns could adversely affect our business and operating results. Negative conditions in the general economy both

in China and abroad, including conditions resulting from changes in gross domestic product growth, the continued sovereign debt crisis,

financial and credit market fluctuations, political deadlock, natural catastrophes, pandemics, warfare and terrorist attacks on the United

States, Europe, the Asia Pacific region or elsewhere, could cause a decrease in business investments, including corporate spending on

business intelligence software in general and negatively affect the rate of growth of our business.

General worldwide economic

conditions may experience significant downturns and may be unstable. These conditions make it extremely difficult for our customers and

us to forecast and plan future business activities accurately, and they could cause customers to re-evaluate their decisions to subscribe

to our platform, which could delay and lengthen our sales cycles or result in cancellations of planned purchases. Furthermore, during

challenging economic times, customers may tighten their budgets and face issues in gaining timely access to sufficient credit, which could

result in an impairment of their ability to make timely payments to us. In turn, we may be required to increase our allowance for doubtful

accounts, which would adversely affect our financial results.

To the extent subscriptions

to our system solutions are perceived by customers and potential customers to be discretionary, our revenue may be disproportionately

affected by delays or reductions in general information technology spending. Moreover, competitors may respond to market conditions by

lowering prices and attempting to lure away our customers. In addition, the increased pace of consolidation in certain industries may

result in reduced overall spending on our system solutions.

We cannot predict the timing,

strength or duration of any economic slowdown, instability or recovery, generally or within any particular industry. If the economic conditions

of the general economy or industries in which we operate do not improve, or worsen from present levels, our business, operating results,

financial condition and cash flows could be adversely affected.

The growth and success of our business depends

on our ability to develop new services and enhance existing services in order to keep pace with rapid changes in technology.

The market for our services

is characterized by rapid technological changes, evolving industry standards, changing customer preferences and new product and service

introductions. Our future growth and success depend significantly on our ability to anticipate developments in technologies, and develop

and offer new services to meet our customers’ evolving needs. We may not be successful in anticipating or responding to these developments

in a timely manner, or if we do respond, the services or technologies we develop may not be successful in the marketplace. The development

of some of the services and technologies may involve significant upfront investments and the failure of these services and technologies

may result in us being unable to recover these investments, in part or in full. Further, services or technologies that are developed by

our competitors may render our services uncompetitive or obsolete. In addition, new technologies may be developed that allow our customers

to more cost-effectively perform the services that we provide, thereby reducing demand for our services. Should we fail to adapt to the

rapidly changing technologies or if we fail to develop suitable services to meet the evolving and increasingly sophisticated requirements

of our customers in a timely manner, our business and results of operations could be materially and adversely affected.

Furthermore, our future growth

and success could be adversely affected by conditions of potential business partners, which may cause delay or failure in development

of the services or technologies.

If we do not succeed in attracting new customers

for our services and growing revenues from existing customers, we may not achieve our revenue growth goals.

We plan to significantly expand

the number of customers we serve to diversify our customer base and grow our revenues. Obtaining new customers is important for us to

achieve rapid revenue growth. We also plan to grow revenues from our existing customers by identifying and selling additional services

to them. Our ability to attract new customers, as well as our ability to grow revenues from existing customers, depends on various factors,

including our ability to offer high quality services at competitive prices, the strength of our competitors and the capabilities of our

sales and marketing teams. If we are not able to continue to attract new customers or to grow revenues from our existing customers, we

may not be able to grow our revenues as quickly as we anticipate or at all.

We may be unable to effectively manage our

expansion for the anticipated growth, which could place significant strain on our management personnel, systems and resources. We may

not be able to achieve anticipated growth, which could materially and adversely affect our business and prospects.

As of the date of this Annual

Report, we have 137 full-time employees. As of the date of this Annual Report, we have six branches, of which are located in China (Shenzhen,

Guangzhou, Changsha, Wuhan, Nanning, Hangzhou) and maintain offices in Guangzhou, Shenzhen, Changsha, Wuhan, Nanning and Hangzhou to serve

different customers in various geographic locations. In order to pursue existing and potential market opportunities, we plan to expand

our business including (i) establishing new offices and expanding our current offices in China; (ii) exploring and expanding into international

markets; and (iii) upgrading our existing services and introducing new services. We are facing the following challenges with respect to

our planned expansion:

| ● | recruiting,

training, developing and retaining sufficient industry and technology talents and management personnel; |

| ● | creating

and capitalizing upon economies of scale; |

| ● | managing

a larger number of customers in a greater number of locations; |

| ● | maintaining

effective oversight of personnel and offices; |

| ● | coordinating

work among offices and project teams and maintaining high resource utilization rates; |

| ● | integrating

new personnel and expanded operations while preserving our culture and core values; |

| ● | developing

and improving our internal administrative infrastructure, particularly our financial, operational, human resources, communications and

other internal systems, procedures and controls; and |

| ● | adhering

to and further improving our service quality and process execution standards and maintaining high levels of customer satisfaction. |

Moreover, as we introduce

new services or enter into new markets, we may face new market, technological and operational risks and challenges with which we are unfamiliar,

and it may require substantial management efforts and skills to mitigate these risks and challenges. As a result of any of these problems

associated with expansion, our business, results of operations and financial condition could be materially and adversely affected. Furthermore,

we may not be able to achieve anticipated growth, which could materially and adversely affect our business and prospects.

We face risks associated with having an

extended selling and implementation cycle for our services that require us to make significant resource commitments prior to realizing

revenues for those services.

We have an extended selling

cycle for certain of our software applications and technology services, which requires significant investment of capital, human resources

and time by both our customers and us. Before committing to use our services, potential customers require us to expend substantial time

and resources to educate them on the value of our services and our ability to meet their requirements. Therefore, our selling cycle is

subject to various risks and delays over which we have little or no control, including our customers’ decisions to choose alternatives

to our services (such as other providers or in-house resources) and the timing of our customers’ budget cycles and approval processes.

Implementing our services, particularly for our application development services also involves a significant commitment of resources over

an extended period of time ranging from three months to three years from both our customers and us. As a result, we may have a longer

selling cycle and delay in business meetings, which could materially and adversely affect our business and our financials. Our customers

may experience delays in obtaining internal approvals or delays associated with our services, thereby further delaying the implementation

process. Our current and future customers may not be willing or able to invest the time and resources necessary to implement our services,

and we may fail to close sales with potential customers to which we have devoted significant time and resources, which could have a material

adverse effect on our business, results of operations, financial condition and cash flows.

Adverse changes in the economic environment,

either in China or globally, could reduce our customers’ purchases from us and increase pricing pressure, which could materially

and adversely affect our revenues and results of operations.

The software application and

technology service industry are particularly sensitive to the economic environment, both in China and globally, and tend to decline during

general economic downturns. Accordingly, our results of operations, financial condition and prospects are subject to a significant degree

to the economic environment, especially for regions in which we and our customers operate. During an economic downturn, our customers

may cancel, reduce or defer their technology spending or change their technology strategy, and reduce their purchases from us. The recent

global economic slowdown, any future economic slowdown, and the resulting diminution in technology spending, could also lead to increased

pricing pressure from our customers. The trade war between the U.S. and China which may lead to higher percentage of tariff to be placed

on Chinese and American goods and services could also lead to a reduction of import and export volume for some of our customers resulting

in reduced purchases of our services from these customers. The occurrence of any of these events could materially and adversely affect

our revenues and results of operations.

We generate a significant portion of our

revenues from a relatively small number of major customers and loss of business from these customers could reduce our revenues and significantly

harm our business.

We believe that in the foreseeable

future we will continue to derive a significant portion of our revenues from a small number of major customers. For the year ended December

31, 2024, one customer accounted for 36.8% of the Company’s total revenues. For the year ended December 31, 2023, three customers

accounted for 27.1%, 15.5% and 15.1% of the Company’s total revenues, respectively. For the year ended December 31, 2022, one customer

accounted for 31.8% of the Company’s total revenues.

Our ability to maintain close

relationships with major customers is essential to the growth and profitability of our business. However, the volume of work performed

for a specific customer is likely to vary from year to year, especially since we are generally not our customers’ exclusive technology

services provider and we do not have long-term commitments with any of our customer to purchase our services. A major customer in one

year may not provide the same level of revenues for us in any subsequent year. The services that we provide to our customers, and the

revenues and income from those services, may decline or vary as the type and quantity of services we provide changes over time. In addition,

our reliance on any individual customer for a significant portion of our revenues may give that customer a certain degree of pricing leverage

against us when negotiating contracts and terms of service. In addition, a number of factors other than our performance could cause the

loss of or reduction in business or revenues from a customer, and these factors are not predictable. These factors may include organization

restructuring, pricing pressure, changes to its technology strategy, switching to another services provider or returning work in-house.

The loss of any of our major customers could adversely affect our financial condition and results of operations.

We may be forced to reduce the prices of

our services due to increased competition and reduced bargaining power with our customers, which could lead to reduced revenues and profitability.

The software application and

technology service industry in China is developing rapidly and related technology trends are constantly evolving. This results in the

frequent introduction of new services and significant price competition from our competitors. We may be unable to offset the effect of

declining average sales prices through increased sales volumes and/or reductions in our costs. Furthermore, we may be forced to reduce

the prices of our services in response to offerings made by our competitors. Finally, we may not have the same level of bargaining power

we have enjoyed in the past when it comes to negotiating for the prices of our services, all of which could lead to reduced revenues and

profitability.

A portion of our income is generated, and

will in the future continue to be generated, on a project basis with a fixed price; we may not be able to accurately estimate costs and

determine resource requirements in relation to our projects, which would reduce our margins and profitability.

A portion of our income is

generated, and will continue to be generated, from fees we receive for our projects at a fixed price. Our projects often involve complex

technologies, utilizing workforces with different skill sets and competencies, and must be completed within compressed timeframes and

meet customer requirements that are subject to changes and increasingly stringent. In addition, some of our fixed-price projects are multi-year

projects that require us to undertake significant projections and planning related to resource utilization and costs. If we fail to accurately

assess the time and resources required for completing projects and to price our projects profitably, our business, results of operations

and financial condition could be adversely affected.

Our revenues and results of operations are

affected by seasonal trends.

Our business is affected by

seasonal trends. In particular, our revenues are typically progressively higher in the second, third and fourth quarters of each year

compared to the first quarter of each year due to seasonal trends, such as: (i) a general slowdown in business activities and a reduced

number of working days during the first quarter of each year as a result of the Chinese New Year holiday; and (ii) our customers in general

tend to spend their technology and software budgets in the second half of the year and in particular the fourth quarter. Other factors

that may cause our quarterly operating results to fluctuate include, among others, changes in general economic conditions in China and

the impact of unforeseen events. We believe that our revenues will continue to be affected in the future by seasonal trends. As a result,

you may not be able to rely on period-to-period comparisons of our operating results as an indication of our future performance, and we

believe it is more meaningful to evaluate our business on an annual basis.

If we are unable to collect our receivables

from our existing customers, our results of operations and cash flows could be adversely affected.

Our business depends on our

ability to successfully obtain payment from our customers of the amounts they owe us for our services. As of December 31, 2024, 2023 and

2022, our accounts receivable balance, net of allowance, amounted to approximately $17.3 million, $21.5 million and $14.8 million, respectively.

As of December 31, 2024, two customers accounted for 15.6% and 10.3% of the Company’s accounts receivable, respectively. As of December

31, 2023, one customer accounted for 15.9% of the Company’s accounts receivable. As of December 31, 2022, no customer accounted

for more than 10% of our accounts receivable. The significant outstanding accounts receivable balance was mainly related to certain projects

for our government customers such as government agencies, authorities and state-owned enterprises. Due to multiple levels of the government

approval process for payments, it could take extra time for us to collect the full proceeds from our governmental customers. In addition,

since we generally do not require collateral or other security from our customers, we establish an allowance for credit losses based upon

estimates, historical experiences and other factors surrounding the credit risk of specific customers. However, actual losses on customer

receivables balance could differ from those that we anticipate and as a result we might need to adjust our allowance. There is no guarantee

that we will accurately assess the creditworthiness of our customers. Macroeconomic conditions, including related turmoil in the global

financial system, could also result in financial difficulties for our customers, including limited access to the credit markets, insolvency

or bankruptcy, and as a result could cause customers to delay payments to us, request modifications to their payment arrangements that

could increase our receivables balance, or default on their payment obligations to us. As a result, an extended delay or default in payment

relating to a significant account will have a material and adverse effect on the aging schedule and turnover days of our accounts receivable.

If we are unable to collect our receivables from our customers in accordance with the contracts with our customers, our results of operations

and cash flows could be adversely affected.

We face a number of risks in our strategy

to target larger organizations for sales of our services, and if we do not manage these efforts effectively, our business and results

of operations could be adversely affected.

A portion of our sales and

marketing efforts are focusing on larger corporate and governmental organizations. As a result, we face a number of risks with respect

to this strategy. For example, we expect to incur higher costs and longer sales cycles for larger organizations, and we may be less effective

in predicting when will we complete these sales. In our industry, the decision to invest in our services may require a great number of

product evaluations and multiple approvals within a potential customer’s organization, which may require us to invest more

time educating these potential customers. In addition, larger organizations may demand more features and professional services. As a result,

these sales opportunities would likely to lengthen our typical sales cycle and may require us to devote greater research and development,

sales, support, and professional services resources to individual customers. This could strain our resources and result in increased costs.

Moreover, larger customers may demand discounts in pricing, which could lower the amount of revenue we generate from any particular services

that we offer. If an expected transaction is delayed until a subsequent period, or if we are unable to close one or more expected significant

transactions with larger customers or potential new customers in a particular period, our results of operations for that period, and for

any future periods in which revenue from such transaction would otherwise have been recognized, may be adversely affected. Our investments

in marketing and selling to large organizations may not be successful, which could harm our results of operations and our overall ability

to grow our customer base.

Our business depends, in part, on services

to the public sector, and significant changes in the contracting or fiscal policies of the public sector could have an adverse effect

on our business.

We derive a large portion

of our revenue from our services to governmental organizations, and we believe that the success and growth of our business will continue

to depend in part on our successful procurement of government contracts. Factors that could impede our ability to maintain or increase

the amount of revenue derived from government contracts, include:

| ● | changes

in fiscal or contracting policies; |

| ● | decreases

in available government funding; |

| ● | changes

in government programs or applicable requirements; |

| ● | the

adoption of new laws or regulations or changes to existing laws or regulations; and |

| ● | potential

delays or changes in the government appropriations or other funding authorization processes. |

The occurrence of any of the

foregoing could cause governmental organizations to delay or refrain from purchasing our services in the future or otherwise have an adverse

effect on our business, results of operations and financial condition.

Any failure to offer high-quality customer

support may adversely affect our relationships with our customers.

Our ability to retain existing

customers and attract new customers depends on our ability to maintain a consistently high level of customer service and technical support.

Our customers depend on our service support team to assist them in utilizing our services effectively and to help them to resolve issues

quickly and to provide ongoing support. If we are unable to hire and train sufficient support resources or are otherwise unsuccessful

in assisting our customers effectively, it could adversely affect our ability to retain existing customers and could prevent prospective

customers from adopting to our services. We may be unable to respond quickly enough to accommodate short-term increases in demand for

customer support. We also may be unable to modify the nature, scope and delivery of our customer support to compete with changes in the

support services provided by our competitors. Increased demand for customer support, without corresponding revenue, could increase our

costs and adversely affect our business, results of operations and financial condition. Our sales are highly dependent on our business

reputation and on positive recommendations from customers. Any failure to maintain high-quality customer support, or a market perception

that we do not maintain high-quality customer support, could adversely affect our reputation, business, results of operations and financial

condition.

Incorrect or improper implementation or

use of our services could result in customer dissatisfaction and negatively affect our business, results of operations, financial condition,

and growth prospects.

Our services are deployed

in a wide variety of increasingly complex technology environments, including on premises, in the cloud or in hybrid environments. We believe

our future success will depend on our ability to elevate the sales of our services for use in such deployments. We must often assist our

customers in achieving successful implementations of our services, which we do through our professional consulting and technical support

services. If our customers are unable to implement our services successfully, or unable to do so in a timely manner, customer perceptions

of our services may be harmed, our reputation and brand may suffer, and customers may choose to cease usage of our services or not to

expand their use of our services. Our customers may need trainings in the proper use of and the variety of benefits that can be derived

from our services to maximize their benefits. If our services are not effectively implemented or accurately used as intended, or if we

fail to adequately train customers on how to efficiently and effectively use our services, our customers may not be able to achieve satisfactory

outcomes. This could result in negative publicity and legal claims against us, which may cause us to generate fewer sales to new customers

and reductions in renewals or expansions of the use of our services with existing customers, any of which would harm our business and

results of operations.

Failure to adhere to regulations that govern

our customers’ businesses could result in breaches of contracts with our customers. Failure to adhere to the regulations that govern

our business could result in us being unable to effectively perform our services.

Our customers’ business

operations are subject to certain rules and regulations in China or elsewhere. Our customers may contractually require that we perform

our services in a manner that would enable them to comply with such rules and regulations. Failure to perform our services in such manner

could result in breaches of contract with our customers and, in some limited circumstances, civil fines and criminal penalties for us.

In addition, we are required under various PRC laws to obtain and maintain permits and licenses to conduct our business. If we do not

maintain our licenses or other qualifications to provide our services, we may not be able to provide services to our existing customers

or be able to attract new customers and could lose revenues, which could have a material adverse effect on our business and results of

operations.

If our new enhancements to our services

do not achieve sufficient market acceptance, our financial results and competitive position will suffer.

We expend substantial amount

of time and money to research and develop new enhancements of our services to incorporate additional features, improve functionality or

other enhancements in order to meet our customers’ rapidly evolving demands. When we develop an enhancement to our services, we

typically incur expenses and expend resources upfront to develop, market and promote the new enhancements. Therefore, when we develop

and introduce new enhancements to our services, they must achieve high levels of market acceptance in order to justify the amount of our

investment in developing and bringing them to market. If our new enhancements to our services do not garner widespread market adoption

and implementation, our growth prospects, future financial results and competitive position could suffer.

If we cause disruptions to our customers’

businesses or provide inadequate service, our customers may have claims for substantial damages against us, and as a result our profits

may be substantially reduced.

If we make errors in the course

of delivering services to our customers or fail to consistently meet service requirements of a customer, these errors or failures could

disrupt the customer’s business, which could result in a reduction in our net revenues or a claim for substantial damages against

us. In addition, a failure or inability to meet a contractual requirement could seriously damage our reputation and affect our ability

to attract new business.

The services we provide are

often critical to our customers’ businesses. We generally provide customer support after our customized application is delivered.

Certain of our customer contracts require us to comply with security obligations including but not limited to, maintaining system security,

ensuring our system is virus-free, maintaining business continuity procedures, and verifying the integrity of employees that work with

our customers by conducting background checks. Any failure in a customer’s system or breach of security relating to the services

we provide to the customer could damage our reputation or result in a claim for substantial damages against us. Any significant failure

of our systems could impede our ability to provide services to our customers, have a negative impact on our reputation, cause us to lose

customers, reduce our revenues and harm our business.

Unauthorized disclosure, destruction or

modification of data, through cybersecurity breaches, computer viruses or otherwise or disruption of our services could expose us to liability,

protracted and costly litigation and damage our reputation.

Our business involves the

collection, storage, processing and transmission of customers’ business data. An increasing number of organizations, including large

merchants and businesses, other large technology companies, financial institutions and governmental institutions, have disclosed breaches

of their information technology systems, some of which have involved sophisticated and highly targeted attacks, including on portions

of their websites or infrastructure. We could also be subject to breaches of security by hackers. Threats may derive from human error,

fraud or malice on the part of employees or third parties, or may result from accidental technological failure. Security concerns are

increased when we transmit information. Electronic transmissions can be subject to attacks, interceptions or losses. Also, computer viruses

and malware can be distributed and spread rapidly over the internet and could infiltrate our systems or those of our associated participants,

which can impact the confidentiality, integrity and availability of information, and the integrity and availability of our products, services

and systems, among other effects. Denial of services or other attacks could be launched against us for a variety of purposes, including

interfering with our services or creating a diversion for other malicious activities. These types of actions and attacks could disrupt

our delivery of products and services or make them unavailable, which could damage our reputation, force us to incur significant expenses

in remediating the resulting impacts, expose us to uninsured liabilities, subject us to lawsuits, fines or sanctions, distract our management

or increase our costs of business operations.

Our encryption of data and

other protective measures may not prevent unauthorized access or use of sensitive data. A breach of our system or that of one of our associated

participants may subject us to material losses or liabilities. A misuse of such data or a cybersecurity breach could harm our reputation

and deter customers from using our products and services, thus reducing our revenue. In addition, any such misuse or breach could cause

us to incur costs to correct the breaches or failures, expose us to uninsured liability, increase our risk of regulatory scrutiny, subject

us to lawsuits, result in the imposition of material penalties and fines under the applicable laws or regulations.

We cannot assure you that

there are written agreements in place with every associated participant or that such written agreements will prevent the unauthorized

use, modification, destruction or disclosure of data or enable us or our customers to obtain reimbursement in the event that should we

suffer incidents resulting in the unauthorized use, modification, destruction or disclosure of data. Any unauthorized use, modification,

destruction or disclosure of data could result in protracted and costly litigation, which could have a material adverse effect on our

business, financial condition and results of operations.

Cybersecurity incidents are

increasing in frequency and evolving in nature and include, but are not limited to, installation of malicious software, unauthorized access

to data and other electronic security breaches that could lead to disruptions in systems, unauthorized release of confidential or otherwise

protected information and the corruption of data. Given the unpredictability of the timing, nature and scope of information technology

disruptions, there can be no assurance that the procedures and controls that we employ will be sufficient to prevent security breaches

from occurring and we could be subject to manipulation or improper use of our systems and networks or financial losses from remedial actions,

any of which could have a material adverse effect on our business, financial condition and results of operations.

Interruptions or performance problems associated

with our technology and infrastructure may adversely affect our business, results of operations, and financial condition.

Our continued growth depends

in part on the ability of our existing customers and new customers to access our SaaS services, at any time and within an acceptable amount

of time. We may in the future experience service disruptions, outages and other performance problems due to a variety of factors, including

infrastructure changes, human or software errors or capacity constraints. In some instances, we may not be able to identify the cause

or causes of these performance problems within an acceptable period of time. It may become increasingly difficult to maintain and improve

our performance as our SaaS services become more complex. If our services are unavailable or if our customers are unable to access features

of our services within a reasonable amount of time or at all, our business would be negatively affected.

We currently provide our SaaS

services via designated data centers and we intend to outsource our cloud infrastructure to commercially available cloud infrastructure

as a service providers (“IaaS”), which can host our services. Our customers need to be able to access our services

at any time, without interruption or degradation of performance. IaaS providers run their own platforms that we access, and we are, therefore,

vulnerable to service interruptions. We expect that in the future we may experience interruptions, delays and outages in service

and availability from time to time due to a variety of factors, including infrastructure changes, human or software errors, website hosting

disruptions and capacity constraints. Capacity constraints could be due to a number of potential causes including technical failures,

natural disasters, fraud or security attacks. In addition, if our security, or that of IaaS providers, is compromised, our services are

unavailable or our customers are unable to use our services within a reasonable amount of time or at all, then our business, results of

operations and financial condition could be adversely affected. In some instances, we expect that we may not be able to identify the cause

or causes of these performance problems within a period of time acceptable to our customers. It may become increasingly difficult to maintain

and improve our service performance, especially during peak usage times, as the features of our services become more complex and the usage

of our services increases. Any of the above circumstances or events may harm our reputation, cause customers to stop using our services,

impair our ability to increase revenue from existing customers, impair our ability to grow our customer base and otherwise harm our business,

results of operations, and financial condition.

The market for our BaaS (blockchain-as-a-service)

services is new and unproven, which could result in limited customer adoption of our services, limited customer retention, or weaker customer

expansion.

We currently provide our BaaS

services as pilot projects on a limited basis to selected customers. While we believe that, over time, the concept of a BaaS services

will become fundamental to an organization’s core operations involving global trade, the market for BaaS services is largely unproven

and is subject to a number of risks and uncertainties.

The market for BaaS services

is new and less mature than traditional on-premises software applications, and the adoption rate for BaaS services may be slower among

customers with business practices requiring highly customizable application software. Our success with BaaS services will depend to a

substantial extent on the widespread adoption of BaaS services in general, but we cannot be certain that the trend of adoption of BaaS

services will continue in the future. In particular, many organizations have invested substantial personnel and financial resources in

integrating traditional software into their businesses over time, and some may be reluctant or unwilling to migrate to BaaS. It is difficult

to predict customer adoption rates and demand for our BaaS services, the future growth rate and size of the BaaS services market or the

entry of competitive applications. The expansion of the BaaS services market depends on a number of factors, including the cost, performance

and perceived value associated with BaaS. If BaaS services do not continue to achieve market acceptance, or there is a reduction in demand

for BaaS services caused by a lack of customer acceptance, technological challenges, weakening economic conditions, data security or privacy

concerns, governmental regulations, competing technologies and services or decreases in information technology spending, it would result

in decreased revenues and our business would be adversely affected.

It is difficult to predict our future operating

results.

Our ability to accurately

forecast our future operating results is limited and subject to a number of uncertainties, including planning for and modeling future

growth. We have encountered, and will continue to encounter, risks, and uncertainties frequently experienced by growing companies in rapidly

changing industries. If our assumptions regarding these risks and uncertainties, which we use to plan our business, are incorrect or change

due to industry or market developments, or if we do not address these risks successfully, our operating results could differ materially

from our expectations and our business could suffer.

If we have overestimated the size of our

total addressable market, our future growth rate may be limited.

We have estimated the size of our total addressable market based on

data published by third parties and internally generated data and assumptions. We have not independently verified any third-party information

and cannot be assured of its accuracy or completeness. While we believe our market size estimates are reasonable, such information is

inherently imprecise. In addition, our projections, assumptions and estimates of opportunities within our market are necessarily subject

to a high degree of uncertainty and risk due to a variety of factors, including but not limited to those described in this Annual Report.

If this third-party or internally generated data prove to be inaccurate or we make errors in our assumptions based on that data, our actual

market may be more limited than our estimates. In addition, these inaccuracies or errors may cause us to misallocate capital and other

critical business resources, which could harm our business.

Even if our total addressable

market meets our size estimates and experiences growth, we may not continue to grow our share of the market. Our growth is subject to

many factors, including our success in implementing our business strategy, which is subject to various risks and uncertainties. Accordingly,

the estimates of our total addressable market included in this Annual Report should not be taken as indicative of our ability to grow

our business. For more information regarding the estimates of market opportunity and the forecasts of market growth included in this Annual

Report, see “Business — Our Opportunity.”

We face intense competition from onshore

and offshore software application and technology service providers, and if we are unable to compete effectively, we may lose customers

and our revenues may decline.

The market for software applications and technology services is highly

competitive and we expect competition to persist and intensify. We believe that the principal competitive factors in our markets are domain

knowledge and industry expertise, breadth and depth of service offerings, quality of the services offered, reputation and track record,

marketing and selling skills, scalability of technology infrastructure and price. In the software application and technology services

market, customers tend to engage multiple service providers instead of using an exclusive service provider, which could reduce our revenues

to the extent that customers obtain services from other competing providers. Our ability to compete also depends in part on a number of

factors beyond our control, including the ability of our competitors to recruit, train, develop and retain highly skilled professionals,

the price at which our competitors offer comparable services and our competitors’ responsiveness to customer needs. Therefore, we

cannot assure you that we will be able to retain our customers while competing against such competitors. Increased competition, our inability

to compete successfully against competitors, pricing pressures or loss of market share could harm our business, financial condition and

results of operations.

Our corporate culture has contributed to

our success, and if we cannot maintain this culture as we grow, we could lose the innovation, creativity and teamwork fostered by our

culture, which could harm our business.

We believe that our culture

has been and will continue to be a key contributor to our success. We have optimized our operations in 2024 fiscal year and the number

of our total employees decreased from 178 in December 2023 to 137 in December 2024. We expect to continue to adjust our workforce according

to operational needs. If we do not continue to maintain our corporate culture as we grow, we may be unable to foster the innovation, creativity,

and teamwork we believe we need to support our growth. Our substantial anticipated headcount growth and our transition from a private

company to a public company may result in a change to our corporate culture, which could harm our business.

Our success depends substantially on the

continuing efforts of our senior executives and other key personnel, and our business may be severely disrupted if we lose their services.

Our future success heavily

depends upon the continued services of our senior executives and other key employees. If one or more of our senior executives or key employees

are unable or unwilling to continue in their present positions, it could disrupt our business operations, and we may not be able to replace

them easily or at all. In addition, competition for senior executives and key personnel in our industry is intense, and we may be unable

to retain our senior executives and key personnel or attract and retain new senior executive and key personnel in the future, in which

case our business may be severely disrupted, and our financial condition and results of operations may be materially and adversely affected.

If any of our senior executives or key personnel joins a competitor or forms a competing company, we may lose customers, suppliers, know-how

and key professionals and staff members to them. Also, if any of our business development managers, who generally keep a close relationship

with our customers, joins a competitor or forms a competing company, we may lose customers, and our revenues may be materially and adversely

affected. Additionally, there could be unauthorized disclosure or use of our technical knowledge, practices or procedures by such personnel.

All of our executives and key personnel have entered into employment agreements with us that contain non-competition provisions, non-solicitation

and nondisclosure covenants. However, if any dispute arises among our executive officers, key personnel and us, such non-competition,

non-solicitation and nondisclosure provisions might not provide effective protection to us, especially in China, where most of these executive

officers and key employees reside, in light of the uncertainties with respect to the interpretation and enforcement of PRC laws, rules

and regulations.

Due to intense competition for highly skilled

personnel, we may fail to attract and retain enough sufficiently trained personnel to support our operations; as a result, our ability

to generate new business may be negatively affected and our revenues could decline.

The software application and

technology service industry rely on skilled personnel, and our success depends to a significant extent on our ability to recruit, train,

develop and retain qualified personnel, especially experienced middle and senior level management. There is significant competition for

skilled personnel, especially experienced middle and senior level management, with the skills necessary to perform the services we offer

to our customers. Increased competition for these personnel, in the software application and technology service industry or otherwise,

could have an adverse effect on us. We have established certain programs to enhance our human capital and employee loyalty, however, a

significant increase in our attrition rate could decrease our operating efficiency and productivity and could lead to a decline in demand

for our services. Additionally, failure to recruit, train, develop and retain personnel with the qualifications necessary to fulfill the

needs of our existing and future customers or to assimilate new personnel successfully could have a material adverse effect on our business,

financial condition and results of operations. Failure to retain our key personnel on customer projects or find suitable replacements

for key personnel upon their departure may lead to termination of some of our customer contracts or cancellation of some of our projects,

which could materially and adversely affect our business.

Our profitability will suffer if we are

not able to maintain our resource utilization levels and continue to improve our productivity levels.

Our gross margin and profitability

are significantly impacted by our utilization levels of human resources as well as our ability to increase our productivity levels. We

have expanded our operations in recent years through organic growth, which has resulted in a significant increase in our headcount and

fixed overhead costs. We may face difficulties maintaining high levels of utilization. Although we try to use all commercially reasonable

efforts to accurately estimate service and resource requirements from our customers, we may overestimate or underestimate, which may result

in unexpected cost and strain or redundancy of our human capital and adversely impact our utilization levels. In addition, some of our

professionals are trained to work for specific customers or on specific projects and some of our sales are dedicated to specific customers

or specific projects. Our ability to continually increase our productivity levels depends significantly on our ability to recruit, train,

develop and retain high-performing professionals and project staffs appropriately and optimize our mix of services and delivery methods.

If we experience a slowdown or stoppage of service for any customer or on any project for which we have dedicated professionals or project

staffs, we may not be able to efficiently reallocate these professionals and project staffs to other customers and projects to keep their

utilization and productivity levels high. If we are not able to maintain high resource utilization levels without corresponding cost reductions

or price increases, our profitability will suffer.

If we are not able to maintain a strong

brand for our services and increase market awareness of our Company and our services, then our business, results of operations and financial

condition may be adversely affected.

We believe that we have a

strong brand name in our industry and the continuing success of our services will depend in part on our ability to develop and sustain

a strong brand identity for our services and to increase the market awareness of our services and their capabilities. The successful promotion

of our brand will depend largely on our continuous marketing efforts and our ability to offer high quality services to our customers.

Our brand promotion activities may not be successful or help to elevate the revenue. In addition, independent industry analysts may provide

reviews of our services and of competing products and services, which may significantly influence the perception of our services in the

marketplace. If these reviews are negative or not as positive as reviews of our competitors’ products and services, then our brand

reputation may be harmed.

The promotion of our brand

also requires us to make substantial expenditures, and we anticipate that these expenditures will increase as our industry becomes more

competitive and as we seek to expand into new markets. These higher expenditures may not result in any increased revenue or incremental

revenue that is sufficient to offset the higher expense levels. If we do not successfully maintain and enhance our brand, then our business

may not grow, we may see our pricing power reduced when compared to our competitors and we may lose customers, all of which would adversely

affect our business, results of operations and financial condition.

We may be unsuccessful

in entering into strategic alliances or identifying and acquiring suitable acquisition candidates, which could impede our growth and negatively

affect our revenues and net income.

We have pursued strategic

alliances and intend to pursue strategic acquisition opportunities to increase our scale and geographical presence, expand our service

offerings and capabilities and enhance our industry and technical expertise. While we believe the strategic plans that we implemented

would enable us to better leverage synergies between our existing businesses and the newly expanded business, thus improved our overall

business operations, those strategic plans may not be ultimately successful. See “Item 4. Information on the Company — C.

History and Development of the Company” for further information on the acquisition transactions entered into by us.

In addition, it is possible

that in the future we may not be successful in identifying suitable alliances or acquisition candidates. Even if we identify suitable

candidates, we may not be able to consummate these arrangements on terms commercially acceptable to us or to obtain necessary regulatory

approvals in the case of acquisitions. Challenges we face in the potential acquisition and integration process include:

| ● | integrating

operations, services and personnel in a timely and efficient manner; |

| ● | unforeseen

or undisclosed liabilities; |

| ● | generating

sufficient revenue and net income to offset acquisition costs; |

| ● | potential

loss of, or harm to, employee or customer relationships; |

| ● | properly

structuring our acquisition consideration and any related post-acquisition earn-outs and successfully monitoring any earn-out calculations

and payments; |

| ● | retaining

key senior management and key sales and marketing and research and development personnel; |

| ● | potential

incompatibility of solutions, services and technology or corporate cultures; |

| ● | consolidating