FORM 20-F

☐ REGISTRATION STATEMENT PURSUANT TO SECTION

12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13

OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐ SHELL COMPANY REPORT PURSUANT TO SECTION

13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File No.: 001-39957

NLS PHARMACEUTICS LTD.

(Exact name of registrant as specified in its charter)

Translation of registrant’s name into

English: Not applicable

Switzerland

(Jurisdiction of incorporation or organization)

The Circle 6

8058 Zurich

Switzerland

(Address of principal executive offices)

Alexander Zwyer

Chief Executive Officer

Tel: +41 44 512 21 50

contact@nls-pharma.com

The Circle 6, Postfach

8058 Zurich

Switzerland

(Name, Telephone, E-mail and/or Facsimile number

and Address of Company Contact Person)

Securities registered or to be registered pursuant

to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common shares, nominal value CHF 0.03 per share (CHF 0.8 as of December 31, 2024) | | NLSP | | Nasdaq Capital Market |

| Warrants to purchase common shares, nominal value CHF 0.03 per share | | NLSPW | | Nasdaq Capital Market |

Securities registered or to be registered pursuant

to Section 12(g) of the Act: None

Securities for which there is a reporting obligation

pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s

classes of capital or common stock as of the close of the period covered by the annual report: 3,159,535 common shares, nominal value

CHF 0.03 per share, as of December 31, 2024.

Indicate by check mark if

the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

If this report is an annual

or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the

Exchange Act of 1934.

Yes ☐ No ☒

Indicate by check mark whether

the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether

the registrant has submitted every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding

12 months.

Yes ☒ No ☐

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition

of “large accelerated filer, “accelerated filer,” and emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | Non-accelerated filer ☒ |

| | | Emerging growth company ☒ |

If an emerging growth company

that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the

extended transition period for complying with any new or revised financial accounting standards † provided pursuant to Section

13(a) of the Exchange Act. ☐

| † | The term “new or revised financial accounting standard”

refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate by check mark whether

the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control

over financial reporting under Section 404(b) of the Sarbanes Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that

prepared or issued its audit report. ☐

If securities are registered

pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing

reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether

any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the

registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark which

basis of accounting the registrant has used to prepare the financial statements included in this filing.

U.S. GAAP ☒

International Financial Reporting

Standards as issued by the International Accounting Standards Board ☐

Other ☐

If “Other” has

been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to

follow.

☐ Item 17 ☐ Item

18

If this is an annual report, indicate by check

mark whether the registrant is a shell company.

Yes ☐ No ☒

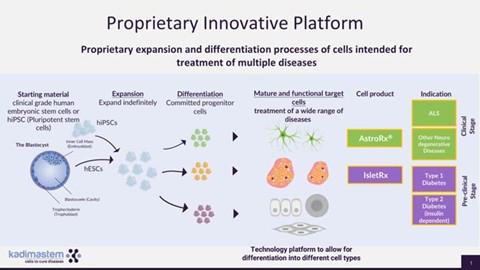

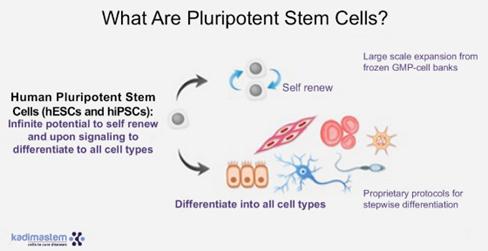

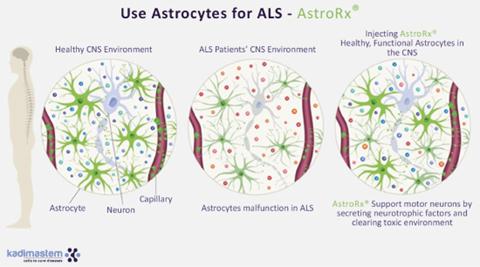

In this annual report, “we,”

“us,” “our,” the “Company” and “NLS” refer to NLS Pharmaceutics Ltd., a Swiss corporation,

and its wholly owned subsidiary, NLS Pharmaceutics Inc., a Delaware corporation. “Kadimastem” refers to Kadimastem Ltd.,

an Israeli publicly traded company limited by shares (TASE: KDST). “Merger Sub” refers to NLS Pharmaceutics (Israel) Ltd.,

an Israeli company and a wholly owned subsidiary of the Company. “Merger Agreement” refers to the Agreement and Plan of Merger

entered into by and between NLS, Merger Sub and Kadimastem, pursuant to which Merger Sub will merge with and into Kadimastem, with Kadimastem

as the surviving company, or the “Merger.”

Unless the context otherwise

indicates or requires, the NLS logo and all product names and trade names used by us in this annual report, including Quilience®

and Nolazol®, are our proprietary trademarks and service marks. Quilience® and Nolazol® are NOT approved drugs. They

refer to Mazindol ER an investigational drug currently in late stage clinical development by NLS. All trademarks or trade names referred

to in this annual report are the property of their respective owners. Solely for convenience, the trademarks and trade names in this annual

report are referred to without the ® and ™ symbols, but such references should not be construed as any indicator

that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend the use

or display of other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by,

any other companies.

Our reporting currency and

functional currency is the United States, or U.S., dollar. Unless otherwise expressly stated or the context otherwise requires, references

in this annual report to “dollars,” “USD” or “$” mean U.S. dollars, and references to “CHF”

are to the Swiss Franc. U.S. dollar translations of CHF amounts presented in this annual report were done on different dates in accordance

with the date as of such entry in the Company’s books and are derived from our audited financial statements included elsewhere in

this annual report. U.S. dollar translations of CHF amounts presented in this annual report that are not derived from our audited financial

statements included elsewhere in this annual report are translated using the rate of CHF 1.00 to $1.0965, based on the exchange rate provided

by the Swiss Federal Tax Administration on December 31, 2024.

This annual report includes

statistical, market and industry data and forecasts which we obtained from publicly available information and independent industry publications

and reports that we believe to be reliable sources. These publicly available industry publications and reports generally state that they

obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy or completeness of the

information. Although we believe that these sources are reliable, we have not independently verified the information contained in such

publications. Further, Kadimastem has supplied all information contained or incorporated by reference into this annual report relating

to Kadimastem.

On September 25, 2024,

we effectuated a 1-for-40 reverse share split in order to regain compliance with Nasdaq Listing Rule 5550(a)(2). All historical

quantities of Common Shares and per share data herein are presented on a post-split basis to give effect to our 1-for-40 reverse

share split effected prior to the start of trading on the Nasdaq Capital Market, or Nasdaq, on September 27, 2024. Further, on

January 14, 2025, the shareholders of the Company approved a change in the par value of our Common Shares from CHF 0.80 to CHF 0.03

per share, effective January 17, 2025. All share amounts reflect the par value of CHF 0.80 as of December 31, 2024 and no

adjustments have been made for the change in par value to additional paid in capital for

the reduction in par value.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information included

in this annual report on Form 20-F, or this annual report, may be deemed to be “forward-looking statements,” including some

of the statements made under Item 3.D. “Risk Factors,” Item 5 “Operating and Financial Review and Prospects,”

“Business” and elsewhere in this annual report constitute forward-looking statements. Forward-looking statements are often

characterized by the use of forward-looking terminology such as “may,” “will,” “expect,” “anticipate,”

“estimate,” “continue,” “believe,” “predict,” “should,” “intend,”

“project” or other similar words, but are not the only way these statements are identified.

These forward-looking statements

may include, but are not limited to, statements relating to our objectives, plans and strategies, statements that contain projections

of results of operations or of financial condition, expected capital needs and expenses, statements relating to the research, development,

completion and use of our product candidates, and all statements (other than statements of historical facts) that address activities,

events or developments that we intend, expect, project, believe or anticipate will or may occur in the future.

Forward-looking statements

are not guarantees of future performance and are subject to risks and uncertainties. We have based these forward-looking statements on

assumptions and assessments made by our management in light of their experience and their perception of historical trends, current conditions,

expected future developments and other factors they believe to be appropriate.

Important factors that could

cause actual results, developments and business decisions to differ materially from those anticipated in these forward-looking statements

include, among other things:

| |

● |

the regulatory pathways that we may elect to utilize in seeking European Medicines Agency, or EMA, the U.S. Food and Drug Administration, or FDA, and other regulatory approvals; |

| |

|

|

| |

● |

the completion and timing of the transaction contemplated by our Merger Agreement with Kadimastem are uncertain, and the risk that the transaction may not close as expected or at all; |

| |

|

|

| |

● |

our ability to drive revenue growth, enhance research and development capabilities, and improve financial performance as a result of the potential merger with Kadimastem is subject to uncertainties, including unforeseen costs and integration issues; |

| |

|

|

| |

● |

that our financial position raises substantial doubt about our ability to continue as a going concern; |

| |

|

|

| |

● |

our ability to maintain listing and effectively comply with the listing requirements of the Nasdaq; |

| |

● |

the re-scheduling of Mazindol ER in the U.S. by the U.S. Drug Enforcement Agency, or the DEA, following approval by the FDA; |

| |

● |

the launch of a different formulation or different dosage of Mazindol by another company; |

| |

● |

the use of Quilience (Mazindol ER) in a compassionate use program, or CUP, and the results thereof; |

| |

● |

obtaining EMA and FDAFDA approval of, or other regulatory action in Europe or the United States and elsewhere with respect to, Quilience, Nolazol, NLS-4, or other product candidates that we may seek to develop; |

| |

● |

the commercial launch and future sales of Quilience and/or Nolazol, or any other future product candidates; |

| |

● |

the dosage of Quilience, Nolazol, and or any of our pipeline drugs; |

| |

|

|

| |

● |

our ability to move NLS-3, NLS-8, NLS-11, NLS-12 and any of our Aexon Labs (Dual) Orexin compounds (recently secured through an in-license) into investigational new drug, or IND-enabling studies; |

| |

|

|

| |

● |

our expectations regarding the timing of commencing further clinical trials, the process entailed in conducting each such trial, including dosages, and the order of such trials with each of our product candidates or whether such trials will be conducted at all; |

| |

● |

improved convenience relating to the prescription of and use of Nolazol for prescribers and patients (and their parents); |

| |

● |

our expectations regarding the supply of mazindol; |

| |

● |

third-party payor reimbursement for Quilience, Nolazol, and or any of our pipeline drugs; |

| |

|

|

| |

● |

our estimates regarding anticipated expenses, capital requirements and our needs for additional financing; |

| |

● |

changes to the narcolepsy patient market size and market adoption of Quilience by physicians and patients; |

| |

● |

the timing, cost, regulatory approvals or other aspects of the commercial launch of Quilience and Nolazol; |

| |

● |

submission of a Marketing Authorisation Application, or MAA, and New Drug Application, or NDA, with the EMA and FDA for Quilience, Nolazol, and or any of our pipeline drugs, respectively; |

| |

● |

completion and receiving favorable results of clinical trials for Quilience, Nolazol, and or any of our pipeline drugs; |

| |

|

|

| |

● |

issuance of patents to us by the U.S. Patent and Trademark Office, or PTO, and other governmental patent agencies; |

| |

● |

new issuances of orphan drug designations; |

| |

● |

the overall global political and economic environment in the countries in which we operate; |

| |

|

|

| |

● |

the development and approval of the use of mazindol for additional indications other than narcolepsy and attention deficit hyperactivity disorder, or ADHD; |

| |

|

|

| |

● |

the development and commercialization, if any, of any other product candidates that we may seek to develop; |

| |

|

|

| |

● |

the use of mazindol controlled release, or CR, for treatment of additional indications other than narcolepsy, idiopathic hypersomnia, or IH, and ADHD; and |

| |

● |

the ability of our management team to lead the development of our product candidates, conclude a strategic partnership deal for Mazindol or any of our pipeline compounds. |

These statements are only

current predictions and are subject to known and unknown risks, uncertainties and other factors that may cause our or our industry’s

actual results, levels of activity, performance or achievements to be materially different from those anticipated by the forward-looking

statements. We discuss many of these risks in this in greater detail under Item 3.D. “Risk Factors” and elsewhere in this

annual report. You should not rely upon forward-looking statements as predictions of future events. Readers are urged to carefully review

and consider the various disclosures made throughout this annual report which are designed to advise interested parties of the risks and

factors that may affect our business, financial condition, results of operations and prospects.

You should not put undue reliance

on any forward-looking statements. Any forward-looking statements in this annual report are made as of the date hereof, and we undertake

no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise,

except as required by law.

In addition, the section of

this annual report entitled “Item 4. Information on the Company” contains information obtained from independent industry sources

and other sources that we have cited but not independently verified.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT

AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. [Reserved.]

B. Capitalization and Indebtedness.

Not applicable.

C. Reasons for the Offer and Use of Proceeds.

Not applicable.

D. Risk Factors.

You should carefully consider

the risks described below, together with all of the other information in this annual report. The risks described below are not the only

risks facing us. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially

and adversely affect our business operations. If any of these risks actually occurs, our business and financial condition could suffer

and the price of our common shares and our publicly listed warrants, or Warrants, could decline.

Summary of Risk Factors

Investing in our common shares

and Warrants involves substantial risks. Our ability to execute our strategy is also subject to certain risks. The risks described below

may cause us not to realize the full benefits of our strengths or may cause us to be unable to successfully execute all or part of our

strategy. In particular, our risks include, but are not limited to, the following summary of such risk factors:

| |

● |

We may be unable to successfully use mazindol, on which we depend substantially, as the drug substance for each of our current clinical mid-stage product candidates, Quilience, for the treatment of narcolepsy, and Nolazol, for the treatment of ADHD, and which outcome could prove costly to our business and could prevent us from obtaining regulatory or marketing approval; |

| |

|

|

| |

● |

We may not be able to initiate our Phase 3 clinical trials in Quilience without additional pre-clinical studies, chemistry, manufacturing, and controls, or CMC, work or early-stage clinical trials; |

| |

● |

Prior results of mazindol for the treatment of other indications may not be replicated in the clinical trials that we conduct for the treatment of narcolepsy or ADHD; |

| |

|

|

| |

● |

If, and when, we seek to commercialize Quilience and/or Nolazol, we may be partially dependent upon prescriptions from physicians for the sale of both such product candidates, and therefore, the loss of a significant number of patient referrals by physicians prescribing Quilience and/or Nolazol may have an adverse effect on our future revenues, if any, which could have an adverse effect on our business, financial condition and results of operations; |

| |

● |

We are dependent on a sole manufacturer for mazindol drug substance and product. Any delay, price increase, or unavailability could materially disrupt our clinical development or commercialization efforts; |

| |

● |

Failure to secure additional strategic partnerships could negatively affect our commercialization prospects; |

| |

● |

If we are unable to obtain and maintain effective patent rights for our products, we may not be able to compete effectively in our markets. If we are unable to protect the confidentiality of our trade secrets or know-how, such proprietary information may be used to compete against us; |

| |

● |

If we are unable to maintain effective proprietary rights for our products, we may not be able to compete effectively in our markets; |

| |

● |

We may face future claims that our personnel improperly used or disclosed third-party confidential information or trade secrets from prior employers; |

| |

● |

Our financial statements for the year ended December 31, 2024, contained a going concern disclosure in Note 1 regarding substantial doubt about our ability to continue as a going concern. This going concern disclosure in Note 1 of financial statements could prevent us from obtaining new financing on reasonable terms or at all and risk our ability to continue operating as a going concern; |

| |

● |

To date, we have not generated any revenue, and we do not expect to

generate any significant revenue unless and until we obtain marketing approval to commercialize Quilience and/or Nolazol. We are unable

to predict the extent of future losses or when we will become profitable based on the sale of any product, if at all. Even if we succeed

in developing and commercializing our product candidates, we may never generate sufficient revenue to sustain profitability. As of December

31, 2024, we had an accumulated deficit of approximately $74.4 million; |

| |

● |

We have not generated revenue, have a history of losses, and expect to continue incurring losses. We will need substantial additional capital to advance our pipeline, including Quilience, Nolazol, other candidates (NLS-3, NLS-4, NLS-8, NLS-11, NLS-12), and the recently in-licensed Aexon platform, which may not be available or may only be available on unfavorable terms; |

| |

|

|

| |

● |

As a public company, we must comply with extensive U.S., Swiss, and Nasdaq regulations, which are costly and require significant management attention. We may be delisted from Nasdaq due to non-compliance or financial constraints; |

| |

● |

We require regulatory approvals, including from the FDA and EMA, to commercialize our products; |

| |

● |

Clinical data may not satisfy regulatory authorities or may require additional studies, delaying or preventing approval; |

| |

● |

As a foreign private issuer and an emerging growth company, we follow reduced U.S. reporting standards, which could impact investor confidence; |

| |

|

|

| |

● |

We have identified material weaknesses in our internal controls; failure to remediate them may impair financial reporting and harm investor trust; |

| |

● |

If the Merger with Kadimastem is not consummated, NLS’s share price and business could be adversely affected; |

| |

|

|

| |

● |

Following the Merger, NLS may lose its foreign private issuer status and face increased U.S. reporting and compliance obligations; |

| |

● |

The Merger with Kadimastem may result in dilution and reduced influence for current NLS shareholders. |

| |

● |

NLS may not be able to successfully integrate Kadimastem’s business or realize the expected benefits of the Merger; |

| |

● |

Following the Merger, NLS plans to shift its business to Kadimastem’s cell therapy platform, which may not succeed; |

| |

● |

Kadimastem has no revenue and a history of losses, and its drug candidates may never receive regulatory approval or be commercialized; and |

| |

● |

Legal or regulatory challenges, including lawsuits, could delay or prevent the completion of the Merger with Kadimastem. |

Risks Related to Our Current Business

We depend substantially on the success of

our two product candidates, Quilience and Nolazol. We cannot give any assurance that any of our product candidates will receive regulatory

approval, which is necessary before they can be commercialized.

We have invested

almost all of our efforts and financial resources to achieve and maintain phase 3 readiness in research and development and general and

administrative costs of our two product candidates, Quilience for the treatment of excessive daytime sleepiness, or EDS, and cataplexy

associated with narcolepsy and Nolazol, for the treatment of ADHD. The process to develop, obtain regulatory approval for and commercialize

pharmaceutical product candidates is long, complex, costly and inherently uncertain of outcome. We are not permitted to market any of

our product candidates in the United States, European Union, or the EU, or any other jurisdiction until we receive the requisite regulatory

approvals. We may be able to generate pre-approval revenues from compassionate use activities leveraging on an expanded access policy

in certain countries around the world. However, we cannot give any assurance that our current clinical development plan will proceed as

planned, or that our product candidates will receive regulatory approval, or that such regulatory approval, if received, will be within

a timeframe that allows us to effectively compete with our competitors, or be successfully marketed and commercialized.

Our initiation of clinical trials for Quilience

is dependent upon the review and approval of the relevant regulatory agencies and authorities and if we are required to conduct pre-clinical

trials, approval of an NDA or MAA, if any, for Quilience would be delayed and we may require additional capital as a result thereof.

Based in part on the prior

use and FDA approval of mazindol to manage exogenous obesity, we have been able to commence our Phase 2 clinical trials for Quilience

without having to do prior pre-clinical and/or early-stage clinical trials, such as Phase 1 trials. No assurance can be given that the

EMA or FDA will agree to allow us to initiate Phase 3 clinical trials for Quilience without conducting such pre-clinical clinical trials.

If the FDA or EMA, or any other applicable regulatory agency, were to require us to conduct additional pre-clinical trials, our planned

development strategy for Quilience would be materially impacted and approval of an NDA or MAA, if any, for Quilience would be delayed

and we may require additional capital as a result thereof.

In addition, we may request

a Paediatric Investigation Plan, or PIP, deferral in order to delay conducting clinical trials for Quilience in children until after we

receive an MAA from the EMA for the use of Quilience in adults. A PIP deferral, as can be agreed upon by the EMA, allows an applicant

to delay studies in children until after there is sufficient data on use in adults; we anticipate that we will be able to receive a PIP

deferral from the EMA for Quilience; however, there is no guarantee that this deferral will be granted, which could impact our planned

development process and would make the product candidate approval process more costly.

The commencement and completion of clinical

trials can be delayed or prevented for a number of reasons.

We may not be able to commence

or complete the clinical trials that would support our submission of an NDA to the FDA or MAA to the EMA. Drug development is a long,

expensive and uncertain process, and delay or failure can occur at any stage of any of our clinical trials. Clinical trials can be delayed

or prevented for a number of reasons, including:

| |

● |

difficulties obtaining regulatory approval to commence a clinical trial or complying with conditions imposed by a regulatory authority regarding the scope or term of a clinical trial; |

| |

|

|

| |

● |

delays in reaching or failing to reach agreement on acceptable terms with prospective contract research organizations, or CROs, and trial sites, the terms of which can be subject to extensive negotiation and may vary significantly among different CROs and trial sites; |

| |

● |

insufficient or inadequate supply or quality of a product candidate or other materials necessary to conduct our clinical trials; |

| |

● |

if the FDA or EMA elect to enact policy changes, as a result of a pandemic threat or otherwise; |

| |

● |

difficulties obtaining institutional review board, or IRB, approval to conduct a clinical trial at a prospective site; and |

| |

|

|

| |

● |

challenges recruiting and enrolling patients to participate in clinical trials for a variety of reasons, including size and nature of patient population, proximity of patients to clinical sites, eligibility criteria for the trial, nature of trial protocol, the availability of approved effective treatments for the relevant disease and competition from other clinical trial programs for similar indications. |

Clinical trials may also be

delayed or terminated as a result of ambiguous or negative interim results. In addition, a clinical trial may be suspended or terminated

by us, the FDA, the IRBs at the sites where the IRBs are overseeing a trial, a data safety monitoring board overseeing the clinical trial

at issue or by other regulatory authorities due to a number of factors, including:

| |

● |

failure to conduct the clinical trial in accordance with regulatory requirements or our clinical protocols; |

| |

● |

inspection of the clinical trial operations or trial sites by the FDA or other regulatory authorities; |

| |

● |

unforeseen safety issues (including those that result from COVID-19) or lack of effectiveness; and |

| |

● |

lack of adequate funding to continue the clinical trial. |

The results of pre-clinical studies, early-stage

clinical trials, data obtained from real-world use, and published third-party studies may not be indicative of results in future clinical

trials and we cannot assure you that any planned or future clinical trials will lead to results sufficient for the necessary regulatory

approvals.

The results of pre-clinical

studies may not be predictive of the results of clinical trials, and the results of any completed clinical trials, including studies derived

from real-world use and studies in published literature, or clinical trials we commence may not be predictive of the results of later-stage

clinical trials. Additionally, interim results during a clinical trial do not necessarily predict final results. Later clinical trial

results may not replicate earlier clinical trials for a variety of reasons, including differences in trial design, different trial endpoints

(or lack of trial endpoints in exploratory studies), subject population, number of subjects, subject selection criteria, trial duration,

drug dosage and formulation and lack of statistical power in the earlier studies. There can be no assurance that any of our clinical trials

will ultimately be successful or support further clinical development of any of our product candidates. A number of companies in the pharmaceutical

and biotechnology industries have suffered significant setbacks in clinical development even after achieving promising results in earlier

studies, and any such setbacks in our clinical development could have a negative impact on our business.

We may find it difficult to enroll patients

in our clinical trials. Difficulty in enrolling patients could delay or prevent clinical trials of our product candidates.

Identifying and qualifying

patients to participate in clinical trials of our product candidates is critical to our success. The timing of our clinical trials depends

in part on the speed at which we can recruit patients to participate in testing our product candidates, and we may experience delays in

our clinical trials if we encounter difficulties in enrollment.

In addition, as a rare disorder,

there is a limited patient pool from which to draw for our clinical trials for Quilience. Further, the eligibility criteria of our clinical

trials will further limit the pool of available study participants as we will require that patients have specific characteristics that

we can measure or to assure their disease is either severe enough or not too advanced to include them in a study.

Additionally, the process

of finding patients may prove costly. We also may not be able to identify, recruit and enroll a sufficient number of patients to complete

our clinical trials because of the perceived risks and benefits of the product candidate under study, the availability and efficacy of

competing therapies and clinical trials, the proximity and availability of clinical trial sites for prospective patients and the patient

referral practices of physicians. If patients are unwilling to participate in our studies for any reason, the timeline for recruiting

patients, conducting studies and obtaining regulatory approval of our potential product candidates will be delayed.

If we experience delays in

the completion or termination of any clinical trial of our product candidates, the commercial prospects of our product candidates will

be harmed, and our ability to generate product candidate revenue from any of these product candidates could be delayed or prevented. In

addition, any delays in completing our clinical trials will increase our costs, slow down our product candidate development and approval

process and jeopardize our ability to commence product candidate sales and generate revenues. Any of these occurrences may harm our business,

financial condition and prospects significantly. In addition, many of the factors that cause, or lead to, a delay in the commencement

or completion of clinical trials may also ultimately lead to the denial of regulatory approval of our product candidates.

Interim topline and preliminary data from

our clinical trials that we announce or publish from time to time may change as more patient data become available and are subject to

audit and verification procedures that could result in material changes in the final data.

From time to time, we may

publish interim topline or preliminary data from our clinical trials. Interim data from clinical trials that we may complete are subject

to the risk that one or more of the clinical outcomes may materially change as patient enrollment continues and more patient data become

available. Preliminary or topline data also remain subject to audit and verification procedures that may result in the final data being

materially different from the preliminary data we previously published. As a result, interim and preliminary data should be viewed with

caution until the final data are available. Adverse differences between preliminary or interim data and final data could significantly

harm our reputation and business prospects.

Changes in methods of product candidate

manufacturing or formulation may result in additional costs or delay.

As product candidates proceed

through pre-clinical studies to late-stage clinical trials towards potential approval and commercialization, it is common that various

aspects of the development program, such as manufacturing methods and formulation, are altered along the way in an effort to optimize

processes and results. Such changes carry the risk that they will not achieve these intended objectives. Any of these changes could cause

our product candidates to perform differently and affect the results of planned clinical trials or other future clinical trials conducted

with the materials manufactured using altered processes. Such changes may also require additional testing, FDA or EMA notification or

FDA approval. This could delay completion of clinical trials, require the conduct of bridging clinical trials or the repetition of one

or more clinical trials, increase clinical trial costs, delay approval of our product candidates and jeopardize our ability to commence

sales and generate revenues.

International expansion of our business

exposes us to business, regulatory, political, operational, financial and economic risks associated with doing business outside of the

United States, Switzerland or the EU.

Other than our

headquarters and other operations which are located in Switzerland and our wholly owned U.S. subsidiary, NLS Pharmaceutics Inc., a

Delaware corporation (as further described below), we currently have limited international operations, but our business strategy

incorporates potentially significant international expansion, particularly in anticipation of approval of our product candidates. We

may plan to maintain sales representatives and conduct physician and patient association outreach activities, as well as clinical

trials, outside of the United States, Switzerland and Europe. If Quilience and/or Nolazol or any of our other product candidates are

approved for commercialization outside the United States, Switzerland, or the EU, we will likely enter into agreements with third

parties to market the drugs in these additional global territories. We expect that we will be subject to additional risks related to

entering into or maintaining international business relationships, including:

| |

● |

different regulatory requirements for drug approvals in foreign countries; |

| |

● |

differing United States and foreign drug import and export rules, tariffs and other trade barriers; |

| |

● |

reduced protection for intellectual property rights in foreign countries; |

| |

● |

failure by us to obtain regulatory approvals for the use of our products in various countries; |

| |

● |

different reimbursement systems; |

| |

● |

economic weakness, including inflation, or political instability in particular foreign economies and markets; |

| |

● |

multiple, conflicting and changing laws and regulations such as privacy regulations, tax laws, export and import restrictions, employment laws, regulatory requirements and other governmental approvals, permits and licenses; |

| |

● |

complexities associated with managing multiple payor reimbursement regimes, government payors or patient self-pay systems; |

| |

● |

financial risks, such as longer payment cycles, difficulty collecting accounts receivable, the impact of local and regional financial crises on demand and payment for our products and exposure to foreign currency exchange rate fluctuations, which could result in increased operating expenses and reduced revenues; |

| |

● |

workforce uncertainty in countries where labor unrest is more common than in the United States; |

| |

● |

production shortages resulting from any events affecting raw material supply or manufacturing capabilities abroad; |

| |

|

|

| |

● |

regulatory and compliance risks that relate to maintaining accurate information and control over sales and activities that may fall within the purview of the U.S. Foreign Corrupt Practices Act, or FCPA, its books and records provisions or its anti-bribery provisions; |

| |

● |

business interruptions resulting from cyber-attacks, geo-political actions, including war (such as the Russia-Ukraine war and Israel’s multi-front war) and terrorism, or natural disasters including earthquakes, typhoons, floods and fires. |

| |

● |

potential liability resulting from development work conducted by these distributors; and |

| |

● |

business interruptions resulting from a local or worldwide pandemic, such as COVID-19, geopolitical actions, including war and terrorism, or natural disasters. |

Any of these factors could

significantly harm our future international expansion and operations and, consequently, our results of operations.

Even if any of our product candidates receives

marketing approval, it may fail to achieve the degree of market acceptance by physicians, patients, third-party payors and others in the

medical community necessary for commercial success.

The commercial success of

Quilience and/or Nolazol will depend upon the acceptance of each product by the medical community, including physicians, patients and

third-party payors. The degree of market acceptance of any approved product will depend on a number of factors, including:

| |

● |

the efficacy and safety of the product; |

| |

● |

the potential advantages of the product compared to available therapies; |

| |

|

|

| |

● |

the convenience and ease of administration compared to alternative treatments; |

| |

|

|

| |

● |

limitations or warnings, including use restrictions contained in the product’s approved labeling; |

| |

● |

distribution and use restrictions imposed by the EMA, FDA, or other regulatory authority or agreed to by us as part of a mandatory or voluntary risk management plan; |

| |

● |

availability of alternative treatments, including, in the case of Nolazol, a number of competitive products already approved for the treatment of ADHD or expected to be commercially launched in the near future; |

| |

● |

pricing and cost effectiveness in relation to alternative treatments; |

| |

● |

if the product is included under physician treatment guidelines as a first-, second-, or third-line therapy; |

| |

● |

the strength of sales, marketing and distribution support; |

| |

|

|

| |

● |

the availability of third-party coverage and adequate reimbursement and the willingness of patients to pay out-of-pocket in the absence of coverage by third-party payors; |

| |

● |

the strength of sales, marketing and distribution support; |

| |

● |

the willingness of patients to pay for drugs out of pocket in the absence of third-party coverage; and |

| |

|

|

| |

● |

the willingness of the target patient population to try new therapies and of physicians to prescribe these therapies. |

If Quilience and/or Nolazol

is approved but does not achieve an adequate level of acceptance by physicians, third party payors and patients, we may not generate sufficient

revenue from the product, and we may not become or remain profitable. In addition, our efforts to educate the medical community and third-party

payors on the benefits of the product may require significant resources and may never be successful.

In addition, we may choose

to collaborate with third parties that have direct sales forces and established distribution systems, either to augment our own sales

force and distribution systems or in lieu of our own sales force and distribution systems. If we enter into arrangements with third parties

to perform sales, marketing and distribution services for our products, the resulting revenues or the profitability from these revenues

to us are likely to be lower than if we had sold, marketed and distributed our products ourselves. If we are unable to enter into such

arrangements on acceptable terms or at all, we may not be able to successfully commercialize any of our product candidates that receive

regulatory approval. Depending on the nature of the third-party relationship, we may have little control over such third parties, and

any of these third parties may fail to devote the necessary resources and attention to sell, market and distribute our products effectively.

If we are not successful in commercializing our product candidates, either on our own or through collaborations with one or more third

parties, our future product revenue will suffer and we may incur significant additional losses.

Even if we are able to commercialize any

product candidates, the products may become subject to unfavorable pricing regulations or third-party coverage and reimbursement policies,

any of which could harm our business.

Our ability to commercialize

any product candidates successfully will depend, in part, on the extent to which coverage and reimbursement for these products and related

treatments will be available from government health administration authorities, private health insurers and other organizations. Government

authorities and third-party payors, such as private health insurers and health maintenance organizations, decide which medications they

will pay for and impact reimbursement levels.

Obtaining and maintaining

adequate reimbursement for our products may be difficult. We cannot be certain if and when we will obtain an adequate level of reimbursement

for our products by third party payors. Even if we do obtain adequate levels of reimbursement, third-party payors, such as government

or private healthcare insurers, may carefully review and increasingly question the coverage of, and challenge the prices charged for,

our drugs. Reimbursement rates from private health insurance companies vary depending on the company, the insurance plan and other factors.

A primary trend in the U.S. healthcare industry and elsewhere is cost containment. Government authorities and third-party payors have

attempted to control costs by limiting coverage and the amount of reimbursement for particular medications. Increasingly, third-party

payors are requiring that drug companies provide them with predetermined discounts from list prices and are challenging the prices charged

for drugs. We may also be required to conduct expensive pharmacoeconomic studies to justify coverage and reimbursement or the level of

reimbursement relative to other therapies. If coverage and reimbursement are not available or reimbursement is available only to limited

levels, we may not be able to successfully commercialize any product candidate for which we obtain marketing approval, and the royalties

resulting from the sales of those products may also be adversely impacted.

There may be significant delays

in obtaining reimbursement for newly approved drugs, and coverage may be more limited than the purposes for which the drug is approved

by the FDA or similar regulatory authorities outside the United States. Moreover, eligibility for reimbursement does not imply that a

drug will be paid for in all cases or at a rate that covers our costs, including research, development, manufacture, sale and distribution.

Interim reimbursement levels for new drugs, if applicable, may also not be sufficient to cover our costs and may not be made permanent.

Reimbursement rates may vary according to the use of the drug and the clinical setting in which it is used, may be based on reimbursement

levels already set for lower cost drugs and may be incorporated into existing payments for other services. Net prices for drugs may be

reduced by mandatory discounts or rebates required by government healthcare programs or private payors and by any future relaxation of

laws that presently restrict imports of drugs from countries where they may be sold at lower prices than in the United States. Our inability

to promptly obtain coverage and adequate reimbursement rates from both government-funded and private payors for any approved products

that we develop could have a material adverse effect on our operating results, our ability to raise capital needed to commercialize products

and our overall financial condition.

The regulations that govern

marketing approvals, pricing, coverage and reimbursement for new drug products vary widely from country to country. Current and future

legislation may significantly change the approval requirements in ways that could involve additional costs and cause delays in obtaining

approvals. Some countries require approval of the sale price of a drug before it can be reimbursed. In many countries, the pricing review

period begins after marketing or product licensing approval is granted. In some foreign markets, prescription drug pricing remains subject

to continuing governmental control, including possible price reductions, even after initial approval is granted. As a result, we might

obtain marketing approval for a product in a particular country, but then be subject to price regulations that delay our commercial launch

of the product, possibly for lengthy time periods, and negatively impact the revenues we are able to generate from the sale of the product

in that country. Adverse pricing limitations may hinder our ability to recoup our investment in one or more product candidates, even if

our product candidates obtain marketing approval. There can be no assurance that our product candidates, if they are approved for sale

in the United States or in other countries, will be considered medically necessary or cost-effective for a specific indication, or that

coverage or an adequate level of reimbursement will be available.

Our product candidates Quilience and Nolazol

contain the active ingredient mazindol, which is currently listed as a Schedule IV controlled substance under the Controlled Substances

Act of 1970, or CSA. Failure to maintain compliance with applicable requirements under the CSA or a change in the drug enforcement agency,

or the DEA, scheduling (e.g., from IV to III) post approval or other applicable federal or state regulations could have an adverse effect

on our operations and business.

Controlled substances are

classified by the DEA as Schedule I, II, III, IV or V, or CI, CII, CIII, CIV, and CV, substances, with CI substances considered to present

the highest risk of substance abuse and Schedule V substances the lowest risk. The active ingredient of our lead and follow-on product

candidates is mazindol, which is classified as a Schedule IV controlled substance under the CSA, and regulations of the DEA. Under the

CSA, subject to certain exemptions, every person who manufactures, distributes, dispenses, imports or exports any controlled substance

must register with the DEA.

Although the CSA’s restrictions

governing substances in CIV are not as stringent as those for substances in CI, CII or CIII, they could still limit our ability to market

and commercialize Quilience and Nolazol, if approved for marketing. In addition, failure to maintain compliance with applicable requirements

under the CSA, particularly as manifested in loss or diversion of regulated substances, can result in enforcement action that could include

civil penalties, refusal to renew registrations or quotas, revocation of registrations or quotas or criminal proceedings, any of which

could have a material adverse effect on our business, results of operations and financial condition. Individual states also regulate controlled

substances, and we along with our contract manufacturers will be subject to state regulation on distribution of these products.

Our market is subject to intense competition,

which may result in others commercializing products before or more successfully than us. If we are unable to compete effectively, Quilience

and/or Nolazol may be rendered non-competitive or obsolete, which may adversely affect our operating results.

The development and commercialization

of new products is highly competitive. Our potential competitors include major pharmaceutical companies, specialty pharmaceutical companies

and biotechnology companies worldwide with respect to Quilience and/or Nolazol or any future product candidate that we may seek to develop

or commercialize. Our competitors may succeed in developing, acquiring or licensing technologies and products that are more effective,

have fewer or more tolerable side effects or are more convenient or less costly than Quilience and/or Nolazol or any future product candidate

we may develop, which could render any product candidates obsolete and non-competitive. Our competitors also may obtain FDA or other marketing

approvals for their products before we are able to obtain approval for ours, which could result in competitors establishing a strong market

position before we are able to enter the applicable market.

Many of our potential competitors,

alone or with their strategic partners, have significantly greater financial resources and expertise in research and development, manufacturing,

pre-clinical testing, conducting clinical trials, obtaining marketing approvals and commercializing approved products than we do. There

is a trend toward consolidation in the pharmaceutical and biotechnology industry, and additional mergers and acquisitions in these industries

may result in even more resources being concentrated among a smaller number of our competitors, which may adversely affect us.

Smaller or early-stage companies

may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. These

companies also compete with us in recruiting and retaining qualified scientific and management personnel and establishing clinical trial

sites and patient registration for clinical trials.

In addition, if we enter the

markets of our product candidates, with such entrance remaining subject to various additional regulatory approvals, too late in the cycle,

we may not achieve commercial success, or we may have to reduce our price in order to effectively compete, which would impact our ability

to generate revenues, obtain profitability and adversely affect our operating results.

While orphan drug product candidates are

typically sold at a high price relative to other medications, the market may not be receptive to high pricing of our product candidates.

We are developing certain

product candidates to treat rare central nervous system, or CNS, disorders with high unmet medical needs, a space where medications are

usually sold at high prices compared with other medications. Accordingly, even if regulatory authorities approve our product candidates,

the market may not be receptive to, and it may be difficult for us to achieve, a per-patient per-year price high enough to allow us to

realize a return on our investment.

Unfavorable global economic conditions,

including as a result of the ongoing war between Russia and Ukraine as well as Israel’s multi-front war, could have a negative impact

on our operations, which could materially and adversely affect our business, financial condition, results of operations, prospects and

market price of our common shares.

Global economic instability

and unfavorable conditions could materially and adversely affect our business. The war between Russia and Ukraine is ongoing. The impact

to Ukraine as well as actions taken by other countries, including new and stricter sanctions imposed by Canada, the United Kingdom, the

European Union, the United States and other countries against officials, individuals, regions, and industries in Russia and Ukraine, and

actions taken by Russia in response to such sanctions, and responses of countries and political bodies to such sanctions, tensions, and

military actions and the potential for more widespread conflict, have resulted in supply chain disruptions, increases in inflation, financial

market volatility and capital markets disruption. In addition, the war between Israel and Hamas is ongoing and has opened additional fronts.

Any resulting instability and unfavorable economic conditions from the wars could disrupt our and our collaborators’ supply chains

and adversely affect our and our collaborators’ ability to conduct ongoing and future clinical trials of our product candidates.

The extent and duration of the wars, sanctions and resulting economic, market and other disruptions are impossible to predict, but could

be substantial. Any such disruptions may heighten the impact of the other risks described in this annual report.

If product liability lawsuits are brought

against us, we may incur substantial liabilities, even if we have appropriate insurance policies, and we may be required to limit commercialization

of our product candidates.

We are exposed to potential

product liability and professional indemnity risks that are inherent in the research, development, manufacturing, marketing and use of

pharmaceutical products. Currently, we have no products that have been approved for marketing or commercialization; however, the use of

our product candidates in clinical trials, and the sale of these product candidates, if approved, in the future, may expose us to liability

claims. Product liability claims may be brought against us or our partners by participants enrolled in our clinical trials, patients,

health care providers, pharmaceutical companies, our collaborators or others using, administering or selling any of our future approved

products. If we cannot successfully defend ourselves against any such claims, we may incur substantial liabilities, even if we have product

liability or such other applicable insurance policies in effect. We may not be able to maintain adequate levels of insurance for these

liabilities at reasonable cost and/or reasonable terms. Excessive insurance costs or uninsured claims would add to our future operating

expenses and adversely affect our financial condition. As a result of such lawsuits and their potential results, we may be required to

limit commercialization of our product candidates. Regardless of the merits or eventual outcome, liability claims may result in:

| |

● |

decreased demand for our product candidates; |

| |

|

|

| |

● |

termination of clinical trial sites or entire trial programs; |

| |

|

|

| |

● |

injury to our reputation and negative media attention; |

| |

● |

product recalls or increased warnings on product labels; |

| |

● |

withdrawal of clinical trial participants; |

| |

● |

costs of to defend the related litigation; |

| |

● |

diversion of management and our resources; |

| |

|

|

| |

● |

substantial monetary awards to, or costly settlements with, clinical trial participants, patients or other claimants; |

| |

|

|

| |

● |

higher insurance premiums; |

| |

|

|

| |

● |

loss of initiation of investigations by regulators or other authorities; and |

| |

|

|

| |

● |

the inability to successfully commercialize our product candidates, if approved. |

Risks Related to the Regulatory Environment

Obtaining approval of an NDA or a MAA even

after clinical trials that are believed to be successful is an uncertain process.

We are not permitted to market

Quilience and/or Nolazol in the United States or the EU until we receive regulatory approval of an NDA from the FDA or MAA from the EMA,

or in any foreign countries until we receive the requisite approval from regulatory authorities in such countries. We have not received

regulatory clearance to conduct the additional clinical trials that are necessary to be able to submit an NDA to the FDA for Nolazol.

Similarly, we have not received regulatory clearance in the EU to conduct clinical trials that are necessary to receive approval of a

MAA for Quilience in Europe. As such, we have not submitted an MAA for any of our product candidates.

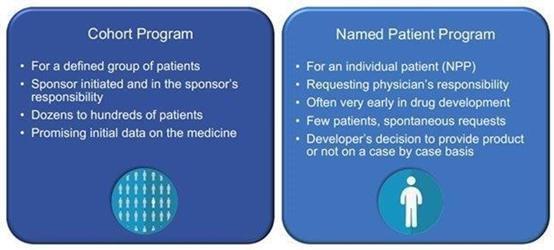

We may be able make our products

available on a named patient basis and generate pre-approval revenues from compassionate use activities leveraging on an expanded access

policy in certain countries around the world.

Even if we complete our planned

clinical trials and believe the results to be successful, all of which are uncertain, obtaining regulatory approval is an extensive, lengthy,

expensive and uncertain process, and the FDA and EMA, and other regulatory authorities may delay, limit or deny approval of Quilience

and/or Nolazol for many reasons, including, but not limited to:

| |

● |

we may not be able to demonstrate to their satisfaction that the product candidate is a safe or effective treatment for a given indication; |

| |

|

|

| |

● |

the results of clinical trials may not meet the level of statistical significance or clinical significance required by the regulatory agencies; |

| |

● |

disagreements regarding the number, design, size, conduct or implementation of our clinical trials, or with our interpretation of data from pre-clinical studies or clinical trials; |

| |

|

|

| |

● |

a lack of acceptance of the accuracy or sufficiency of the data generated at our clinical trial sites to demonstrate, among others, that clinical and other benefits outweigh its safety risks or to support the submission of an NDA or MAA; |

| |

|

|

| |

● |

difficulties scheduling an advisory committee meeting in a timely manner or the advisory committee, or such other similar committee, may recommend against approval of our application or may recommend that such regulators require, as a condition of approval, additional pre-clinical studies or clinical trials, limitations on approved labeling, or distribution and use restrictions; |

| |

● |

the requirement that we develop a Risk Evaluation and Mitigation Strategy, or REMS, as a condition of approval, which may or may not be feasible for us; |

| |

● |

the identification of deficiencies in the manufacturing processes or facilities of third-party manufacturers with which we enter into agreements for clinical and commercial supplies; |

| |

|

|

| |

● |

changes in approval policies or the adoption of new regulations by such regulators; and |

| |

|

|

| |

● |

we may be unable to be granted a PIP deferral which we intend to request from the EMA for delayed clinical trials and subsequent approval in children; this may delay our clinical trial program or approvals for adults, or we may have successful clinical trial results for adults but not children (if we were required to conduct pediatric studies prior to the receipt of an NDA or MAA for use of our product candidates in adults), or vice versa. |

Before we can submit an NDA

to the FDA, we must conduct pivotal trials, in addition to human pharmacokinetic and bioavailability studies, that will be substantially

broader than our Phase 2 trial for Nolazol and or Quilience. An NDA must be supported by extensive clinical and pre-clinical data, as

well as extensive information regarding chemistry, manufacturing and controls to demonstrate the safety and effectiveness of the applicable

product candidate. The number and types of pre-clinical studies and clinical trials that will be required varies depending on the product

candidate, the disease or condition that the product candidate is designed to target and the regulations applicable to any particular

product candidate. Obtaining approval of an NDA is a lengthy, expensive and uncertain process, and we may not be successful in obtaining

approval. The FDA review processes can take years to complete and approval is never guaranteed.

In this respect, we will also

need to agree on a protocol with the FDA for the pivotal trials before commencing those trials. Pivotal trials frequently produce unsatisfactory

results even though prior clinical trials were successful. Therefore, the results of the additional trials that we conduct may or may

not be successful. The FDA may suspend all clinical trials or require that we conduct additional clinical, nonclinical, manufacturing

validation or drug product quality studies and submit those data before it will consider or reconsider the NDA. Depending on the extent

of these or any other studies, approval of any applications that we submit may be delayed by several years, or may require us to expend

more resources than we have available. It is also possible that additional studies, if performed and completed, may not be considered

sufficient by the FDA to approve the NDA. If any of these outcomes occur, we would not receive approval for Quilience or Nolazol at such

time, if any, when we seek FDA approval. We may face similar risks with respect to obtaining regulatory approval from the EMA for Quilience,

and for Nolazol, at such time, if any, when we seek EMA approval. The risks that we face in obtaining applicable approvals from the FDA

and EMA for Quilience and/or Nolazol or any other product candidate that we may seek to develop, may also exist with other regulatory

authorities, such as those in Latin America.

Even if we obtain FDA, EMA

or other regulatory approval for Quilience and/or Nolazol, the approval might contain significant limitations related to use restrictions

for certain age groups, warnings, precautions or contraindications, or may be subject to significant post-marketing studies or risk mitigation

requirements. In addition, even if we obtain an MAA from the EMA for the use of Quilience in adults, there can be no guarantee that we

will receive an MAA for Quilience for the use in children. If we are unable to successfully commercialize Quilience and/or Nolazol we

may be forced to cease operations.

The results of clinical trials conducted

at clinical sites outside the United States may not be accepted by the FDA and the results of clinical trials conducted at clinical sites

in the United States may not be accepted by international regulatory authorities.

We are conducting our

Phase 2 clinical trials in the United States. In future, we are planning to conduct Phase 2b and or Phase 3 clinical trials in the

United States and the EU. Although the FDA may accept data from clinical trials conducted outside the United States, acceptance of

this data is subject to certain conditions imposed by the FDA. For example, the clinical trial must be well-designed and conducted

and performed by qualified investigators in accordance with ethical principles such as IRB or ethics committee approval and informed

consent. The study population must also adequately represent the U.S. population, and the data must be applicable to the U.S.

population and U.S. medical practice in ways that the FDA deems clinically meaningful. Generally, the subject population for any

clinical trials conducted outside of the United States must be representative of the U.S. population. In addition, while these

clinical trials are subject to the applicable local laws, FDA acceptance of the data will be dependent upon its determination that

the trials were conducted consistent with all applicable U.S. laws and regulations. There can be no assurance the FDA or

international regulatory authorities will accept data from trials conducted outside of the United States or inside the United

States, as the case may be, as adequate support of a marketing application. If the FDA or international regulatory authorities do

not accept the data from sites in our globally conducted clinical trials, it would likely result in the need for additional trials,

which would be costly and time-consuming and could delay or permanently halt the development of one or more of our product

candidates.

Our product candidates may cause undesirable

side effects or have other properties that could delay or prevent their regulatory approval, limit the commercial potential or result

in significant negative consequences following regulatory approval, if obtained.

During the conduct of clinical

trials, patients may experience changes in their health, including illnesses, injuries, discomforts or a fatal outcome. It is possible

that as we develop Quilience and Nolazol, or other product candidates that we may seek to develop, in larger, longer and more extensive

clinical trials as use of our product candidates becomes more widespread if they receive regulatory approval, illnesses, injuries, discomforts

and other adverse events that were observed in earlier clinical trials, as well as conditions that did not occur or went undetected in

previous clinical trials, will be reported by subjects. Many times, side effects are only detectable after investigational products are

tested in larger scale, Phase 2b/Phase 3 clinical trials or, in some cases, after they are made available to patients on a commercial

scale after approval. If additional clinical experience indicates that Quilience and/or Nolazol, or other product candidates that we may

seek to develop, have side effects or cause serious or life-threatening side effects, the development of the product candidate may fail

or be delayed, or, if the product candidate has received regulatory approval, such approval may be revoked or limited.

Additionally, if any of our

product candidates receives marketing approval, the FDA or EMA could require us to adopt a REMS to ensure that the benefits outweigh its

risks, which may include, among other things, a medication guide outlining the risks of the product for distribution to patients, a communication

plan to health care practitioners, and restrictions on how or where the product can be distributed, dispensed or used. Furthermore, if

we or others later identify undesirable side effects caused by Quilience and/or Nolazol, several potentially significant negative consequences

could result, including:

| |

● |

regulatory authorities may suspend or withdraw approvals of such a product candidate; |

| |

● |

regulatory authorities may require additional warnings on the label; |

| |

● |

regulatory authorities may issue negative publicity regarding the affected product, including safety communications; |

| |

● |

we may be required to change the way the product is distributed, dispensed or administered, or conduct additional pre-clinical studies or clinical trials; |

| |

|

|

| |

● |

we may need to voluntarily recall our products; and |

| |

● |

we could be sued and held liable for harm caused to patients. |

Any of these events could

prevent us from achieving or maintaining market acceptance of the affected product candidate and could significantly harm our business,

prospects, financial condition and results of operations.

We will need to obtain FDA approval of any

proposed names for our product candidates that gain marketing approval, and any failure or delay associated with such naming approval

may adversely impact our business.

Any name we intend to

use for our product candidates will require approval from the FDA regardless of whether we have secured a formal trademark

registration from the U.S. Patent and Trademark Office, or the U.S. PTO. The FDA typically conducts a review of proposed product

names, including an evaluation of whether proposed names may be confused with the names of other drug products. The FDA may object

to any product name we submit if it believes the name inappropriately implies medical claims. If the FDA objects to any of our

proposed product names, we may be required to adopt an alternative name for our product candidates, which could result in further

evaluation of proposed names with the potential for additional delays and costs.

Obtaining regulatory approval for clinical

trials of Nolazol in children will be more difficult than obtaining such approvals for adult clinical trials since the requirements for

regulatory approval to conduct pediatric clinical trials are more stringent.

Pediatric drug development

requires additional nonclinical work (such as animal studies in juvenile animals and additional reproductive toxicity work), as well as

staged clinical work in determining safe dosing and monitoring. These additional tasks involve investment of significant additional resources

beyond those needed for approval of the drug for adults. Approval of Nolazol for use in children may be significantly delayed due to these

additional requirements and this may have an adverse effect on the commercial prospects for Nolazol and our ability to generate product

revenues would be delayed, possibly materially. We cannot guarantee that we will receive any regulatory approvals to commercialize our

product candidates in children.

Changes in regulatory requirements and guidance

or unanticipated events during our clinical trials may occur, which may result in necessary changes to clinical trial protocols, which

could result in increased costs to us, delay our development timeline or reduce the likelihood of successful completion of our clinical

trials.

Changes in regulatory requirements

and guidance or unanticipated events during our clinical trials may occur, as a result of which we may need to amend clinical trial protocols.

Amendments may require us to resubmit our clinical trial protocols to IRBs for review and approval, which may impact the cost, timing

or successful completion of a clinical trial. If we experience delays in completion of, or if we terminate, any of our clinical trials,

the commercial prospects for Quilience and Nolazol would be harmed and our ability to generate product revenues would be delayed, possibly

materially.

Our development and regulatory strategy

for our product candidates depends in part on published scientific literature and the FDA’s prior findings regarding the safety

and efficacy of approved products containing mazindol. If the FDA does not conclude that our product candidates satisfy the requirements

for the Section 505(b)(2) regulatory approval pathway, or if the requirements for our product candidates under Section 505(b)(2) are not

as we expect, the approval pathway would likely take significantly longer, cost significantly more and entail significantly greater complications

and risks than anticipated and in either case may not be successful.

The Drug Price Competition

and Patent Term Restoration Act of 1984, also known as the Hatch-Waxman Amendments, added Section 505(b)(2) to the Federal Food, Drug,

and Cosmetic Act, or FDCA, or Section 505(b)(2). Section 505(b)(2) permits the submission of an NDA where at least some of the information

required for approval comes from studies not conducted by or for the applicant and for which the applicant has not obtained a right of

reference. We intend to seek FDA approval through the Section 505(b)(2) regulatory pathway for Quilience and may seek this regulatory

pathway for other product candidates that we seek to develop.

If the FDA does not

allow us to pursue the Section 505(b)(2) regulatory pathway as anticipated, we may need to conduct additional pre-clinical and or

clinical trials, provide additional data and information and meet additional standards for regulatory approval. If this were to

occur, the time and financial resources required to obtain FDA approval, and complications and risks associated with FDA approval,

would substantially increase. We may need to obtain additional funding, which could result in significant dilution to the ownership

interests of our then existing shareholders to the extent we issue equity securities or convertible debt. We cannot assure you that

we would be able to obtain such additional financing on terms acceptable to us, if at all. Moreover, inability to pursue the Section

505(b)(2) regulatory pathway could result in new competitive product candidates reaching the market faster than our product

candidates, which could materially adversely impact our competitive position and prospects. Even if we are allowed to pursue the

Section 505(b)(2) regulatory pathway, we cannot assure you that our product candidates will receive the requisite approvals for

commercialization.

We may seek designations for our product

candidates with the FDA and other comparable regulatory authorities that are intended to confer benefits such as a faster development

process or an accelerated regulatory pathway, but there can be no assurance that we will successfully obtain such designations. In addition,

even if one or more of our product candidates are granted such designations, we may not be able to realize the intended benefits of such

designations.

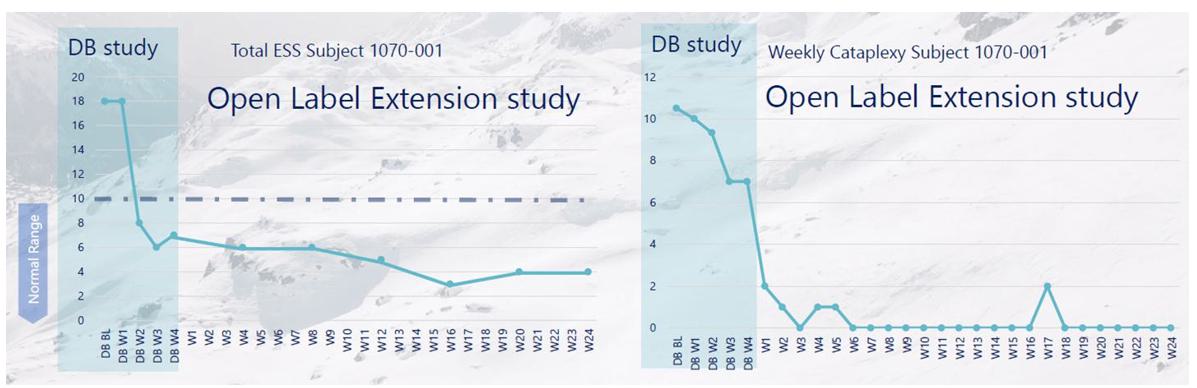

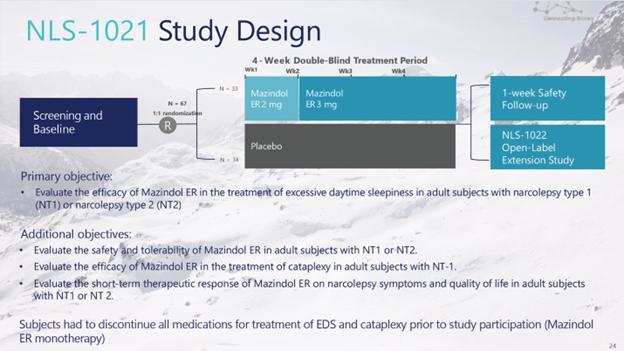

The FDA, and other comparable