falseJune 30, 2025Q20001612042--12-310001612042asnd:PerformanceStockUnitsMemberasnd:TwoThousandAndTwentySevenMember2025-01-012025-06-300001612042ifrs-full:IssuedCapitalMember2025-06-300001612042ifrs-full:AtFairValueMember2025-06-300001612042ifrs-full:TreasurySharesMember2025-01-012025-06-300001612042ifrs-full:TopOfRangeMemberasnd:RoyaltyPharmaUnitedStatesYorvipathMember2024-09-032024-09-030001612042ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember2024-06-300001612042ifrs-full:FinancialLiabilitiesAtAmortisedCostMember2025-06-300001612042ifrs-full:Level3OfFairValueHierarchyMember2024-01-012024-06-300001612042ifrs-full:TreasurySharesMember2024-06-300001612042asnd:RestOfWorldMember2025-01-012025-06-300001612042ifrs-full:AtFairValueMember2024-12-310001612042asnd:ForeignCurrencyConversionOptionMember2025-01-012025-06-300001612042ifrs-full:LaterThanOneYearAndNotLaterThanFiveYearsMember2025-06-300001612042asnd:RestrictedStockUnitsMember2024-12-3100016120422024-12-310001612042asnd:ProfitLossMember2024-04-012024-06-300001612042ifrs-full:AtFairValueMemberifrs-full:Level3OfFairValueHierarchyMember2025-06-300001612042asnd:UnitedStatesSkytrofaMember2024-04-012024-06-300001612042asnd:FairValueHierarchyCarryingAmountMember2025-06-300001612042asnd:Warrant1Member2024-12-310001612042ifrs-full:OrdinarySharesMember2025-01-012025-06-300001612042ifrs-full:IssuedCapitalMember2024-06-300001612042ifrs-full:IssuedCapitalMember2024-12-310001612042asnd:VisenPharmaceuticalsMember2025-06-300001612042ifrs-full:TopOfRangeMemberasnd:PerformanceStockUnitProgramMember2025-06-300001612042ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember2024-12-310001612042country:DK2024-04-012024-06-300001612042asnd:ConvertibleSeniorNotesMember2022-03-3100016120422025-04-012025-06-300001612042asnd:AmericanDepositorySharesMemberasnd:ShareRepurchaseProgramMember2025-02-122025-02-120001612042ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember2025-06-300001612042asnd:UnitedStatesYorvipathMember2024-04-012024-06-300001612042ifrs-full:IssuedCapitalMember2023-12-310001612042asnd:FairValueHierarchyCarryingAmountMemberifrs-full:Level3OfFairValueHierarchyMember2024-12-310001612042ifrs-full:OrdinarySharesMember2025-06-300001612042ifrs-full:FinancialAssetsAtAmortisedCostMember2025-06-300001612042srt:EuropeMember2025-04-012025-06-300001612042ifrs-full:IssuedCapitalMember2024-01-012024-06-300001612042asnd:ConvertibleSeniorNotesMember2025-01-012025-06-300001612042ifrs-full:LaterThanThreeYearsAndNotLaterThanFiveYearsMember2025-06-3000016120422025-06-300001612042ifrs-full:IssuedCapitalMember2025-01-012025-06-300001612042ifrs-full:Level3OfFairValueHierarchyMember2023-12-310001612042asnd:RestrictedStockUnitsMember2025-01-012025-06-300001612042ifrs-full:SharePremiumMember2025-06-300001612042ifrs-full:BottomOfRangeMemberasnd:RoyaltyPharmaUnitedStatesYorvipathMember2024-09-032024-09-030001612042asnd:RestrictedStockUnitsMemberasnd:TwoThousandAndTwentySixMember2025-01-012025-06-300001612042ifrs-full:Level3OfFairValueHierarchyMember2025-01-012025-06-300001612042ifrs-full:TopOfRangeMemberasnd:Warrant1Member2025-06-300001612042ifrs-full:OrdinarySharesMember2024-01-012024-06-300001612042ifrs-full:FinancialLiabilitiesAtFairValueMemberifrs-full:FinancialLiabilitiesAtAmortisedCostMember2025-06-300001612042ifrs-full:TreasurySharesMember2025-06-300001612042srt:EuropeMember2024-04-012024-06-300001612042ifrs-full:FinancialAssetsAtAmortisedCostMember2024-12-310001612042srt:NorthAmericaMember2024-04-012024-06-300001612042asnd:AmericanDepositorySharesMember2025-06-300001612042asnd:UnitedStatesSkytrofaMember2025-04-012025-06-300001612042asnd:VisenPharmaceuticalsMember2025-01-012025-06-300001612042asnd:ConvertibleSeniorNotesMemberifrs-full:FixedInterestRateMember2022-03-310001612042asnd:UnitedStatesYorvipathMember2025-01-012025-06-3000016120422024-04-012024-06-300001612042ifrs-full:RetainedEarningsMember2023-12-310001612042ifrs-full:TreasurySharesMember2024-12-310001612042ifrs-full:BottomOfRangeMemberasnd:Warrant1Member2025-06-300001612042asnd:TwoThousandAndTwentySixMemberasnd:RestrictedStockUnitsAndPerformanceStockUnitMember2025-01-012025-06-300001612042asnd:ProfitLossMember2025-01-012025-06-300001612042asnd:EventsAfterReportingPeriodMember2025-07-310001612042asnd:RestOfWorldMember2024-01-012024-06-300001612042ifrs-full:RetainedEarningsMember2025-01-012025-06-300001612042asnd:RestrictedStockUnitsAndPerformanceStockUnitMember2025-01-012025-06-300001612042asnd:ProfitLossMember2025-04-012025-06-300001612042asnd:PerformanceStockUnitsMemberasnd:TwoThousandAndTwentySixMember2025-01-012025-06-3000016120422023-12-310001612042asnd:RestrictedStockUnitsAndPerformanceStockUnitMember2025-06-300001612042ifrs-full:RetainedEarningsMember2024-01-012024-06-300001612042ifrs-full:NotLaterThanOneYearMember2025-06-300001612042asnd:FairValueHierarchyCarryingAmountMemberifrs-full:Level3OfFairValueHierarchyMember2025-06-300001612042ifrs-full:PreviouslyStatedMember2024-04-012024-06-300001612042asnd:RestOfWorldMember2025-04-012025-06-300001612042asnd:RestrictedStockUnitsMemberasnd:TwoThousandAndTwentyEightMember2025-01-012025-06-300001612042asnd:ConvertibleSeniorNotesMember2025-06-300001612042asnd:TwoThousandAndTwentyEightMemberasnd:RestrictedStockUnitsAndPerformanceStockUnitMember2025-01-012025-06-300001612042asnd:PerformanceStockUnitsMemberasnd:TwoThousandAndTwentyEightMember2025-01-012025-06-300001612042asnd:ConvertibleSeniorNotesMember2022-03-012022-03-310001612042asnd:ConvertibleSeniorNotesMemberifrs-full:FixedInterestRateMember2025-06-300001612042ifrs-full:SharePremiumMember2024-01-012024-06-300001612042asnd:ConvertibleSeniorNotesMember2024-01-012024-06-300001612042ifrs-full:FinancialLiabilitiesAtFairValueMemberifrs-full:FinancialLiabilitiesAtAmortisedCostMember2024-12-310001612042ifrs-full:TreasurySharesMember2024-01-012024-06-300001612042country:DK2025-04-012025-06-300001612042ifrs-full:RetainedEarningsMember2025-06-300001612042asnd:UnitedStatesSkytrofaMember2025-01-012025-06-300001612042ifrs-full:SharePremiumMember2025-01-012025-06-300001612042ifrs-full:RetainedEarningsMember2024-06-300001612042srt:EuropeMember2025-01-012025-06-300001612042srt:NorthAmericaMember2025-01-012025-06-300001612042asnd:Warrant1Member2025-01-012025-06-3000016120422025-01-012025-06-300001612042ifrs-full:TopOfRangeMemberasnd:RoyaltyPharmaUnitedStatesSkytrofaMember2023-09-012023-09-300001612042ifrs-full:Level3OfFairValueHierarchyMember2024-06-300001612042srt:NorthAmericaMember2025-04-012025-06-300001612042asnd:RestrictedStockUnitsMember2025-06-300001612042ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember2024-01-012024-06-300001612042asnd:PerformanceStockUnitsMember2025-06-300001612042ifrs-full:DerivativesMemberifrs-full:HistoricalVolatilityForSharesMeasurementInputMember2025-06-300001612042asnd:RestrictedStockUnitsAndPerformanceStockUnitMember2024-12-310001612042ifrs-full:DerivativesMemberasnd:SharePriceMeasurementInputMember2025-01-012025-06-300001612042country:DK2024-01-012024-06-300001612042asnd:Warrant1Member2025-06-300001612042asnd:RoyaltyPharmaUnitedStatesSkytrofaMember2023-09-012023-09-300001612042ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember2025-01-012025-06-300001612042asnd:RestrictedStockUnitsMemberasnd:TwoThousandAndTwentySevenMember2025-01-012025-06-300001612042ifrs-full:SharePremiumMember2023-12-310001612042asnd:PerformanceStockUnitsMember2024-12-310001612042ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember2023-12-310001612042asnd:TwoThousandAndTwentySevenMemberasnd:RestrictedStockUnitsAndPerformanceStockUnitMember2025-01-012025-06-300001612042asnd:UnitedStatesYorvipathMember2024-01-012024-06-3000016120422024-01-012024-06-300001612042asnd:UnitedStatesYorvipathMember2025-04-012025-06-300001612042ifrs-full:SharePremiumMember2024-06-300001612042asnd:PerformanceStockUnitsMember2025-01-012025-06-300001612042ifrs-full:BottomOfRangeMemberasnd:RoyaltyPharmaUnitedStatesSkytrofaMember2023-09-012023-09-300001612042ifrs-full:RetainedEarningsMember2024-12-310001612042ifrs-full:TreasurySharesMember2023-12-310001612042asnd:UnitedStatesSkytrofaMember2024-01-012024-06-300001612042ifrs-full:DerivativesMemberasnd:SharePriceMeasurementInputMember2025-06-300001612042ifrs-full:FinancialLiabilitiesAtAmortisedCostMember2024-12-3100016120422024-06-300001612042asnd:ConvertibleSeniorNotesMemberasnd:AmericanDepositorySharesMember2025-06-300001612042asnd:CollaborationsAndLicenseAgreementsMemberasnd:RoyaltiesAndMilestonesMember2025-01-012025-06-300001612042asnd:CollaborationsAndLicenseAgreementsMemberasnd:RoyaltiesAndMilestonesMember2025-04-012025-06-300001612042ifrs-full:AtFairValueMemberifrs-full:Level3OfFairValueHierarchyMember2024-12-310001612042asnd:VisenPharmaceuticalsMember2025-03-212025-03-210001612042asnd:PerformanceStockUnitProgramMember2025-01-012025-06-300001612042ifrs-full:Level3OfFairValueHierarchyMember2025-06-300001612042asnd:ProfitLossMember2024-01-012024-06-300001612042srt:EuropeMember2024-01-012024-06-300001612042ifrs-full:SharePremiumMember2024-12-310001612042asnd:FairValueHierarchyCarryingAmountMember2024-12-310001612042country:DK2025-01-012025-06-300001612042srt:NorthAmericaMember2024-01-012024-06-300001612042asnd:AmericanDepositorySharesMemberasnd:ShareRepurchaseProgramMember2025-06-300001612042asnd:ConvertibleSeniorNotesMember2025-01-012025-06-300001612042asnd:RestOfWorldMember2024-04-012024-06-300001612042asnd:RoyaltyPharmaUnitedStatesYorvipathMember2024-09-032024-09-030001612042asnd:RoyaltyPharmaUnitedStatesYorvipathMember2024-09-012024-09-300001612042ifrs-full:Level3OfFairValueHierarchyMember2024-12-31iso4217:EURxbrli:purexbrli:sharesiso4217:DKKxbrli:sharesasnd:Multipleasnd:Daysasnd:Segmentiso4217:XBBiso4217:EURxbrli:sharesiso4217:USDiso4217:HKDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO SECTION 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August, 2025

Commission File Number: 001-36815

Ascendis Pharma A/S

(Exact Name of Registrant as Specified in Its Charter)

Tuborg Boulevard 12

DK-2900 Hellerup

Denmark

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

INCORPORATION BY REFERENCE

This report on Form 6-K shall be deemed to be incorporated by reference into the registration statements on Form S-8 (Registration Numbers 333-228576, 333-203040, 333-210810, 333-211512, 333-213412, 333-214843, 333-216883, 333-254101, 333-261550, 333-270088, 333-277519, 333-281916, and 333-285322) and Form F-3 (Registration Numbers 333-209336 and 333-282196) of Ascendis Pharma A/S (the “Company”) (including any prospectuses forming a part of such registration statements) and to be a part thereof from the date on which this report is filed, to the extent not superseded by documents or reports subsequently filed or furnished.

Information Contained in this Report on Form 6-K

Financial Statements

This report contains the Company’s Unaudited Condensed Consolidated Interim Financial Statements as of and for the period ended June 30, 2025, including Management’s Discussion and Analysis of Financial Condition and Results of Operations for the period presented therein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

Ascendis Pharma A/S |

|

|

|

|

Date: August 7, 2025 |

|

By: |

/s/ Michael Wolff Jensen |

|

|

|

Michael Wolff Jensen |

|

|

|

Executive Vice President, Chief Legal Officer |

ASCENDIS PHARMA A/S

INDEX TO UNAUDITED CONDENSED CONSOLIDATED INTERIM FINANCIAL STATEMENTS

Unaudited Condensed Consolidated Interim Statements of Profit or (Loss)

and Other Comprehensive Income or (Loss) for the Three and Six Months Ended June 30, 2025 and 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

(EUR’000, except per share data) |

|

Notes |

|

2025 |

|

|

2024 |

|

|

2025 |

|

|

2024 |

|

Consolidated Statement of Profit or (Loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

5 |

|

|

158,045 |

|

|

|

35,998 |

|

|

|

258,998 |

|

|

|

131,892 |

|

Cost of sales |

|

|

|

|

31,447 |

|

|

|

11,465 |

|

|

|

48,963 |

|

|

|

19,034 |

|

Gross profit |

|

|

|

|

126,598 |

|

|

|

24,533 |

|

|

|

210,035 |

|

|

|

112,858 |

|

Research and development expenses |

|

|

|

|

71,988 |

|

|

|

83,478 |

|

|

|

158,591 |

|

|

|

154,165 |

|

Selling, general, and administrative expenses |

|

|

|

|

107,561 |

|

|

|

74,312 |

|

|

|

208,608 |

|

|

|

141,095 |

|

Operating profit/(loss) |

|

|

|

|

(52,951 |

) |

|

|

(133,257 |

) |

|

|

(157,164 |

) |

|

|

(182,402 |

) |

Share of profit/(loss) of associates |

|

4 |

|

|

(4,097 |

) |

|

|

(5,322 |

) |

|

|

22,482 |

|

|

|

(11,118 |

) |

Finance income |

|

|

|

|

55,059 |

|

|

|

49,052 |

|

|

|

83,912 |

|

|

|

14,395 |

|

Finance expenses |

|

|

|

|

33,018 |

|

|

|

19,624 |

|

|

|

77,803 |

|

|

|

58,553 |

|

Profit/(loss) before tax |

|

|

|

|

(35,007 |

) |

|

|

(109,151 |

) |

|

|

(128,573 |

) |

|

|

(237,678 |

) |

Income taxes (expenses) |

|

|

|

|

(3,848 |

) |

|

|

(229 |

) |

|

|

(4,909 |

) |

|

|

(2,737 |

) |

Net profit/(loss) for the period |

|

|

|

|

(38,855 |

) |

|

|

(109,380 |

) |

|

|

(133,482 |

) |

|

|

(240,415 |

) |

Attributable to owners of the Company |

|

|

|

|

(38,855 |

) |

|

|

(109,380 |

) |

|

|

(133,482 |

) |

|

|

(240,415 |

) |

Basic earnings/(loss) per share |

|

6 |

|

€ |

(0.64 |

) |

|

€ |

(1.91 |

) |

|

€ |

(2.22 |

) |

|

€ |

(4.21 |

) |

Diluted earnings/(loss) per share (1) |

|

6 |

|

€ |

(0.82 |

) |

|

€ |

(2.21 |

) |

|

€ |

(2.22 |

) |

|

€ |

(4.21 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Statement of Comprehensive Income or (Loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net profit/(loss) for the period |

|

|

|

|

(38,855 |

) |

|

|

(109,380 |

) |

|

|

(133,482 |

) |

|

|

(240,415 |

) |

Other comprehensive income/(loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Items that may be reclassified subsequently to profit or (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exchange differences on translating foreign operations |

|

|

|

|

(1,399 |

) |

|

|

15 |

|

|

|

(1,474 |

) |

|

|

78 |

|

Other comprehensive income/(loss) for the period, net of tax |

|

|

|

|

(1,399 |

) |

|

|

15 |

|

|

|

(1,474 |

) |

|

|

78 |

|

Total comprehensive income/(loss) for the period, net of tax |

|

|

|

|

(40,254 |

) |

|

|

(109,365 |

) |

|

|

(134,956 |

) |

|

|

(240,337 |

) |

Attributable to owners of the Company |

|

|

|

|

(40,254 |

) |

|

|

(109,365 |

) |

|

|

(134,956 |

) |

|

|

(240,337 |

) |

(1)Dilutive earnings per share for the three months ended June 30, 2024 has been restated. Refer to Note 6, “Earnings Per Share” for further information.

Unaudited Condensed Consolidated Interim Statements of Financial Position as of June 30, 2025 and December 31, 2024

|

|

|

|

|

|

|

|

|

|

|

(EUR’000) |

|

Notes |

|

June 30,

2025 |

|

|

December 31,

2024 |

|

Assets |

|

|

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

|

|

|

Intangible assets |

|

|

|

|

3,790 |

|

|

|

4,028 |

|

Property, plant and equipment |

|

4 |

|

|

93,542 |

|

|

|

98,714 |

|

Investments in associates |

|

4 |

|

|

34,902 |

|

|

|

13,575 |

|

Other receivables |

|

11 |

|

|

2,711 |

|

|

|

2,317 |

|

|

|

|

|

|

134,945 |

|

|

|

118,634 |

|

Current assets |

|

|

|

|

|

|

|

|

Inventories |

|

|

|

|

303,381 |

|

|

|

295,609 |

|

Trade receivables |

|

11 |

|

|

110,452 |

|

|

|

166,280 |

|

Income tax receivables |

|

|

|

|

2,738 |

|

|

|

1,775 |

|

Other receivables |

|

11 |

|

|

8,029 |

|

|

|

9,385 |

|

Prepayments |

|

|

|

|

34,311 |

|

|

|

28,269 |

|

Cash and cash equivalents |

|

11 |

|

|

494,046 |

|

|

|

559,543 |

|

|

|

|

|

|

952,957 |

|

|

|

1,060,861 |

|

Total assets |

|

|

|

|

1,087,902 |

|

|

|

1,179,495 |

|

|

|

|

|

|

|

|

|

|

Equity and liabilities |

|

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

|

|

Share capital |

|

9 |

|

|

8,211 |

|

|

|

8,149 |

|

Distributable equity |

|

|

|

|

(195,783 |

) |

|

|

(113,855 |

) |

Total equity |

|

4 |

|

|

(187,572 |

) |

|

|

(105,706 |

) |

|

|

|

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

|

|

|

|

Borrowings |

|

11 |

|

|

330,186 |

|

|

|

365,080 |

|

Contract liabilities |

|

|

|

|

692 |

|

|

|

5,000 |

|

Deferred tax liabilities |

|

|

|

|

9,596 |

|

|

|

7,258 |

|

|

|

|

|

|

340,474 |

|

|

|

377,338 |

|

Current liabilities |

|

|

|

|

|

|

|

|

Convertible notes, matures in April 2028 |

|

|

|

|

|

|

|

|

Borrowings |

|

11 |

|

|

418,073 |

|

|

|

458,207 |

|

Derivative liabilities |

|

11 |

|

|

186,579 |

|

|

|

150,670 |

|

|

|

|

|

|

604,652 |

|

|

|

608,877 |

|

Other current liabilities |

|

|

|

|

|

|

|

|

Borrowings |

|

11 |

|

|

44,275 |

|

|

|

33,329 |

|

Contract liabilities |

|

|

|

|

1,789 |

|

|

|

936 |

|

Trade payables and accrued expenses |

|

11 |

|

|

93,718 |

|

|

|

96,394 |

|

Other liabilities |

|

11 |

|

|

39,924 |

|

|

|

67,956 |

|

Income tax payables |

|

|

|

|

711 |

|

|

|

1,222 |

|

Provisions |

|

|

|

|

149,931 |

|

|

|

99,149 |

|

|

|

|

|

|

330,348 |

|

|

|

298,986 |

|

|

|

|

|

|

935,000 |

|

|

|

907,863 |

|

Total liabilities |

|

|

|

|

1,275,474 |

|

|

|

1,285,201 |

|

Total equity and liabilities |

|

|

|

|

1,087,902 |

|

|

|

1,179,495 |

|

Unaudited Condensed Consolidated Interim Statements of Changes in Equity as of June 30, 2025 and 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distributable Equity |

|

|

|

|

(EUR’000) |

|

Share

Capital |

|

|

Share

Premium |

|

|

Treasury

Shares |

|

|

Foreign

Currency

Translation

Reserve |

|

|

Accumulated

Deficit |

|

|

Total |

|

Equity as of January 1, 2025 |

|

|

8,149 |

|

|

|

2,444,175 |

|

|

|

(113 |

) |

|

|

1,783 |

|

|

|

(2,559,700 |

) |

|

|

(105,706 |

) |

Net profit/(loss) for the period |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(133,482 |

) |

|

|

(133,482 |

) |

Other comprehensive income/(loss), net of tax |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,474 |

) |

|

|

— |

|

|

|

(1,474 |

) |

Total comprehensive income/(loss) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,474 |

) |

|

|

(133,482 |

) |

|

|

(134,956 |

) |

Transactions with Owners |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-based payment (Note 8) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

55,580 |

|

|

|

55,580 |

|

Acquisition of treasury shares (Note 10) |

|

|

— |

|

|

|

— |

|

|

|

(16 |

) |

|

|

— |

|

|

|

(17,380 |

) |

|

|

(17,396 |

) |

Transfer under stock incentive programs (Note 10) |

|

|

— |

|

|

|

— |

|

|

|

49 |

|

|

|

— |

|

|

|

(49 |

) |

|

|

— |

|

Net settlement under stock incentive programs |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(11,396 |

) |

|

|

(11,396 |

) |

Capital increase (Note 9) |

|

|

62 |

|

|

|

26,240 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

26,302 |

|

Equity as of June 30, 2025 |

|

|

8,211 |

|

|

|

2,470,415 |

|

|

|

(80 |

) |

|

|

309 |

|

|

|

(2,666,427 |

) |

|

|

(187,572 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distributable Equity |

|

|

|

|

(EUR’000) |

|

Share

Capital |

|

|

Share

Premium |

|

|

Treasury

Shares |

|

|

Foreign

Currency

Translation

Reserve |

|

|

Accumulated

Deficit |

|

|

Total |

|

Equity as of January 1, 2024 |

|

|

7,749 |

|

|

|

2,123,074 |

|

|

|

(146 |

) |

|

|

721 |

|

|

|

(2,277,095 |

) |

|

|

(145,697 |

) |

Net profit/(loss) for the period |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(240,415 |

) |

|

|

(240,415 |

) |

Other comprehensive income/(loss), net of tax |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

78 |

|

|

|

— |

|

|

|

78 |

|

Total comprehensive income/(loss) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

78 |

|

|

|

(240,415 |

) |

|

|

(240,337 |

) |

Transactions with Owners |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-based payment (Note 8) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

43,327 |

|

|

|

43,327 |

|

Transfer under stock incentive programs |

|

|

— |

|

|

|

— |

|

|

|

28 |

|

|

|

— |

|

|

|

(28 |

) |

|

|

— |

|

Capital increase |

|

|

70 |

|

|

|

21,504 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

21,574 |

|

Equity as of June 30, 2024 |

|

|

7,819 |

|

|

|

2,144,578 |

|

|

|

(118 |

) |

|

|

799 |

|

|

|

(2,474,211 |

) |

|

|

(321,133 |

) |

Unaudited Condensed Consolidated Interim Cash Flow Statements for the Six Months Ended June 30, 2025 and 2024

|

|

|

|

|

|

|

|

|

|

|

Six Months Ended

June 30, |

|

(EUR’000) |

|

2025 |

|

|

2024 |

|

Operating activities |

|

|

|

|

|

|

Net profit/(loss) for the period |

|

|

(133,482 |

) |

|

|

(240,415 |

) |

Reversal of finance income |

|

|

(83,912 |

) |

|

|

(14,395 |

) |

Reversal of finance expenses |

|

|

77,803 |

|

|

|

58,553 |

|

Reversal of (gain)/loss on disposal of property, plant and equipment |

|

|

— |

|

|

|

(91 |

) |

Reversal of income taxes |

|

|

4,909 |

|

|

|

2,737 |

|

Adjustments for non-cash items: |

|

|

|

|

|

|

Non-cash consideration relating to revenue |

|

|

(2,214 |

) |

|

|

(25,639 |

) |

Share of (profit)/loss of associates |

|

|

(22,482 |

) |

|

|

11,118 |

|

Share-based payment |

|

|

55,580 |

|

|

|

43,327 |

|

Depreciation |

|

|

8,615 |

|

|

|

8,632 |

|

Impairment of property, plant and equipment |

|

|

7,508 |

|

|

|

— |

|

Amortization |

|

|

238 |

|

|

|

233 |

|

Changes in working capital: |

|

|

|

|

|

|

Inventories |

|

|

(7,772 |

) |

|

|

(42,268 |

) |

Receivables |

|

|

50,047 |

|

|

|

(22,747 |

) |

Prepayments |

|

|

(6,801 |

) |

|

|

1,867 |

|

Contract liabilities |

|

|

(3,455 |

) |

|

|

(840 |

) |

Trade payables, accrued expenses and other liabilities |

|

|

(25,558 |

) |

|

|

(10,571 |

) |

Provisions |

|

|

65,536 |

|

|

|

72,276 |

|

Cash flows generated from/(used in) operations |

|

|

(15,440 |

) |

|

|

(158,223 |

) |

Finance income received |

|

|

7,603 |

|

|

|

6,265 |

|

Finance expenses paid |

|

|

(9,689 |

) |

|

|

(7,714 |

) |

Income taxes received/(paid) |

|

|

(4,128 |

) |

|

|

(3,218 |

) |

Cash flows from/(used in) operating activities |

|

|

(21,654 |

) |

|

|

(162,890 |

) |

Investing activities |

|

|

|

|

|

|

Acquisition of intangible assets and property, plant and equipment |

|

|

(5,041 |

) |

|

|

(541 |

) |

Proceeds from disposal of property, plant and equipment |

|

|

— |

|

|

|

950 |

|

Settlement of marketable securities |

|

|

— |

|

|

|

7,354 |

|

Cash flows from/(used in) investing activities |

|

|

(5,041 |

) |

|

|

7,763 |

|

Financing activities |

|

|

|

|

|

|

Repayment of borrowings |

|

|

(8,553 |

) |

|

|

(5,606 |

) |

Proceeds from exercise of warrants |

|

|

26,302 |

|

|

|

21,574 |

|

Acquisition of treasury shares, net of transaction costs |

|

|

(17,396 |

) |

|

|

— |

|

Payment of withholding taxes under stock incentive programs |

|

|

(11,396 |

) |

|

|

— |

|

Cash flows from/(used in) financing activities |

|

|

(11,043 |

) |

|

|

15,968 |

|

Increase/(decrease) in cash and cash equivalents |

|

|

(37,738 |

) |

|

|

(139,159 |

) |

Cash and cash equivalents at January 1 |

|

|

559,543 |

|

|

|

392,164 |

|

Effect of exchange rate changes on balances held in foreign currencies |

|

|

(27,759 |

) |

|

|

5,691 |

|

Cash and cash equivalents at June 30 |

|

|

494,046 |

|

|

|

258,696 |

|

Cash and cash equivalents include: |

|

|

|

|

|

|

Bank deposits |

|

|

494,046 |

|

|

|

258,696 |

|

Cash and cash equivalents at June 30 |

|

|

494,046 |

|

|

|

258,696 |

|

Notes to the Unaudited Condensed Consolidated Interim Financial Statements

Note 1—General Information

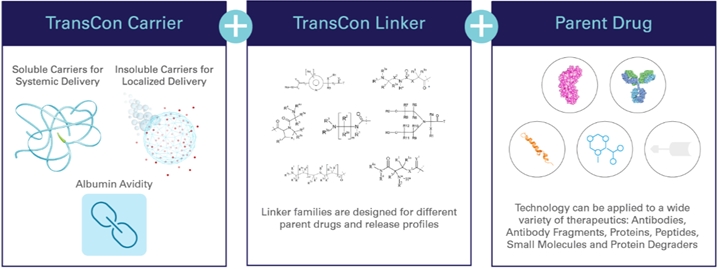

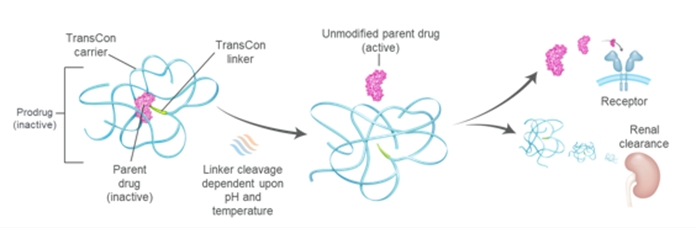

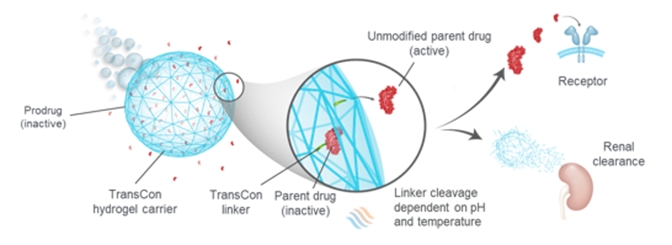

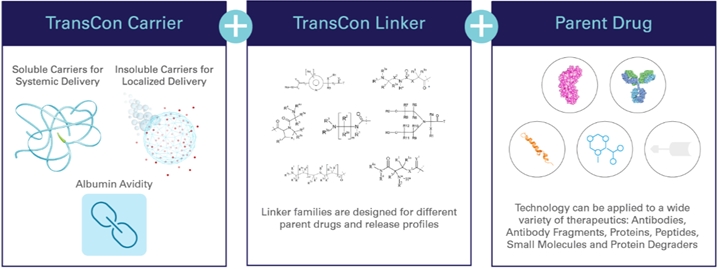

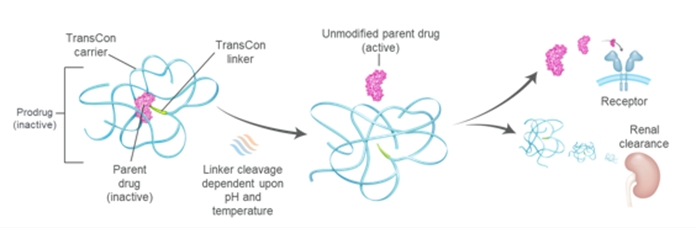

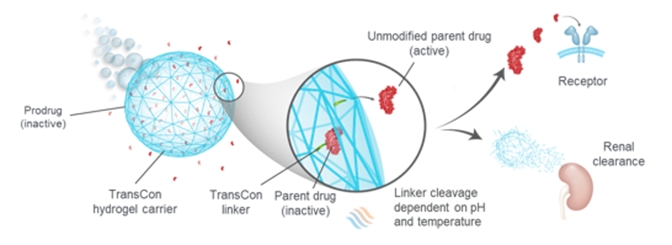

Ascendis Pharma A/S, together with its subsidiaries, is a global biopharmaceutical company focused on applying its innovative TransCon technology platform to make a meaningful difference for patients. Ascendis Pharma A/S was incorporated in 2006 and is headquartered in Hellerup, Denmark. Unless the context otherwise requires, references to the “Company,” “we,” “us,” and “our” refer to Ascendis Pharma A/S and its subsidiaries.

The address of the Company’s registered office is Tuborg Boulevard 12, DK-2900, Hellerup, Denmark. The Company’s registration number in Denmark is 29918791.

On February 2, 2015, the Company completed an initial public offering which resulted in the listing of American Depositary Shares (“ADSs”), representing the Company’s ordinary shares, under the symbol “ASND” in the United States on the Nasdaq Global Select Market.

The Company’s Board of Directors (the “Board”) approved these unaudited condensed consolidated interim financial statements on August 7, 2025.

Note 2—Summary of Material Accounting Policies

Basis of Preparation

The unaudited condensed consolidated interim financial statements of the Company are prepared in accordance with International Accounting Standard 34, “Interim Financial Reporting.” Certain information and disclosures normally included in the annual consolidated financial statements prepared in accordance with IFRS Accounting Standards (“IFRS”) have been condensed or omitted. Accordingly, these unaudited condensed consolidated interim financial statements should be read in conjunction with the Company’s audited annual consolidated financial statements for the year ended December 31, 2024 and accompanying notes, which have been prepared in accordance with IFRS as issued by the International Accounting Standards Board (the “IASB”) and as adopted by the European Union (the “EU”).

The accounting policies applied are consistent with those of the previous financial year. A description of the accounting policies is provided in the Accounting Policies section of the audited consolidated financial statements as of and for the year ended December 31, 2024.

New and Amended IFRS Accounting Standards and Interpretations

In August 2023, the IASB amended IAS 21, “The Effects of Changes in Foreign Exchange Rates: Lack of Exchangeability,” to help entities determine whether a currency is exchangeable into another currency and which spot exchange rate to use when it is not. These new requirements apply for annual reporting periods beginning on or after January 1, 2025. The Company does not expect these amendments to have a material impact on its operations or financial statements.

New IFRS Accounting Standards Not Yet Effective

The IASB has issued a number of new or amended standards, which have not yet become effective or have not yet been adopted by the EU. Therefore, these new standards have not been incorporated in these unaudited condensed consolidated interim financial statements.

IFRS 18, “Presentation and Disclosure in Financial Statements”

In April 2024, the IASB issued IFRS 18, “Presentation and Disclosure in Financial Statements” (“IFRS 18”), which replaces IAS 1, “Presentation in Financial Statements.” IFRS 18 introduces new categories and subtotals in the statement of profit or loss, into:

•Discontinued operations.

In addition, IFRS 18 includes new requirements for the location, aggregation and disaggregation of financial information, and disclosure of management-defined performance measures, as defined, if any. IFRS 18 does not include any measurement changes.

If approved by the EU, the amendments will be effective for annual reporting periods beginning on or after January 1, 2027, and must be applied retrospectively, with early adoption permitted. While IFRS 18 will change the structure and subtotal in the statement of profit or loss, the full impact from implementing IFRS 18 is currently being analyzed by the Company.

The unaudited condensed consolidated financial statements are not expected to be affected by other new or amended standards.

Note 3—Significant Accounting Judgements and Estimates

In the application of the Company’s accounting policies, management is required to make judgements, estimates and assumptions about the carrying amounts of assets and liabilities that are not readily apparent from other sources. Judgements, estimates and assumptions applied are based on historical experience and other factors that are relevant, and which are available at the reporting date. Uncertainty concerning estimates and assumptions could result in outcomes that require a material adjustment to assets and liabilities in future periods.

The unaudited condensed consolidated interim financial statements do not include all disclosures for significant accounting judgements, estimates and assumptions, that are required in the annual consolidated financial statements, and therefore should be read in conjunction with the Company’s audited consolidated financial statements as of and for the year ended December 31, 2024.

Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to accounting estimates are recognized prospectively. The three and six months ended June 30, 2025 and 2024 includes adjustments to prior periods estimates and assumptions for sales deductions.

While the application of critical accounting estimates is subject to material estimation uncertainties, management’s ongoing revisions of critical accounting estimates and underlying assumptions have not revealed any other material impact in any of the periods presented in the unaudited condensed consolidated interim financial statements.

There have been no changes to the application of significant accounting judgements or estimation uncertainties regarding accounting estimates compared to December 31, 2024.

Note 4—Significant Events in the Reporting Period

VISEN Pharmaceuticals Initial Public Offering

On March 20, 2025, VISEN Pharmaceuticals (“VISEN”) announced the pricing of its initial public offering (“IPO”) on the Hong Kong Stock Exchange. The IPO closed on March 21, 2025, and VISEN’s shares began trading under the stock code 2561.HK.

The Company’s investment in VISEN is accounted for using the equity method in the consolidated financial statements as the Company has determined that it has significant influence over the investment. Following the IPO, the Company owned 39.2% in VISEN. As a result, a non-cash gain of €33.6 million was recognized in the consolidated statement of profit or loss as part of share of profit/(loss) of associates. The IPO did not change the accounting treatment of VISEN. As of June 30, 2025, VISEN’s share price was HK$45.3, reflecting a total market value of the Company’s equity position of approximately €203 million. As of June 30, 2025, the carrying amount of VISEN using the equity method was €26.6 million.

The management and existing shareholders of VISEN, including Ascendis Pharma, have entered into customary lock-up agreements restricting the sale of VISEN shares for six months following the IPO; additionally, certain significant shareholders of VISEN, including the Company, are subject to an additional lock-up obligation during the period commencing on the date that is six months after the IPO and ending on the date that is 12 months after the IPO during which such shareholders may not sell shares of VISEN to an extent that would cause such shareholder to cease being a controlling shareholder of VISEN pursuant to applicable listing rules.

Share Repurchase Program

On February 12, 2025, the Company announced that the Board has authorized the Company to repurchase up to $18.25 million of the Company’s ADSs, each of which represents one ordinary share of Ascendis Pharma A/S (the “Share Repurchase Program”). On March 4, 2025, the Share Repurchase Program was fully executed in compliance with Rules 10b-18 and 10b5-1 of the Securities Exchange Act of 1934, as amended.

As of June 30, 2025, the Board has authorized to repurchase up to 1,726,015 of the Company’s ADSs.

The holding of treasury shares is disclosed in Note 10, “Treasury Shares.”

Impairment on Property, Plant and Equipment

The six months ended June 30, 2025 included an impairment charge of €7.5 million, related to change in activities at one of our sites in the U.S. and is included as part of research and development expenses, and selling general and administrative expenses. In June 2025, a sublease for the site was incepted with an expected commencement date of January 1, 2026.

Equity Development

As of June 30, 2025, the unaudited condensed consolidated interim statements of financial position presented a negative balance of equity of €187.6 million. Under Danish corporate law, as Ascendis Pharma A/S, the parent company of the Company, holds a positive balance of equity, the Company is currently not subject to legal or regulatory requirements to re-establish the balance of equity. There is no direct impact from the negative balance of equity to the liquidity and capital resources.

Based on its current operating plan, the Company believes that the existing capital resources as of June 30, 2025, will be sufficient to meet projected cash requirements for at least twelve months from the date of this report. However, the Company’s operating plan may change as a result of many factors that are currently unknown, and the Company may need to seek additional funds sooner than planned. Further details regarding borrowings including maturity analysis are provided in Note 11, “Financial Assets and Liabilities.”

Note 5—Revenue

Revenue has been recognized in the unaudited condensed consolidated interim statements of profit or loss with the following amounts:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

(EUR’000) |

|

2025 |

|

|

2024 |

|

|

2025 |

|

|

2024 |

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

Commercial products |

|

|

153,663 |

|

|

|

31,389 |

|

|

|

249,690 |

|

|

|

97,888 |

|

Rendering of services and clinical supply |

|

|

3,570 |

|

|

|

3,740 |

|

|

|

7,094 |

|

|

|

8,365 |

|

Licenses |

|

|

812 |

|

|

|

869 |

|

|

|

2,214 |

|

|

|

25,639 |

|

Total revenue |

|

|

158,045 |

|

|

|

35,998 |

|

|

|

258,998 |

|

|

|

131,892 |

|

Specified per geographical area |

|

|

|

|

|

|

|

|

|

|

|

|

Europe (1) |

|

|

27,894 |

|

|

|

5,082 |

|

|

|

49,222 |

|

|

|

6,649 |

|

North America |

|

|

108,448 |

|

|

|

29,394 |

|

|

|

182,134 |

|

|

|

122,075 |

|

Rest of world |

|

|

21,703 |

|

|

|

1,522 |

|

|

|

27,642 |

|

|

|

3,168 |

|

Total revenue |

|

|

158,045 |

|

|

|

35,998 |

|

|

|

258,998 |

|

|

|

131,892 |

|

(1)For the three and six months ended June 30, 2025, Denmark, the country of domicile, contributed with €2.6 million and €5.0 million, respectively, of revenue. For the three and six months ended June 30, 2024, no revenue was attributable to Denmark.

Revenue from Commercial Products

Revenue from sale of commercial products were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

(EUR’000) |

|

2025 |

|

|

2024 |

|

|

2025 |

|

|

2024 |

|

Revenue from commercial products |

|

|

|

|

|

|

|

|

|

|

|

|

SKYTROFA® |

|

|

50,706 |

|

|

|

26,202 |

|

|

|

102,044 |

|

|

|

91,207 |

|

YORVIPATH® |

|

|

102,957 |

|

|

|

5,187 |

|

|

|

147,646 |

|

|

|

6,681 |

|

Total revenue from commercial products |

|

|

153,663 |

|

|

|

31,389 |

|

|

|

249,690 |

|

|

|

97,888 |

|

In the U.S., the Company has established an integrated organization to commercialize the Company’s approved Endocrinology Rare Disease products, SKYTROFA® and YORVIPATH®. In Europe, the Company is expanding its presence by building integrated organizations in select countries (“Europe Direct”), where the Company has launched SKYTROFA and YORVIPATH. Beyond the U.S. and Europe Direct, SKYTROFA and YORVIPATH may also be sold through exclusive distribution agreements with geographic market leaders (“International Markets”) and under certain strategic collaboration agreements.

YORVIPATH and SKYTROFA is approved by the U.S. Food and Drug Administration (“FDA”) and authorized by the European Commission (“EC”) and other regulatory agencies. The Company began selling YORVIPATH in Europe in the first quarter of 2024 and in the U.S. in December 2024. The Company began selling SKYTROFA in the U.S. in the fourth quarter of 2021 and in Europe in the third quarter of 2023.

Other Revenue

Other revenue is attributable to collaborations and license agreements, and relates to Novo Nordisk A/S (“Novo Nordisk”), Eyconis, Inc. (“Eyconis”), Teijin Limited (“Teijin”) and VISEN. Under the collaboration and license agreements, the Company provides various research and development services and clinical supply. Costs associated with these activities are presented as cost of sales in the unaudited condensed consolidated interim statement of profit or loss.

For the three and six months ended June 30, 2025, no revenue from royalties or milestones has been recognized under the collaborations and license agreements.

Note 6—Earnings Per Share

The following table reflects the earnings and share data used in the basic and diluted earnings per share calculations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

(EUR’000, except per share data) |

|

2025 |

|

|

2024 (Restated)(2) |

|

|

2025 |

|

|

2024 |

|

Earnings |

|

|

|

|

|

|

|

|

|

|

|

|

Net profit/(loss) attributable to ordinary equity holders of the parent for the purposes of basic earnings per share |

|

|

(38,855 |

) |

|

|

(109,380 |

) |

|

|

(133,482 |

) |

|

|

(240,415 |

) |

Impact from convertible notes (interests, foreign exchange gain/(loss), and fair value adjustments on derivative liabilities, net of tax) |

|

|

(13,495 |

) |

|

|

(25,042 |

) |

|

|

— |

|

|

|

— |

|

Net profit/(loss) attributable to ordinary equity holders of the parent adjusted for dilution effects |

|

|

(52,350 |

) |

|

|

(134,422 |

) |

|

|

(133,482 |

) |

|

|

(240,415 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Number of shares |

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of ordinary shares for the purposes of basic earnings per share |

|

|

60,454,589 |

|

|

|

57,345,613 |

|

|

|

60,237,774 |

|

|

|

57,114,435 |

|

Dilution effects from: |

|

|

|

|

|

|

|

|

|

|

|

|

Convertible notes |

|

|

3,456,785 |

|

|

|

3,456,785 |

|

|

|

— |

|

|

|

— |

|

Weighted average number of ordinary shares, diluted earnings per share |

|

|

63,911,374 |

|

|

|

60,802,398 |

|

|

|

60,237,774 |

|

|

|

57,114,435 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share |

|

€ |

(0.64 |

) |

|

€ |

(1.91 |

) |

|

€ |

(2.22 |

) |

|

€ |

(4.21 |

) |

Diluted earnings per share (1) (2) |

|

€ |

(0.82 |

) |

|

€ |

(2.21 |

) |

|

€ |

(2.22 |

) |

|

€ |

(4.21 |

) |

(1)For the six months ended June 30, 2025 and 2024, a total of 5,913,467 and 6,107,875 warrants outstanding, respectively, each carrying the right to subscribe for one ordinary share can potentially dilute earnings per share in the future but have not been included in the calculation of diluted earnings per share because they are out-of the money and/or antidilutive for the periods presented. For the six months ended June 30, 2025 and 2024, 575,000 convertible senior notes which can potentially be converted into 3,456,785 ordinary shares, can potentially dilute earnings per share in the future but have not been included in the calculation of diluted earnings per share because they are antidilutive for the six month periods presented.

(2)Only dilutive earnings per share for the three months ended June 30, 2024 has been restated to reflect the dilutive impact from convertible notes. The previously reported dilutive earnings per share was €(1.91).

Note 7—Segment Information

The Company is managed and operated as one business unit. Accordingly, no additional information on business segments or geographical areas is disclosed apart from revenue on geographical areas as disclosed in Note 5 “Revenue.” Revenue is specified on geographical areas according to the location of the customer.

Note 8—Share-based Payment

As an incentive to the senior management, other employees, members of the Board and select consultants, Ascendis Pharma A/S has established warrant programs, a Restricted Stock Unit (“RSU”) program adopted in December 2021, and a Performance Stock Unit (“PSU”) program adopted in February 2023, which are all classified as equity-settled share-based payment transactions.

Share-based Compensation Costs

Share-based compensation costs are determined using the grant date fair value and are recognized over the vesting period as research and development expenses, selling, general and administrative expenses, or cost of sales. For the three and six months ended June 30, 2025 and 2024, share-based compensation costs recognized in the unaudited condensed consolidated interim statement of profit or loss were €30.0 million and €55.6 million, respectively, and €26.0 million and €43.3 million, respectively.

Restricted Stock Unit Program

RSUs are granted by the Board to members of senior management, other employees and members of the Board (the “RSU-holders”), as stipulated in the program. In addition, RSUs may be granted to select consultants.

One RSU represents a right for the RSU-holder to receive one ADS representing ordinary shares of Ascendis Pharma A/S upon vesting, if the vesting conditions are met. RSUs granted vest over three years with 1/3 of the RSUs vesting on each anniversary date from the date of grant, and require RSU-holders to be employed, appointed as member of the Board, or retained as a consultant (the “service conditions”).

Performance Stock Unit Program

PSUs are granted by the Board to certain members of senior management (the “PSU-holders”), as stipulated in the program. In addition, PSUs may be granted to other employees, select consultants and members of the Board.

One PSU represents a right for the PSU-holder to receive one ADS representing ordinary shares of Ascendis Pharma A/S upon vesting. PSUs vest in a manner similar to the service conditions of the RSUs. In addition to service conditions, vesting is also contingent upon achievement of long-term strategic goals as evaluated by the Board no later than two weeks prior to each vesting date. Exceeding performance targets will not result in vesting of more PSUs than 100%, nor will it result in additional grants.

RSU and PSU Activity

The following table specifies the number of outstanding RSUs and PSUs:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Restricted Stock Units |

|

|

Performance Stock Units |

|

|

Total |

|

Outstanding |

|

(Number) |

|

January 1, 2025 |

|

|

993,807 |

|

|

|

156,667 |

|

|

|

1,150,474 |

|

Granted during the period |

|

|

634,589 |

|

|

|

73,583 |

|

|

|

708,172 |

|

Settled during the period |

|

|

(60,056 |

) |

|

|

(15,716 |

) |

|

|

(75,772 |

) |

Transferred during the period |

|

|

(321,392 |

) |

|

|

(46,588 |

) |

|

|

(367,980 |

) |

Forfeited during the period |

|

|

(43,820 |

) |

|

|

(2,688 |

) |

|

|

(46,508 |

) |

June 30, 2025 |

|

|

1,203,128 |

|

|

|

165,258 |

|

|

|

1,368,386 |

|

Specified by vesting year |

|

|

|

|

|

|

|

|

|

2026 |

|

|

574,370 |

|

|

|

86,659 |

|

|

|

661,029 |

|

2027 |

|

|

420,930 |

|

|

|

54,066 |

|

|

|

474,996 |

|

2028 |

|

|

207,828 |

|

|

|

24,533 |

|

|

|

232,361 |

|

June 30, 2025 |

|

|

1,203,128 |

|

|

|

165,258 |

|

|

|

1,368,386 |

|

Warrant Program

Warrants are granted by the Board in accordance with authorizations given to it by the shareholders of Ascendis Pharma A/S to all employees, members of the Board and select consultants. Each warrant carries the right to subscribe for one ordinary share of a nominal value of DKK 1. The exercise price is fixed at the fair market value of the Company’s ordinary shares at the time of grant as determined by the Board.

Warrant Activity

The following table specifies the number and weighted average exercise prices of, and movements in, warrants:

|

|

|

|

|

|

|

|

|

|

|

Warrants |

|

|

Weighted

Average

Exercise Price |

|

|

|

(Number) |

|

|

(EUR) |

|

Outstanding |

|

|

|

|

|

|

January 1, 2025 |

|

|

6,204,122 |

|

|

|

93.25 |

|

Granted during the period |

|

|

246,743 |

|

|

|

131.88 |

|

Exercised during the period |

|

|

(461,976 |

) |

|

|

55.66 |

|

Forfeited during the period |

|

|

(75,422 |

) |

|

|

100.21 |

|

June 30, 2025 |

|

|

5,913,467 |

|

|

|

97.74 |

|

Vested at June 30, 2025 |

|

|

4,995,826 |

|

|

|

93.72 |

|

The exercise prices of outstanding warrants under the Company’s warrant programs range from €11.98 to €150.80 depending on the grant dates.

Note 9—Share Capital

The share capital of Ascendis Pharma A/S consists of 61,151,463 fully paid shares at a nominal value of DKK 1, all in the same share class, and which includes 597,055 ordinary shares represented by ADSs held by Ascendis Pharma A/S. For the six months ended June 30, 2025, the share capital was increased with 461,976 number of shares.

Note 10—Treasury Shares

The development in the holding of treasury shares was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nominal

values |

|

|

Holding |

|

|

Holding in

% of total

outstanding

shares |

|

|

|

(EUR’000) |

|

|

(Number) |

|

|

|

|

Treasury shares |

|

|

|

|

|

|

|

|

|

January 1, 2025 |

|

|

113 |

|

|

|

845,887 |

|

|

|

1.4 |

% |

Acquired from third parties |

|

|

16 |

|

|

|

119,148 |

|

|

|

— |

|

Transferred under stock incentive programs |

|

|

(49 |

) |

|

|

(367,980 |

) |

|

|

— |

|

June 30, 2025 |

|

|

80 |

|

|

|

597,055 |

|

|

|

1.0 |

% |

Note 11—Financial Assets and Liabilities

The financial assets and liabilities comprise the following:

|

|

|

|

|

|

|

|

|

(EUR’000) |

|

June 30,

2025 |

|

|

December 31,

2024 |

|

Financial assets by category |

|

|

|

|

|

|

Trade receivables |

|

|

110,452 |

|

|

|

166,280 |

|

Other receivables (excluding indirect tax receivables) |

|

|

4,421 |

|

|

|

3,964 |

|

Cash and cash equivalents |

|

|

494,046 |

|

|

|

559,543 |

|

Financial assets measured at amortized cost |

|

|

608,919 |

|

|

|

729,787 |

|

Total financial assets |

|

|

608,919 |

|

|

|

729,787 |

|

Classified in the statement of financial position |

|

|

|

|

|

|

Non-current assets |

|

|

2,711 |

|

|

|

2,317 |

|

Current assets |

|

|

606,208 |

|

|

|

727,470 |

|

Total financial assets |

|

|

608,919 |

|

|

|

729,787 |

|

|

|

|

|

|

|

|

Financial liabilities by category |

|

|

|

|

|

|

Borrowings |

|

|

|

|

|

|

Convertible senior notes |

|

|

418,073 |

|

|

|

458,207 |

|

Royalty funding liabilities |

|

|

283,530 |

|

|

|

305,379 |

|

Lease liabilities |

|

|

90,931 |

|

|

|

93,030 |

|

Trade payables and accrued expenses |

|

|

93,718 |

|

|

|

96,394 |

|

Other liabilities (excluding indirect tax, and employee related payables) |

|

|

3,571 |

|

|

|

311 |

|

Financial liabilities measured at amortized cost |

|

|

889,823 |

|

|

|

953,321 |

|

Derivative liabilities |

|

|

186,579 |

|

|

|

150,670 |

|

Financial liabilities measured at fair value through profit or loss |

|

|

186,579 |

|

|

|

150,670 |

|

Total financial liabilities |

|

|

1,076,402 |

|

|

|

1,103,991 |

|

Classified in the statement of financial position |

|

|

|

|

|

|

Non-current liabilities |

|

|

330,186 |

|

|

|

365,080 |

|

Current liabilities |

|

|

746,216 |

|

|

|

738,911 |

|

Total financial liabilities |

|

|

1,076,402 |

|

|

|

1,103,991 |

|

Borrowings

Convertible Senior Notes

In March 2022, the Company issued an aggregate principal amount of $575.0 million of fixed rate 2.25% convertible notes. The net proceeds from the offering of the convertible notes were $557.9 million (€503.3 million) after deducting the initial purchasers’ discounts and commissions and offering expenses. The convertible notes rank equally in right of payment with all future senior unsecured indebtedness. Unless earlier converted or redeemed, the convertible notes will mature on April 1, 2028.

The convertible notes accrue interest at a rate of 2.25% per annum, payable semi-annually in arrears on April 1 and October 1 of each year. At any time before the close of business on the second scheduled trading day immediately before the maturity date, noteholders may convert their convertible notes at their option into the Company’s ordinary shares represented by ADSs, together, if applicable, with cash in lieu of any fractional ADS, at the then-applicable conversion rate. The initial conversion rate is 6.0118 ADSs per $1,000 principal amount of convertible notes, which represents an initial conversion price of $166.34 per ADS. The conversion rate and conversion price will be subject to customary adjustments upon the occurrence of certain events.

The convertible notes will be optionally redeemable, in whole or in part (subject to certain limitations), at the Company’s option at any time, and from time to time, on or after April 7, 2025, but only if the last reported sale price per ADS exceeds 130% of the conversion price on (i) each of at least 20 trading days, whether or not consecutive, during the 30 consecutive trading days ending on, and including, the trading day immediately before the date the Company sends the related optional redemption notice; and (ii) the trading day immediately before the date the Company sends such notice.

On June 30, 2025, the carrying amount of the convertible notes was €418.1 million, and the fair value was €411.7 million. Fair value cannot be measured based on quoted prices in active markets or other observable input, and accordingly the fair value was measured by using an estimated market rate for an equivalent non-convertible instrument.

Royalty Funding Liabilities

The Company has entered into capped synthetic royalty funding agreements with Royalty Pharma (the “Purchaser”), which is presented as part of borrowings, and represents the Company’s contractual obligations to pay a predetermined percentage of future commercial revenue until reaching a predetermined multiple of proceeds received, according to the detailed provisions of the synthetic royalty funding agreements.

On June 30, 2025, the carrying amount of the royalty funding liabilities was €283.5 million, and the fair value was €289.3 million. Fair value cannot be measured based on quoted prices in active markets or other observable input, and accordingly the fair value was measured by using an estimated market rate for an equivalent instrument.

YORVIPATH Agreement

In September 2024, the Company entered into a $150.0 million capped synthetic royalty funding agreement (the “Royalty Pharma Yorvipath Agreement”) with the Purchaser. The net proceeds were $148.2 million (€134.2 million) after deducting offering expenses.

Under the terms of the Royalty Pharma Yorvipath Agreement, the Company received an upfront payment of $150.0 million (the “Yorvipath Purchase Price”) in exchange for a 3% royalty on net revenue from sales of YORVIPATH in the U.S. (the “Yorvipath Revenue Payments”). The Yorvipath Revenue Payments to the Purchaser will cease upon reaching a multiple of the Yorvipath Purchase Price of 2.0 times, or 1.65 times if the Purchaser receives Yorvipath Revenue Payments in that amount by December 31, 2029.

The Royalty Pharma Yorvipath Agreement includes a buy-out option, which provides the Company with the right to settle all outstanding liabilities at any time by paying a buy-out amount equal to 2.0 times the Yorvipath Purchase Price minus the Yorvipath Revenue Payments paid to the Purchaser as of the effective date of the buy-out notice. However, if the buy-out notice is provided on or prior to September 30, 2028, and the Company has paid the Purchaser, Yorvipath Revenue Payments equal to the Yorvipath Purchase Price as of the date of the buy-out notice, then the buy-out amount is equal to 1.65 times the Yorvipath Purchase Price minus the Yorvipath Revenue Payments paid to the Purchaser as of the effective date of the buy-out notice.

SKYTROFA Agreement

In September 2023, the Company entered into a $150.0 million capped synthetic royalty funding agreement (the “Royalty Pharma Skytrofa Agreement”) with the Purchaser. The net proceeds were $146.3 million (€136.3 million) after deducting offering expenses.

Under the terms of the Royalty Pharma Skytrofa Agreement, the Company received an upfront payment of $150.0 million (the “Skytrofa Purchase Price”) in exchange for a 9.15% royalty on net revenue from sales of SKYTROFA in the U.S., beginning on January 1, 2025 (the “Skytrofa Revenue Payments”). The Skytrofa Revenue Payments to the Purchaser will cease upon reaching a multiple of the Skytrofa Purchase Price of 1.925 times, or 1.65 times if the Purchaser receives Skytrofa Revenue Payments in that amount by December 31, 2031.

The Royalty Pharma Skytrofa Agreement includes a buy-out option, which provides the Company with the right to settle all outstanding liabilities at any time by paying a buy-out amount equal to 1.925 times the Skytrofa Purchase Price minus the Skytrofa Revenue Payments paid to the Purchaser as of the effective date of the buy-out notice. However, if the buy-out notice is provided on or prior to December 31, 2028, and the Company has paid the Purchaser, Skytrofa Revenue Payments equal to the Skytrofa Purchase Price as of the date of the buy-out notice, then the buy-out amount is equal to 1.65 times the Skytrofa Purchase Price minus the Skytrofa Revenue Payments paid to the Purchaser as of the effective date of the buy-out notice.

Derivative Liabilities

Derivative liabilities relate to the foreign currency conversion option embedded in the convertible notes.

Fair value cannot be measured based on quoted prices in active markets or other observable inputs, and accordingly, derivative liabilities are measured by using the Black-Scholes option pricing model. Fair value of the option is calculated, applying the following assumptions: (1) conversion price; (2) the Company’s share price; (3) maturity of the option; (4) a risk-free interest rate equaling the effective interest rate on a U.S. government bond with the same lifetime as the maturity of the option; (5) no payment of dividends; and (6) an expected volatility using the Company’s share price (49.5% and 49.6% as of June 30, 2025 and December 31, 2024, respectively).

For additional description of fair values, refer to the following section “Fair Value Measurement.”

Sensitivity Analysis

On June 30, 2025, all other inputs and assumptions held constant, a 10% relative increase in volatility, will increase the fair value of derivative liabilities by €14.0 million and indicates a decrease in profit or loss and equity before tax. Similarly, a 10% relative decrease in volatility indicates the opposite impact.

Similarly, on June 30, 2025, all other inputs and assumptions held constant, a 10% increase in the share price, will increase the fair value of derivative liabilities by €37.6 million and indicates a decrease in profit or loss and equity before tax. Similarly, a 10% decrease in the share price indicates the opposite impact.

Fair Value Measurement

Because of the short-term maturity for cash and cash equivalents, receivables and trade payables, their fair value approximate carrying amount. Fair value of lease liabilities are not disclosed. Fair value compared to carrying amount of convertible notes, royalty funding liabilities and derivative liabilities, and their level in the fair value hierarchy is summarized in the following table, where:

Level 1 inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities that the entity can access at the measurement date;

Level 2 inputs are inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly; and

Level 3 inputs are unobservable inputs for the asset or liability.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2025 |

|

|

December 31, 2024 |

|

|

|

|

(EUR’000) |

|

Carrying

amount |

|

|

Fair value |

|

|

Carrying

amount |

|

|

Fair value |

|

|

Fair value level |

|

Convertible senior notes |

|

|

418,073 |

|

|

|

411,689 |

|

|

|

458,207 |

|

|

|

438,288 |

|

|

|

3 |

|

Royalty funding liabilities |

|

|

283,530 |

|

|

|

289,322 |

|

|

|

305,379 |

|

|

|

305,673 |

|

|

|

3 |

|

Financial liabilities measured at amortized cost |

|

|

701,603 |

|

|

|

701,011 |

|

|

|

763,586 |

|

|

|

743,961 |

|

|

|

|

Derivative liabilities |

|

|

186,579 |

|

|

|

186,579 |

|

|

|

150,670 |

|

|

|

150,670 |

|

|

|

3 |

|

Financial liabilities measured at fair value through profit or loss |

|

|

186,579 |

|

|

|

186,579 |

|

|

|

150,670 |

|

|

|

150,670 |

|

|

|

|

The following table specifies movements in level 3 fair value measurements:

|

|

|

|

|

|

|

|

|

(EUR’000) |

|

2025 |

|

|

2024 |

|

Derivative liabilities |

|

|

|

|

|

|

January 1 |

|

|

150,670 |

|

|

|

143,296 |

|

Remeasurement recognized in finance (income) or expense |

|

|

35,909 |

|

|

|

15,763 |

|

June 30 |

|

|

186,579 |

|

|

|

159,059 |

|

Maturity Analysis

The following table summarizes maturity analysis (on an undiscounted basis) for non-derivative financial liabilities recognized in the unaudited condensed consolidated interim statements of financial position as of June 30, 2025:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(EUR’000) |

|

< 1 year |

|

|

1-5 years |

|

|

>5 years |

|

|

Total

contractual

cash-flows |