Item 2.02 Results of Operations and Financial Condition.

On November 10, 2025, American Vanguard Corporation (“Registrant” or the “Company”) issued a press release announcing its unaudited financial results for the three-month period ended September 30, 2025. The full text of the press release is linked hereto as Exhibit 99.1 and is incorporated herein by reference.

Also on November 10, 2025, the Company held its previously announced earnings call regarding its unaudited financial results for the three- and nine-month periods ended September 30, 2025. A transcript of the earnings call is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

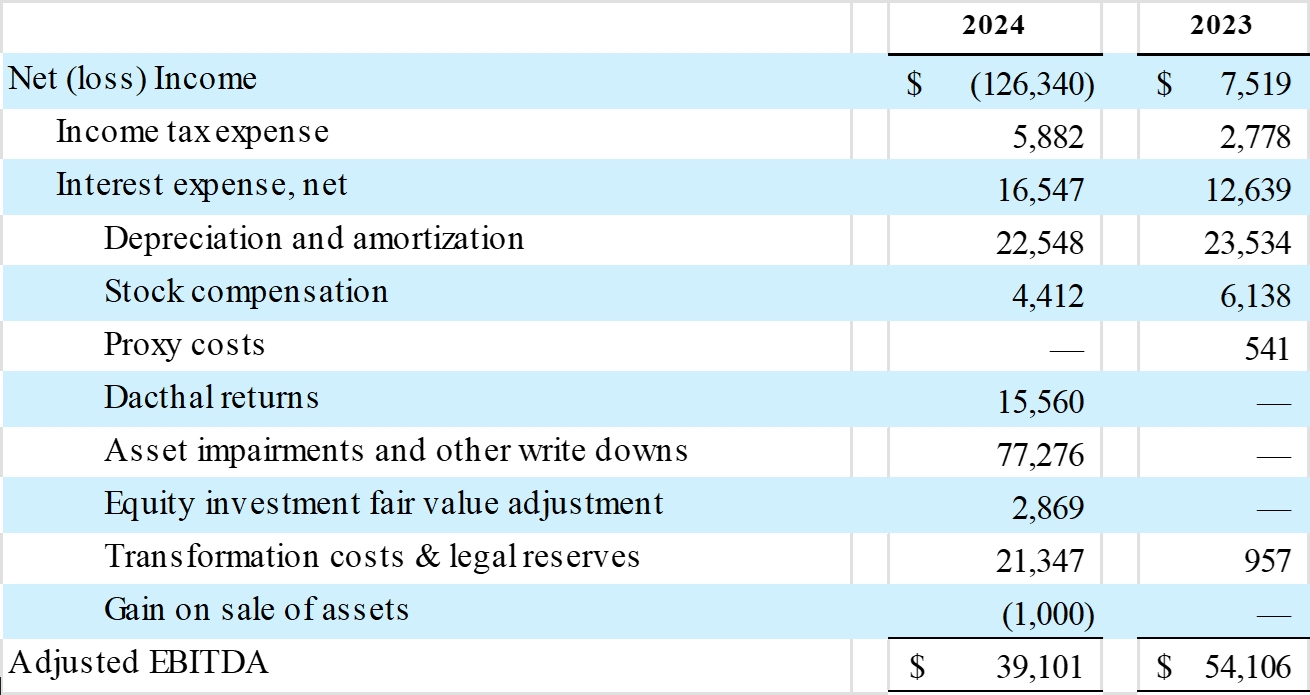

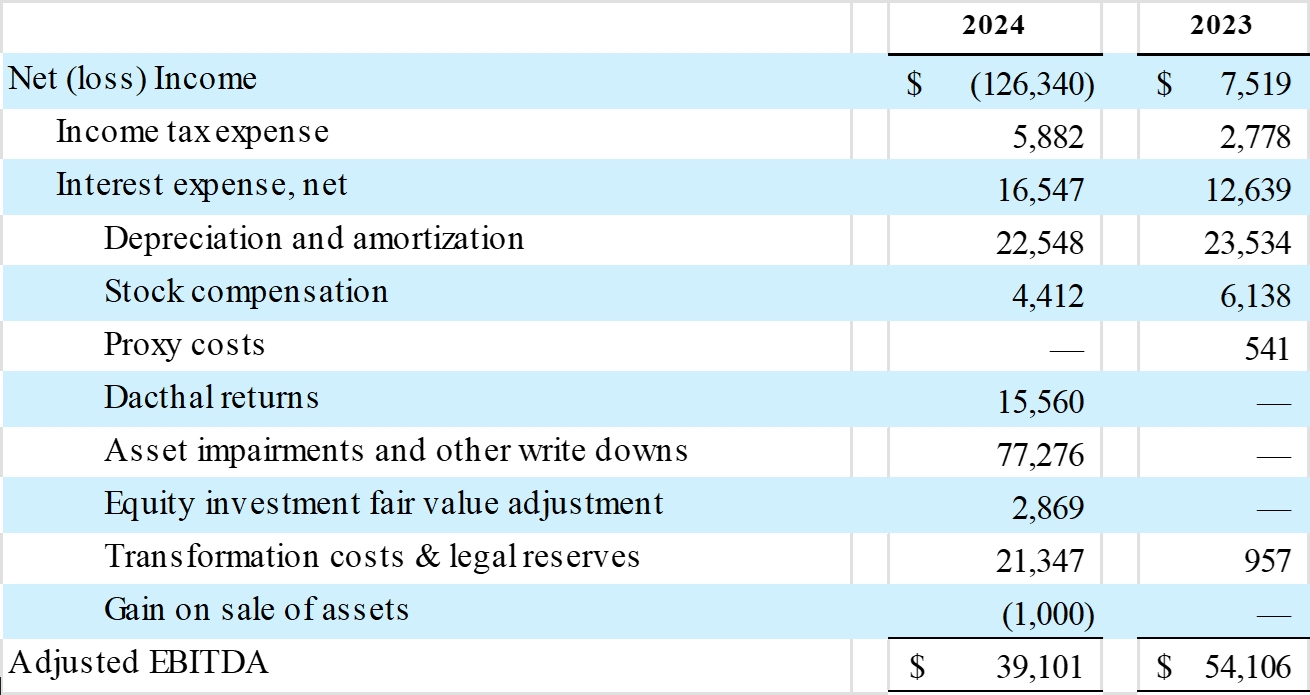

In the Company’s press release dated March 14, 2025, the Company disclosed preliminary Adjusted EBITDA (as defined below) for the full year ended December 31, 2024 of approximately $42 million. In connection with finalizing the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, the Company concluded that its Adjusted EBITDA for the period was $39.1 million.

The Company defines EBITDA as net income or net income attributable to the Company, adjusted for non-controlling interests, depreciation and amortization, provision for income taxes and interest expense. The Company defines Adjusted EBITDA as EBITDA as further adjusted for certain items management believes are not reflective of the underlying operations of our business, including but not limited to the exclusion of charges that are considered by management to be unusual and not representative of the company’s underlying performance and future prospects. In 2024 that included non-recurring expenses and the profit on sale of an asset that was not held for sale. The resulting Adjusted EBITDA measure is exactly aligned with the Company’s metric for its current credit facility agreement.

The Company uses Adjusted EBITDA to assess the operating results and effectiveness and efficiency of its business. The Company presents this non-GAAP financial measure because it believes that investors consider Adjusted EBITDA to be an important supplemental measure of performance, and that this measure is frequently used by securities analysts, investors and other interested parties in the evaluation of companies in the industry. As the Company continues to work through its transformation efforts, management believes that presenting Adjusted EBITDA provides an effective comparison between the Company and its industry peers. Non-GAAP financial measures as reported by the Company may not be comparable to similarly titled metrics reported by other companies and may not be calculated in the same manner. These measures have limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP.

For a reconciliation of the Company’s net income (loss) to Adjusted EBITDA for the three and nine months ended September 30, 2025 and 2024, see Exhibit 99.1. The following table sets forth a reconciliation of the Company’s net income (loss) to Adjusted EBITDA for the years ended December 31, 2024 and 2023:

(In thousands)